The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Thirteen Percent of U.S. Homes with a Mortgage Have Negative Equity in Q2

Residential News » United States Edition | By Miho Favela | July 31, 2015 9:00 AM ET

According to Irvine, California based RealtyTrac's Q2 2015 U.S. Home Equity & Underwater Report, as of the end of the second quarter of 2015 there were 7,443,580 U.S. residential properties that were seriously underwater -- where the combined loan amount secured by the property is at least 25 percent higher than the property's estimated market value -- representing 13.3 percent of all properties with a mortgage.

The second quarter underwater numbers were up from 7,341,922 seriously underwater homes representing 13.2 percent of all homes with a mortgage in the previous quarter -- making Q2 the second consecutive quarter with a slight increase in both the number and share of seriously underwater properties -- but were down from 9,074,449 seriously underwater properties representing 17.2 percent of all homes with a mortgage in the second quarter of 2015. The number and share of seriously underwater homes peaked in the second quarter of 2012 at 12,824,729 seriously homes representing 28.6 percent of all homes with a mortgage.

"Slowing home price appreciation in 2015 has resulted in the share of seriously underwater properties plateauing at about 13 percent of all properties with a mortgage," said Daren Blomquist, vice president at RealtyTrac. "However, the share of homeowners with the double-whammy of seriously underwater properties that are also in foreclosure is continuing to decrease and is now at the lowest level we've seen since we began tracking that metric in the first quarter of 2012."

The share of distressed properties -- those in some stage of the foreclosure process -- that were seriously underwater at the end of the second quarter was 34.4 percent, down from 35.1 percent in the first quarter of 2015 and down from 43.6 percent in the second quarter of 2014 to the lowest level since tracking began in the first quarter of 2012. Conversely, the share of foreclosures with positive equity increased to 42.4 percent in the second quarter, up slightly from 42.1 percent in the first quarter and up from 34.1 percent in the second quarter of 2014.

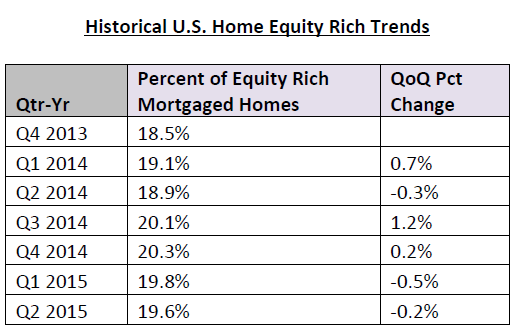

Share of equity rich mortgaged properties up 1 million from year ago, down 300K YTD

The universe of equity-rich mortgaged properties -- those with at least 50 percent equity -- decreased on a quarter-over-quarter basis for the second straight quarter, down to 10.9 million representing 19.6 percent of all properties with a mortgage at the end of the second quarter. That was down from 11.1 million representing 19.8 percent at the end of the first quarter and down from 11.3 million representing 20.3 percent at the end of the fourth quarter, but still up from 9.9 million representing 18.9 percent at the end of the second quarter of 2014.

"Although the number of equity rich homeowners with a mortgage has increased by 1 million compared to a year ago, that number dropped by nearly 300,000 between the end of 2014 and the middle of 2015," Blomquist added. "The number of homeowners with a mortgage who have at least 20 percent equity has dropped by more than 900,000 during the past six months, indicating that homeowners who have gained substantial equity thanks to the housing price recovery over the past three years are taking advantage of that newfound equity. Some are leveraging that equity into a higher LTV refinance or a move-up purchase, some may be downsizing into an all-cash purchase and some may be cashing out of homeownership altogether. Those homeowners cashing out of homeownership altogether would explain why the nation's overall homeownership rate continued to decline in the second quarter even as homeownership rates among millennials increased."

Major metro areas with the highest percentage of equity rich properties reflect areas of continued growth in home prices: San Jose, California (43.8 percent), San Francisco, California (38.3 percent), Honolulu, Hawaii (36.7 percent), Los Angeles, California (32 percent), New York (30.7 percent), Pittsburgh, Pennsylvania (29.4 percent), Poughkeepsie, New York (28.0 percent), Oxnard, California (27.5 percent) and San Diego, California (26.9 percent).

"Over the past two years, the Seattle region has seen the percentage of homeowners who are seriously underwater drop by over 56 percent, one of the fastest and most impressive drops in the country ," said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market. "Usually a decline of this magnitude would suggest an uptick in the number of homes for sale, but unfortunately for Seattle, I don't see this taking place. Many of these homeowners are simply too apprehensive or don't have the financial capacity to move. But what we lose in new listings, we gain in overall market stability."

Markets with the most seriously underwater properties

Markets with a population greater than 500,000 with the highest percentage of seriously underwater properties in Q2 2015 were Lakeland, Florida, (28.5 percent), Cleveland, Ohio (28.2 percent), Las Vegas, Nevada (27.9 percent), Akron, Ohio (27.3 percent), Orlando, Florida (26.1 percent), Tampa, Florida (24.8 percent), Chicago, Illinois (24.8 percent), Palm Bay, Florida (24.4 percent) and Toledo, Ohio (24.3 percent).

Markets where the share of distressed properties -- those in some stage of foreclosure -- that were seriously underwater exceeded 50 percent in the first quarter of 2015 included Las Vegas, Nevada (57.7 percent), Lakeland, Florida (54.8 percent), Cleveland, Ohio (52.9 percent), Chicago, Illinois (52.5 percent), Tampa, Florida (51.7 percent ), Palm Bay, Florida (51.5 percent), and Orlando, Florida (51.2 percent).

