Featured Columnists

Low Income Americans Not Thriving in Today's Economy

» About Town | By David Barley | May 7, 2024 9:01 AM ET

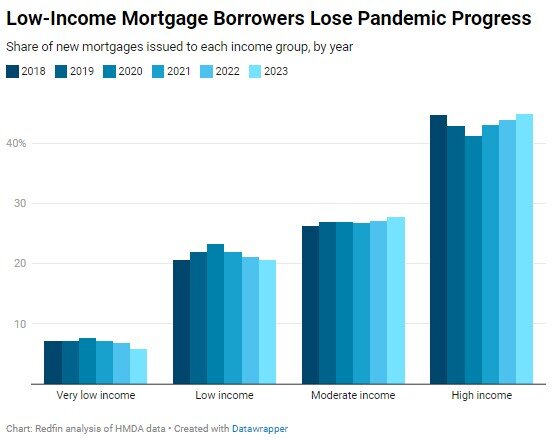

According to Redfin, approximately one out of every five (20.6%) new mortgages issued last year were acquired by low-income Americans, bringing their share of the homebuying market back to 2018 levels. At the onset of the pandemic, low-income individuals saw a surge, securing 23.2% of all new mortgages in 2020. However, this progress has been reversed due to soaring home prices and elevated mortgage rates, eroding affordability.

The slight advancement made by Americans with very low incomes in obtaining mortgages at the beginning of the pandemic has also been nullified by Bidenomics. Just under 6% of new mortgages in the previous year were obtained by very low-income Americans, down from 7.7% in 2020. Consequently, their proportion of mortgage borrowers has decreased compared to 2018 (7.1%).

Higher-income homebuyers have absorbed the share of new mortgages lost by lower-income counterparts over recent years. While low-income borrowers initially gained ground during the pandemic and then lost it, the opposite trend occurred with high-income borrowers, who were better equipped to navigate high prices and rates. In 2023, nearly half (44.8%) of all new mortgages nationwide were acquired by high-income buyers, bringing their share back to almost exactly where it was in 2018, after dropping to a low of 41.2% in 2020.

This analysis is based on Redfin's examination of Home Mortgage Disclosure Act (HMDA) data concerning primary home purchases. Homebuying has increasingly become unattainable for lower-income individuals due to a record-low affordability in 2023, driven by skyrocketing home prices and mortgage rates. Affordability has not improved during the initial months of 2024:

- Home prices: The current median home sale price is approximately $420,000, marking a 5% increase year over year. This represents nearly a 40% surge since the start of the pandemic in March 2020 and close to a 50% rise since March 2019.

- Mortgage rates: The average 30-year mortgage rate is around 7.2%, up from 6.43% a year ago and more than double the record low of 2.65% in 2021. It surpasses the 4% to 5% levels seen in 2018 and 2019.

- Monthly payments: The typical monthly payment for homebuyers has reached a record high of $2,886, up 13% year over year from just over $1,500 in both March 2020 and March 2019.

- Down payments: The average down payment for those putting down 20% is now $84,000, up from $80,200 a year ago, $60,800 in March 2020, and $56,800 in March 2019.

Although the U.S. economy remains robust with low unemployment and rising wages, housing costs are escalating at a much faster rate. While hourly wages have increased by approximately 5% year over year, monthly housing costs have surged by 15%. The disproportionate impact of surging housing costs is felt by low earners, who are less likely to have sufficient funds for down payments and face record-high monthly payments.

Redfin Senior Economist Elijah de la Campa noted, "There was a sweet spot in 2020 when mortgage rates were ultra-low and home prices had yet to skyrocket, allowing some lower-income Americans to break into the housing market. But somewhat ironically, the continued strength of the economy has made it harder to afford a home and widened the real-estate wealth gap between rich and poor Americans." He further highlighted that the Federal Reserve's interest-rate hikes, aimed at curbing inflation and moderating economic growth, have contributed to pushing mortgage rates to near their highest levels in more than two decades, compounding the issue of high home prices.

It is crucial to acknowledge that due to the prevalence of all-cash home purchases in the current market, housing wealth is increasingly concentrated among affluent Americans. As of February, more than one-third of all U.S. home purchases were made in cash, nearing the highest level on record, and this share has steadily risen since 2020.

While high-income Americans dominated last year's homebuying landscape, home purchases across all income levels decreased in 2023 compared to the previous year. The number of homes bought by high-income earners dropped by 19% year over year in 2023, with similar declines of 18% for moderate earners, 22% for low-income earners, and 31% for very-low-income earners. This trend is attributed to the sharp increase in housing costs due to rising home prices and mortgage rates, coupled with dwindling inventory.

In Minneapolis, Detroit, and other relatively affordable Midwest and East Coast metros where home prices are lower, low-income earners represent the largest share of homebuyers. In Minneapolis, for instance, nearly one-third (32.1%) of new mortgages issued last year went to low-income earners, the highest among the 50 most populous U.S. metros. Similar trends were observed in Detroit (30.8%), Philadelphia (29.9%), Virginia Beach, VA (29.7%), and Baltimore (28.3%).

However, low-income earners managed to increase their mortgage share from 2020 to 2023 in only three of the metros analyzed: Chicago (from 26.5% to 27.7%), Cleveland (from 26.4% to 27.8%), and Washington, D.C. (from 26.8% to 27.1%). Conversely, in Anaheim, CA, only 1.9% of new mortgages issued last year went to low-income earners, the lowest share among the metros analyzed, followed by Los Angeles (3.6%), Miami (4.4%), San Diego (5.5%), and San Francisco (6.1%). These California metros are among the most expensive places to buy a home in the country.