The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Office Demand is Outpacing New Supply in Muscat

Commercial News » Middle East and Africa Commercial News Edition | By Michael Gerrity | June 4, 2014 10:46 AM ET

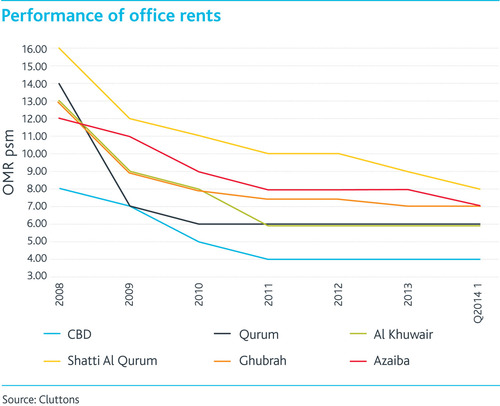

According to international real estate consultancy Cluttons, Muscat's commercial property market is showing signs of continued stability driven by government investment in transportation and energy infrastructure, with occupiers being drawn towards higher quality office space.

Cluttons has just released its Muscat Spring 2014 Commercial Market Outlook report, which reveals that the supply and demand equilibrium for Grade A space is now nearing a tipping point, with the delivery of new stock starting to fall behind the level of demand. As a result, Cluttons forecast that Grade A office rents are likely to drift upwards during 2014.

According to Philip Paul, Head of Cluttons Oman, "At Beach One in Shatti Al Qurm, for instance, we have achieved 80% occupancy since the building was brought to market two years ago, highlighting the depth of demand for Grade A office space. We have experienced a similarly quick pace of lettings for offices at Saud Bahwan Plaza in Al Ghubrah."

Given the significant investments being made by the government to also upgrade the Sultanate's port facilities, the report points to an expected increase in the demand for warehouse and industrial space this year.

Given the significant investments being made by the government to also upgrade the Sultanate's port facilities, the report points to an expected increase in the demand for warehouse and industrial space this year.With the relocation of the freight container terminal from its existing location in Port Sultan Qaboos in Muscat along the coast to Sohar, planned for later this year, it is anticipated that the latter will emerge as an activity hotspot. Cluttons anticipates that occupiers will rush to reposition themselves around the new port and this will help to remove some of the freight traffic from Muscat's already congested road network.

In the hotel sector, a substantial supply pipeline of four and five star hotel rooms are expected in the next five years. Although, there is a need for these luxury rooms in Muscat, there is also a strong danger of oversupply, which may translate into increased downward pressure on room rates.

Paul adds, "Given the expected oversupply of luxury high end hotels, we see a significant opportunity for mid-range three and four star hotels to expand in Oman and this will present new development opportunities as the sector continues to mature. We believe that a diverse range of hotel offerings will add further impetus to Oman's already growing reputation as a holiday destination."

A number of large scale mall developments are currently underway with the current estimated supply of approximately 350,000 sqm of leasable space within shopping malls set to expand by a further 35% over the next two years. Cluttons latest report indicates that the ability of the market to absorb the flurry of new malls due for delivery will certainly put retail rents under strain.

Paul concludes, "We expect to see developers increasingly focused on the creation of smaller neighbourhood malls with leasable areas in the region of 3,000 to 10,000 sqm aimed at servicing the retail needs of the surrounding population. The first of these neighbourhood malls, Al Marsa Village, is set to open later this year at The Wave, with several more likely to follow."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More