The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Global Luxury Home Price Growth Damped by Economic Uncertainty in Q2

Residential News » Monaco Edition | By Michael Gerrity | August 16, 2019 8:00 AM ET

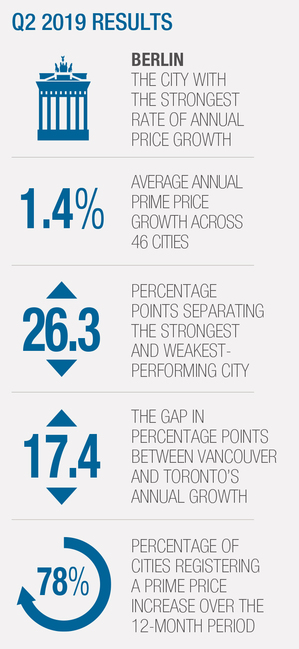

Knight Franks' latest Prime Global Cities Index, which tracks the movement in luxury residential prices across 46 International cities, increased by 1.4% in the year to June 2019, up marginally from 1.3% in March 2019 but still significantly lower than its four-year average of 3.8%.

Knight Franks' latest Prime Global Cities Index, which tracks the movement in luxury residential prices across 46 International cities, increased by 1.4% in the year to June 2019, up marginally from 1.3% in March 2019 but still significantly lower than its four-year average of 3.8%.Although Berlin leads the index, its rate of annual growth has slowed from 14.1% in March 2019 to 12.7% in June 2019. Frankfurt, by comparison, has seen its annual price growth increase from 9.6% to 12.0% over the same period. However, with prime prices in Berlin and Frankfurt currently around â¬11,500 per sq. m and â¬13,500 per sq. m respectively they remain competitive by European standards.

Key Global Prime Property Price Findings:

- Berlin is the city with the strongest rate of annual price growth

- The average annual prime price growth across 46 cities is 1.4%

- 26.3 percentage points separate the strongest and weakest performing city

- 78% of cities are registering a prime price increase over the 12-month period

Some 35 of the 46 cities tracked by the index (76%) registered price growth in the year to June 2019. Of the eleven that saw prices decline year-on-year, Istanbul (-9.9%) and Vancouver (-13.6%) were the weakest markets.

Some 35 of the 46 cities tracked by the index (76%) registered price growth in the year to June 2019. Of the eleven that saw prices decline year-on-year, Istanbul (-9.9%) and Vancouver (-13.6%) were the weakest markets.Six European cities now sit within the top ten, down from seven last quarter as Edinburgh (4.3%) saw price growth moderate pushing it to 12th place.

Madrid and Paris are following similar paths recording 5.2% and 5.0% annual growth respectively. In both cases, the headline figure conceals variations at a neighborhood level.

In Madrid, areas such as Chamberà as well as outer non-prime districts are performing strongly. In Paris, the Left Bank, in particular the 6th and 7th arrondissements are now pausing for breath having witnessed upward of 11% price growth since 2017, whilst the 18th continues its upward trajectory.

In mainland China, tier 1 cities such as Beijing (4.5%) and Guangzhou (2.7%) saw prime price growth strengthen in the first half of 2019 as optimism grew surrounding the potential relaxation of housing policies, even though authorities reiterated their stance against speculation.

In Hong Kong (0%), the opening of various cross-border infrastructure projects, which should boost economic links in the Pearl River Delta over time, failed to counteract immediate concerns over the US/China trade war and political discord.

Singapore's prime market (0.9%) remains subdued as buyers adjust to the latest round of regulations, yet despite this, a number of record sales prices have been achieved so far in 2019.

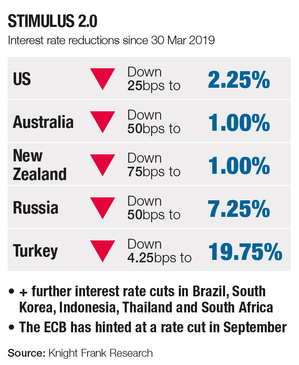

Sluggish economic growth explains the wave of interest rate cuts evident in the last three months as policymakers try to stimulate growth. Much hinges on the next three months with stronger headwinds on the horizon we expect the index to moderate further in the second half of 2019 before strengthening in 2020.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More