The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Home Loan Originations in U.S. Down 8 Percent Annually

Residential News » United States Edition | By Monsef Rachid | May 13, 2016 9:00 AM ET

According to RealtyTrac's Q1 2016 U.S. Residential Property Loan Origination Report, 1.4 million (1,415,511) loans were originated on U.S. residential properties (1 to 4 units) in the first quarter of 2016, down 12 percent from the previous quarter and down 8 percent from a year ago to the lowest level since the first quarter of 2014.

The loan origination report is derived from publicly recorded mortgages and deeds of trust collected by RealtyTrac in more than 950 counties accounting for more than 80 percent of the U.S. population.

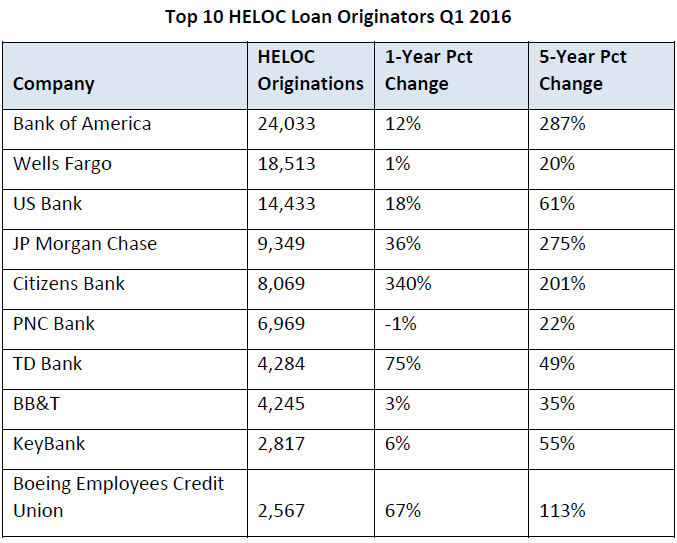

The year-over-year decrease in total originations was driven by a 20 percent year-over-year decrease in refinance originations even while purchase originations increased 3 percent from a year ago and Home Equity Line of Credit (HELOC) originations increased 10 percent from a year ago.

"After a surprisingly strong 2015, the mortgage refi market started running out of steam in the first quarter of 2016 despite lower mortgage interest rates," said Daren Blomquist, senior vice president at RealtyTrac. "Meanwhile the purchase loan market continued the pattern of slow-and-steady growth that it has been following the past two years, and HELOC originations increased on a year-over-year basis for the 16th consecutive quarter, showing that borrowers are regaining both home value and the confidence needed to increasingly leverage their home equity."

Cities with the biggest HELOC increase

Among 50 metropolitan statistical areas with at least 5,000 total loan originations in the first quarter, those with the biggest year-over-year percentage increase in HELOC originations were Dallas, Texas (up 35 percent); Louisville, Kentucky (up 28 percent); Seattle, Washington (up 25 percent); Sacramento, California (up 25 percent); and Columbus, Ohio (up 23 percent).

Other metro areas with a 20 percent or more increase in HELOC originations from a year ago were San Antonio, Texas (up 23 percent); Orlando, Florida (up 23 percent); Portland, Oregon (up 22 percent); Cincinnati, Ohio (up 21 percent); and Tampa, Florida (up 20 percent).

"Loosening credit, low interest rates and the first time millennial buyers moving into the South Florida real estate market all add up to an 8 percent increase in purchase loan originations for the first quarter this year over last year's first quarter," said Mike Pappas, CEO and president at The Keyes Company, covering South Florida. "Our rising prices and increasing equity are giving confidence to homeowners as we have seen HELOCs increase 12 percent year-over-year."

Cities with biggest purchase loan increases

Cities with biggest purchase loan increasesMetro areas with the biggest year-over-year percentage increase in purchase originations were Baltimore, Maryland (up 26 percent); Tucson, Arizona (up 18 percent); Louisville, Kentucky (up 17 percent); Minneapolis-St. Paul (up 14 percent); and Nashville, Tennessee (up 14 percent).

Other metro areas with a more than 10 percent increase in purchase loan originations from a year ago were Washington, D.C. (up 13 percent); Cleveland, Ohio (up 13 percent); Atlanta, Georgia (up 12 percent); Indianapolis, Indiana (up 12 percent); Kansas City (up 11 percent); St. Louis (up 11 percent); and Chicago (up 11 percent).

Cities with biggest refi decrease

Metro areas with the biggest year-over-year percentage decrease in refinance originations were Cincinnati, Ohio (down 35 percent); Philadelphia, Pennsylvania (down 32 percent); Milwaukee, Wisconsin (down 32 percent); Raleigh, North Carolina (down 31 percent); and Salt Lake City, Utah (down 29 percent).

