The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

UK Seeing the Widest Spread of Prime Office Yields in a Decade

Commercial News » London Edition | By Michael Gerrity | June 9, 2015 8:40 AM ET

According to Knight Frank's latest ROMP report, the substantial weight of money targeting regional UK offices has led to further yield compression in the regions - giving a 175 basis point spread of prime yields, the largest seen in over 10 years (since Q4 2003).

Stephen Hodgson, head of regional offices, Knight Frank, commented; "We could potentially be heading towards a 'perfect storm' of improving occupational markets and sustained capital markets, which hopefully will trigger new developments. With the growth of PRS also, this will be provide a major boost to regeneration schemes."

Knight Frank Report Highlights:

-

While the regional occupier market got off to a slow start in Q1, investor appetite for regional office stock strengthened, with turnover in the investment market reaching £1.48bn in Q1 2015. This was almost double the turnover during the same period last year, 5% higher than the previous quarter and the highest single quarter since Q4 2006.

While the regional occupier market got off to a slow start in Q1, investor appetite for regional office stock strengthened, with turnover in the investment market reaching £1.48bn in Q1 2015. This was almost double the turnover during the same period last year, 5% higher than the previous quarter and the highest single quarter since Q4 2006.

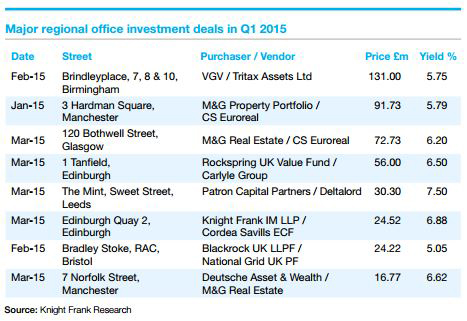

- Birmingham and Manchester proved to be the most popular destination for investors in Q1, with two major transactions comprising VGV's acquisition of RBS's Brindley Place (£131m) headquarters and M&G's purchase of 3 Hardman Square (£92m).

- Not surprisingly, given the substantial weight of money targeting regional offices, and following further yield compression both Birmingham and Manchester now command a premium over the UK's other core markets, at 5.00%. These cities are closely followed by Bristol and Leeds, at 5.25%. At the other end of the spectrum prime office yields in Sheffield moved up 50 bps to 6.75% in Q1. This gives a 175 bps spread of prime yields, which is the largest seen in over 10 years (since Q4 2003).

- Prime headline rents remain under upward pressure. Two markets saw headline rents increase during Q1, with Birmingham rising to £30.00.50 psf and Leeds to £26.00 psf. We anticipate further rises in office rents during the remainder of the year.

- Given current named requirements of 4.58 million sq ft, which is the highest in five years, we expect to see higher levels of occupational demand in Q2 back above the five year average.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

- Commercial Property Investment in Japan Implodes 57 Percent Annually in Late 2023

- Green Energy Companies Flocking to New York City Office Space

- Asia Pacific Commercial Property Investment Upticks 3 Percent in Q4

- U.S. Commercial, Multifamily Borrowing to Hit $576 Billion in 2024

- Japan is Top Cross Border Commercial Property Investment Target in 2024

- U.S. Delinquency Rates for Commercial Properties Increased 6 Percent in Q4 of 2023

- Commercial Property Investment in Japan to Weaken in 2024

- Office Landlords Nationwide Increasing Concessions to Lure Tenants in U.S.

- Hong Kong's Commercial Property Market Faces Ongoing Challenges in 2024

- Online Returns in the U.S. Could Total $82 Billion This Holiday Season

- More Pain Expected in 2024 for America's Commercial Property Sector

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More