The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

UAE Residential Markets Further Stabilizing in 2014

Residential News » Middle East and Africa Residential News Edition | By Michael Gerrity | September 15, 2014 9:11 AM ET

According to Cluttons' annual 2014 UAE Property Report, the UAE's residential property market has experienced improved stability during the first six months of 2014, with the rate of expansion steadying. This has led to the pace of growth in residential rents and values slowing in Abu Dhabi, Dubai and Sharjah.

Backed by a robust economy and a stable real estate sector, the outlook for the UAE remains extremely positive for the remainder of 2014.

Backed by a robust economy and a stable real estate sector, the outlook for the UAE remains extremely positive for the remainder of 2014.UAE Residential Market Highlights:

- Residential values in Dubai rise by 3.8% in H1

- 19% growth in Abu Dhabi residential capital values over the same period

- Sharjah rents up by 17%; Al Nahda is city's top performer

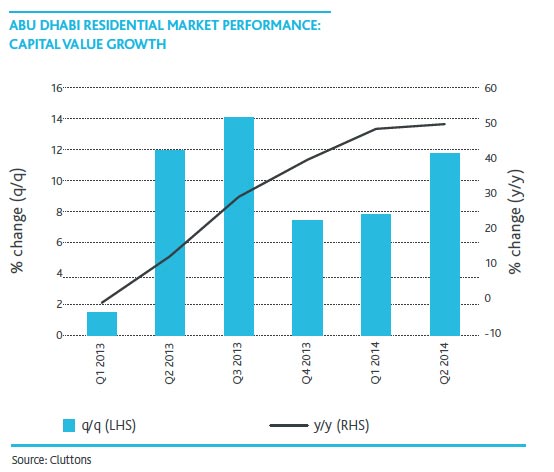

Cluttons' data reveals that Abu Dhabi's freehold market recorded a 11.4% rise in capital values in Q2, leaving them 48% above the same time last year. The latest rise translates into a 19% increase in average house prices during the first six months of the year, with the removal of the rent cap helping in part to fuel buyer demand. In the rental market, Cluttons expects affordability to remain central to the rental value growth equation, with rises likely to slow further in the coming months.

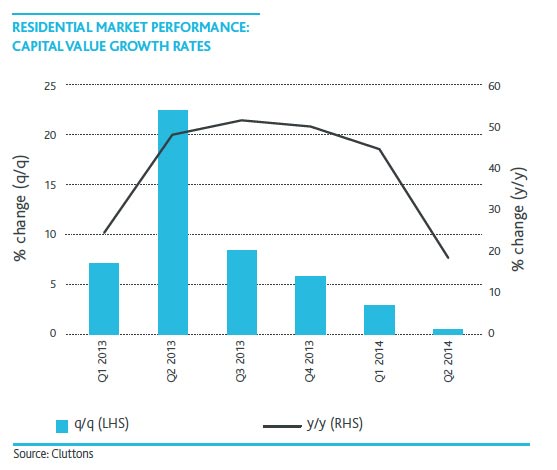

In Dubai, house prices have increased by 0.6% during the second quarter of this year, with villa prices declining by 1.6% and apartment values increasing by 2.3%. This takes price growth for the first six months of the year to 3.8% and reflects the widespread stabilisation of the market. The lettings market has continued to eke out marginal growth, with the city's freehold areas recording a 1.4% rise during Q2, taking total growth during H1 to just under 3%. In real terms, the rental value growth has been relatively flat, after inflation (2.7%), over the same period is factored in. Despite this, average rents remain 8.4% ahead of Q2 2013.

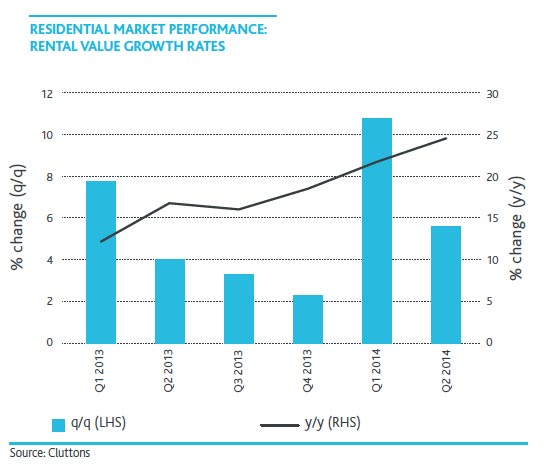

In Dubai, house prices have increased by 0.6% during the second quarter of this year, with villa prices declining by 1.6% and apartment values increasing by 2.3%. This takes price growth for the first six months of the year to 3.8% and reflects the widespread stabilisation of the market. The lettings market has continued to eke out marginal growth, with the city's freehold areas recording a 1.4% rise during Q2, taking total growth during H1 to just under 3%. In real terms, the rental value growth has been relatively flat, after inflation (2.7%), over the same period is factored in. Despite this, average rents remain 8.4% ahead of Q2 2013.Affordable rents in Sharjah continue to entice Dubai-based employees back to the emirate, while a limited supply pipeline has helped to drive up rents during the second quarter by 5.7%, following the 10.8% rise recorded in Q1. In addition, Cluttons notes a rise in the number of businesses from Dubai seeking out bulk staff housing in the emirate. With rental demand remaining high for villas, and supply levels remaining low, rents continue to edge upwards. At the Al Barashi Villa Compound for instance, Cluttons has recorded a consistently high level of enquiries, with average rents for a three-bedroom detached villa, standing at AED 110,000 per annum.

Steve Morgan, Chief Executive at Cluttons Middle East commented, "The UAE's economy has continued to mature and evolve, with the IMF predicting 4.4% annual growth this year. We see this as an indication of further sustainable growth driven by resilient core sectors, which continue to expand on the back of robust, widespread rises in business activity."

Steve Morgan, Chief Executive at Cluttons Middle East commented, "The UAE's economy has continued to mature and evolve, with the IMF predicting 4.4% annual growth this year. We see this as an indication of further sustainable growth driven by resilient core sectors, which continue to expand on the back of robust, widespread rises in business activity.""The real estate market has been a powerful driver behind the strong economic growth and although residential values and rents in Abu Dhabi, Dubai and Sharjah are showing signs of stabilizing, we expect other segments of the economy to compensate for the slower growth rates in the real estate market. It is important to note that although values and rents may be stabilizing to an extent, they are still maintaining a positive growth trajectory and we expect this to persist, which will in turn deliver the sustainability we have been anticipating. The careful implementation of measures at a federal and emirate level have been exceptionally successful in transforming the residential markets; this is particularly true in Dubai, where growth is now tracking a much more sustainable course as the market matures further."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More