The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

UK Shopping Center Investment Doubles

Commercial News » Europe Commercial News Edition | By Francys Vallecillo | June 20, 2013 10:16 AM ET

Sales of U.K. shopping centers reached £1.928 billion for the first half of 2013, more than double the £808 million worth of transactions during the same period a year ago, according to new data from Cushman & Wakefield.

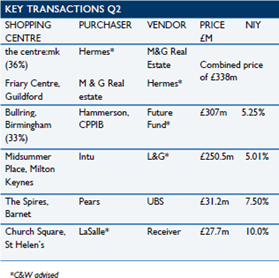

Nine transactions made up the total volume of retail shopping center deals. Most notable was the asset exchange between Hermes and M&G Real Estate during the second quarter. In the swap, M&G received the Friary Center in Guildford while Hermes took full control of the centre:mk in Milton Keynes after receiving M&G's 36 percent share in the center, the firm reports.

Other transactions include Pears' purchase of The Spires, Barnet, from UBS for £31.2 million and LaSalle's purchase of Church Square, St Helens, for £27.7 million from the ING Britannica Portfolio.

Other transactions include Pears' purchase of The Spires, Barnet, from UBS for £31.2 million and LaSalle's purchase of Church Square, St Helens, for £27.7 million from the ING Britannica Portfolio.Demand for prime projects remains high and is outweighing supply, driving yields down from 5.5 percent at the end of 2012 to 5 percent, Cushman & Wakefield reports. The firm expects investor activity to increase in the second half of 2013.

"Investment demand is encouragingly strong and we are seeing investors from all over the world wanting to acquire UK retail assets," Charlie Barke, head of shopping center investment at Cushman & Wakefield, said in a release. "There is a growing belief that the sector has reached the bottom and now offers decent recovery prospects."

There are currently 20 projects under offer with a combined value of £1.012 billion.

Secondary markets are also reporting strong demand, creating competitive bidding, with high yields expected in the next six months, the firm said.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More