"Many consumers in foreclosure don't understand the positive effects of the increased equity we are seeing across the Ohio markets, and the opportunities that this might bring in assisting them to avoid foreclosure," said Michael Mahon, president at HER Realtors, covering the Cincinnati, Dayton and Columbus markets in Ohio. "Across much of Ohio, housing demand is driving increased prices and lower days on the market, contributing to positive equity growth. For homeowners facing troubled financial circumstances due to job loss, divorce, death in the family, or health concerns, the best advice would be to consult with a real estate agent early in the process."

Markets with the highest share of positive equity foreclosures

Those states with the highest percent of distressed properties with positive equity included Colorado (72.0 percent), Alaska (69.8 percent), Texas (66.4 percent), Oklahoma (65.2 percent), and Nebraska (64.4 percent).

Major markets where the share of distressed properties with positive equity exceeded 60 percent included Denver, Colorado (83.7 percent), Austin, Texas (83.1percent), Honolulu, Hawaii (77.5 percent), San Jose, California (77 percent), Pittsburgh, Pennsylvania (75.9 percent), Jackson Mississippi (75 percent), Nashville, Tennessee (69.3 percent) and Houston, Texas (69 percent).

"The strong South Florida price increases over the past few years have moved many homeowners from negative to positive equity. We would encourage the remaining distressed homeowners to ask for a Broker Price Opinion (BPO) regarding the value of their property -- many may be surprised at their improving value," said Mike Pappas, CEO and president of Keyes Company, covering the South Florida market.

"Many homeowners that found themselves upside down in their homes just a few years ago are finding that they are now in a much better position with equity to spare, based on the strong appreciation we have experienced over the last few years," said Greg Smith, owner/broker at RE/MAX Alliance, covering the Denver market in Colorado. "When we look at other areas, such as Las Vegas, where homes seriously underwater have dropped by close to 50 percent, we see the strengthening of the economy as a whole provided by housing."

Homes owned seven to 11 years account for 38 percent of all seriously underwater homes

Residential properties owned between seven years and 11 years accounted for 38 percent of all seriously underwater homes as of the end of the second quarter. The highest seriously underwater rate is for homes owned for nine years, 21.6 percent of which are seriously underwater, followed by those owned for 10 years, 19.8 percent of which are seriously underwater, and those owned for eight years, 19.0 percent of which are seriously underwater.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Homebuyer Median Down Payment Hits Record $67,500

- New Home Sales in America Jump in July

- Zombie Foreclosures in U.S. Decline in Q3, Reaching Lowest Levels Since 2021

- U.S. Home Sales Uptick in July, First Time in 5 Months

- Italy's 2024 Tourism Boom, Tax Perks Energizing Local Home Sales

- U.S. Builder Confidence Moves Lower in August

- U.S. Mortgage Rates Dip to Lowest Levels in Over a Year in Mid-August

- DOJ, NAR Commission Payment Changes Take Effect August Seventeenth

- U.S. Foreclosures Jump 15 Percent Month Over Month in July

- Over 2.6 Million Western U.S. Homes at Risk of Wildfire Damage in 2024

- Opportunity Zone Homes Across America Enjoy Price Gains in Q2

- Orange County, Chicago, Phoenix, and Washington DC Become Trillion Dollar U.S. Housing Markets

- Los Angeles, San Diego and New York Have Highest Concentrations of Renter Households

- Greater Las Vegas Area Home Sales, Prices Rise in July

- People Are Still Moving at Scale From Fire-Prone to Heat and Flood-Prone America

- Buyer Agent Commission Rates Declining in Wake of NAR DOJ Settlement in 2024

- Miami's Brickell Office Market Hits Record $200 Square Foot Rents in 2024

- U.S. Pending Home Sales Rise 5 Percent in June, First Time in 3 Months

- California Home Sales Dip 3 Percent Annually in June

- Macau's Residential Sales Continue to Decline in 2024

- Greater Miami Residential Sales Slide 13 Percent Annually in June

- Greater Orlando Area Home Sales Down 11 Percent in June

- U.S. Home Sales Slipped Dipped 5.4 Percent in June

- Foreign Investment in U.S. Residential Properties Plummet 21 Percent Over Last 12 Months

- U.S. Housing Rents Growing Fastest in Unexpected Places in 2024

- U.S. Mortgage Rates Tick Down in Mid- July

- Mortgage Bankers Oppose Biden Campaign's Nationwide Rent Control Proposal

- Apartment Building Permits in U.S. Drop Nearly 30 Percent Since Pandemic

- Global Home Price Growth Accelerates in 2024

- Las Vegas Area Condo Prices Rise 7.3 Percent Annually in June

- America's Home Affordability Issues Worsen in Mid 2024

- U.S. Mortgage Applications Dip in Late June

- Greater Palm Beach Area Residential Sales Dip 7 Percent in May

- Typical U.S. Home Selling Less Than List Price in June

- Mortgage Rates in U.S. Dip in Late June

- U.S. Pending Home Sales Fall to All-time Low in May

- Greater Miami Home, Condo Prices Continue to Rise in May

- Ireland Home Prices Rise in Q2, Driven by Inventory Shortages

- Home Sales in U.S. Dip for Third Consecutive Month in May

- Homebuilder Confidence in the U.S. Drops to 2024 Low in June

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More