The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Geo-Political Unrest Increasing 'Real Estate Risk' in Some Emerging Markets

Commercial News » Middle East and Africa Commercial News Edition | By Michael Gerrity | July 10, 2014 9:00 AM ET

According to Cushman & Wakefield's new white paper entitled "Emerging and Frontier Markets: Assessing Risk and Opportunity", real estate risk to both assets and employees is on the rise in several emerging-market economies.

"Emerging and frontier markets present some of the most significant opportunities for occupiers and investors," said John Santora, President and Chief Executive Officer of Cushman & Wakefield Corporate Occupier & Investor Services. "The coming months will bring challenges, but the growth opportunities in most markets should outweigh the risks."

Key factors that remain at the forefront for any entity planning to lease, own, or operate property in emerging and frontier markets include transparency risks regarding the reliability and accessibility of information about property rights as well as corruption risks associated with the reputation of business partners and the threat of bribery or unethical business practices. However, the recent political developments in Ukraine, Iraq and Venezuela have increased the profile of geopolitical risks and the related health & safety risks of keeping employees safe and secure.

"Adequate security plans must address the physical asset, the employees, and the company's information," said Raymond W. Kelly, President of Cushman & Wakefield Risk Management Services. "The right plan and protocols begin with pre-occupancy planning and address on-site and off-site security, business continuity, crisis management, and recovery assistance."

Existing political systems in many countries are under pressure and states with poor governance and cultural tensions are susceptible to terrorism and other crimes such as kidnapping. Cyber security is also an increasingly critical issue as companies become more global. In addition, properties associated with more controversial industries such as oil & gas exploration are at higher risk.

While countries with increasing geopolitical risks have fallen out of favor with most occupiers temporarily, there are still significant growth opportunities across many emerging and frontier markets. Multi-nationals see strong population growth, an increasingly educated and affluent labor force and more transparent governments as driving factors for expansion. Property investors see an under supply of adequate real estate to meet corporate demand and are actively developing 21st century buildings in many central business district (CBD) locations.

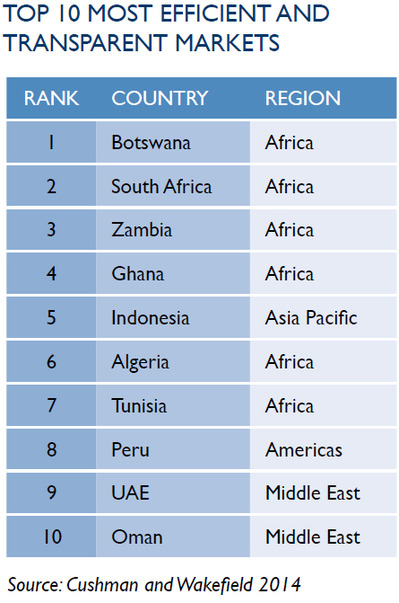

While countries with increasing geopolitical risks have fallen out of favor with most occupiers temporarily, there are still significant growth opportunities across many emerging and frontier markets. Multi-nationals see strong population growth, an increasingly educated and affluent labor force and more transparent governments as driving factors for expansion. Property investors see an under supply of adequate real estate to meet corporate demand and are actively developing 21st century buildings in many central business district (CBD) locations.The lowest risk emerging and frontier real estate markets are dominated by Africa and the Middle East, with eight of the 10 most efficient and transparent countries. South Africa scores well in terms of the ease of securing property and possesses some of the more developed property markets in the region. Across South Africa, the office market has continued its slow recovery with demand from multinational occupiers for well-located, high-quality space expected to be steady, although overall availability remains relatively high.

In Latin America, the top three locations are Peru (8th overall), Mexico (15th overall) and Uruguay (18th overall). Mexico's performance is inconsistent, ranking high in some categories such as market transparency while faring poorly in others such as registering property and political stability. The construction pipeline in Mexico City stands at an all-time high of 1.4 million square meters. Asking prices for rent continue to rise moderately, driven to a large extent by the higher standards of new buildings and sizable absorption.

Indonesia is the most transparent market in the Asia Pacific region (5th overall), followed by Thailand (11th overall), and The Philippines (14th overall). While the Indonesian office market is in a "wait-and-see" mode until after its 2014 general elections, demand for space has been positive and in-line with the country's growing economy, although rents in Jakarta are expected to show lower growth in 2014-2015 in the face of higher supply.

C & W's report evaluates four key risks and ranks 42 countries using a weighted index to determine which markets provide the best opportunity for global expansion.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More