Other metro areas with a 25 percent or bigger decrease in refinance originations from a year ago were Oxnard-Thousand Oaks-Ventura, California (down 28 percent); St. Louis (down 28 percent); Sacramento, California (down 28 percent); Tucson, Arizona (down 27 percent); Louisville, Kentucky (down 26 percent); Chicago, Illinois (down 26 percent); Richmond, Virginia (down 26 percent); San Diego, California (down 25 percent); and Honolulu (down 25 percent).

Loan origination dollar volume up 5 percent as HELOC dollar volume jumps 45 percent

Although the number of originations decreased from a year ago, the estimated total dollar volume of originations increased thanks to higher average loan amounts. There was an estimated $444 billion ($444,560,103,469) in total loan origination dollar volume in Q1 2016, up 5 percent from the previous quarter and up 5 percent from a year ago -- the fifth consecutive quarter with a year-over-year increase in loan origination dollar volume.

The total dollar amount of purchase loans originated in the first quarter was an estimated $146 billion ($145,693,394,297), down 11 percent from the previous quarter but up 8 percent from a year ago. The total dollar amount of refinance loans originated in the first quarter was an estimated $204 billion ($203,593,423,522), up 8 percent from the previous quarter but down 9 percent from a year ago. The total dollar amount of HELOCs originated in the first quarter was an estimated $95 billion ($95,273,285,650), up 34 percent from the previous quarter and up 45 percent from a year ago.

FHA loan share increases annually for fifth consecutive quarter

Among all purchase and refinance loans, 17.5 percent were FHA loans, 8.3 percent were VA loans, 0.8 percent were construction loans, and the remaining 73.4 percent were other loan types, including conventional.

FHA loans as a share of all loan originations increased 7 percent from a year ago while the VA loan share were up 5 percent and construction loans were up 19 percent. The FHA loan share has increased for five consecutive quarters, and in 10 of the 11 last quarters.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Orlando's Housing Market Continues to Slow Down This Fall

- U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

- Construction Input Costs in America Uptick in September

- Global Home Price Growth Further Slows in Mid-2023

- Home Values in U.S. Begin to Slip Late Summer

- Foreclosure Filings in U.S. Spike 34 Percent Annually in Q3

- U.S. Mortgage Credit Availability Upticks in September

- Retail Market is a Bright Spot for Manhattan Real Estate

- Residential Rents in U.S. Dip in September Amid Growing Apartment Supply

- U.S. Mortgage Rates Continue to Surge in October

- Greater Las Vegas Home Sales Down 10 Percent Annually in September

- Most U.S. Homebuyers Say Buying a Home is More Stressful Than Dating in 2023

- Mortgage Applications Dive 6 Percent Last Week in America

- Despite Peak Interest Rates, Global Housing Markets Improved in Q2

- U.S. Architecture Billings Index Reports Softening Business Conditions in August

- U.S. Home Price Growth Pace Upticks Again in August

- 10,000 Residential Properties Have Negative Equity in Hong Kong

- U.S. Pending Home Sales Dropped 7.1 Percent in August

- U.S. Mortgage Rates Reach Highest Level in 23 Years

- American Bankers See Weakening Credit Conditions Through End of 2024

- Palm Beach Area Residential Sales Uptick in August

- Driven by High Mortgage Rates, Pending Home Sales Drop 13% Annually in September

- Miami Area Residential Sales Slip 13 Percent Annually in August

- U.S. Home Sales Dip 15 Percent Annually in August

- Home Flipping Transactions Down in 2023, Profits Up

- U.S. Listings Inventory Rises 4 Percent in August

- The Fed Leaves Rates Alone for Now in September

- Mortgage Applications Uptick in U.S. Amid High Rates

- Single Family Rent Growth in U.S. Drops to 3-Year Low in July

- Greater Orlando Area Home Sales Down 16 Percent Annually in August

- Home Purchase Cancellations Accelerating in the U.S.

- U.S. Construction Input Costs Uptick in August

- U.S. Mortgage Credit Availability Upticks in August

- Monthly Property Foreclosure Activity Upticks in U.S.

- Greater Palm Beach Area Residential Sales Dip 5 Percent Annually in Mid-2023

- NAR Predicts Several U.S. Housing Market Outcomes

- Demand for U.S. Housing is Dropping as Prices Rise

- U.S. Homeowner Equity Decrease by $287 Billion Over the Last 12 Months

- 1 in 5 Millennials Think They'll Never Own a Home in America

- 1 in 8 San Francisco Home Sellers Is Losing Money at Closing in 2023

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More