The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Featured Columnists

Oman Retail Market Set for Significant Change

Commercial News » Gulf Property Report | By Steve Morgan | May 20, 2014 8:29 AM ET

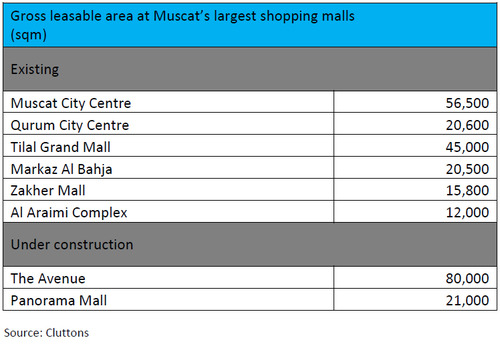

The four largest malls in the Omani capital account for 40% of the total gross leasable retail area across the city: Muscat City Centre, Markaz Al Bahja, Muscat Grand Mall and Qurum City Centre. The retail sector in Muscat is, however, about to witness significant expansion, with a strengthening pipeline of shopping mall developments.

Of the larger malls currently under construction in Muscat, The Avenue and Panorama Mall, both of which are in Bausher and the dedicated military personnel mall in Mawaleh are together expected to increase the supply of larger scale retail mall space over the next two years by over a third. In addition to this, there are currently proposals for three further mega malls, which would be vast retail destinations in their own right, akin to what is already on offer in Dubai. These include Majid Al Futtaim's 'Oman Mall' in Bausher, the Al Futtaim Group's 'Muscat Festival City' in Airport Heights and Al Jarwani Group's 'Downtown Muscat Mall' in Mabellah.

In an increasingly congested and competitive retail landscape, a clear understanding of the consumer target market and well-matched tenant mix will be the key to success for Oman's growing list of malls. Our experience shows that higher-end luxury brands have thus far been unsuccessful in Oman. This is linked to the relatively low levels of disposable income in the Sultanate, when compared to its Gulf Cooperation Council (GCC) peers.

In an increasingly congested and competitive retail landscape, a clear understanding of the consumer target market and well-matched tenant mix will be the key to success for Oman's growing list of malls. Our experience shows that higher-end luxury brands have thus far been unsuccessful in Oman. This is linked to the relatively low levels of disposable income in the Sultanate, when compared to its Gulf Cooperation Council (GCC) peers. Achieving the appropriate balance between luxury and "regular" retailers will be central to the success of Muscat's new shopping malls. This was recently evidenced by the tenant reconfiguration exercise undertaken at Markaz Al Bahja. A shift away from high end retailers, with a focus on more "value brands" helped to drive a significant uplift in the mall's footfall.

In addition, we have found that an anchor supermarket/hypermarket retailer almost guarantees a high footfall across the rest of the mall as well. This is a well tried and trusted technique across the wider GCC.

Away from Muscat's larger malls now looming, an emerging niche sector that we expect to grow rapidly are neighborhood malls. The development of these smaller community shopping malls has been limited to date, however the scope for a number of these, in the region of 3,000 to 10,000 sqm, bolted on to existing residential communities is tremendous. The car culture prevalent in much of the region means that malls are often a car journey away, so being able to service the needs of immediate surrounding population groups will almost certainly ensure the success of smaller retail schemes.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Featured Columnists Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More