The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

CMBS Delinquency Rates Uptick in December

Commercial News » North America Commercial News Edition | By Michael Gerrity | January 4, 2012 1:08 PM ET

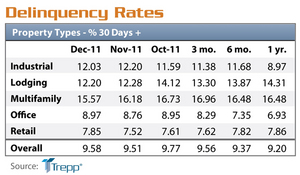

According to a new report by Trepp, after a positive November delinquency report, CMBS delinquency rates reversed course and moved higher in December.

According to a new report by Trepp, after a positive November delinquency report, CMBS delinquency rates reversed course and moved higher in December.Trepp views this as the first of a six to twelve month stretch where the rate could increase by 75 basis points in aggregate. This will come as a result of the first wave of 2007 originated loans reaching their balloon dates over the next few months.

Report Highlights:

- Overall U.S. delinquency rate increases to 9.58%--up seven basis points in December.

- Percentage of loans 30+ days delinquent or in foreclosure: December: 9.58%, November: 9.51%, October: 9.77%.

- If defeased loans were taken out of the equation, the overall delinquency rate would be 10.03%--up eight basis points.

- Percentage of loans seriously delinquent (60+, in foreclosure, REO or non-performing balloons) is at 9.06%--up 18 basis points.

Losing Year for CMBS

2011 will be remembered by tremendous peaks and valleys.

The CMBS market rallied smartly from January until March. At that point, concerns about the impact of the Japanese tsunami and unrest in the Middle East took the winds out of the sails of the CMBS market.

The market resumed its ascension in late April and May. The GG10 bond hits its post-credit crisis best level of about 170 basis points over swaps around this time.

The rally was short-lived, however, as worries over a weakening U.S. economy and the possibility of a Greek default weighed on all the financial markets. This triggered a three month losing streak for CMBS paper, which pushed spreads out to wide levels that had not been seen since August 2010.

As noted above, the market found its sea legs late in the year, but not without some collateral damage from the volatility. Many issuers pulled back or closed their doors entirely, leading many CMBS prognosticators to reduce their forecasts for 2012 issuance

By year's end, spreads were wider but not by nearly as much as one might have feared over the summer. Legacy super seniors were wider by 30 to 50 basis points on average. The GG10 A4 bond was off by 35 basis points over the course of the year.

December Numbers

- Legacy 10-year super senior spreads were 20 to 25 basis points tighter in December in aggregate.

- Average 2007 super seniors are now about 250 basis points over swaps.

- One year ago the average 2007 super senior was 213 basis points over swaps.

- Six months ago the average 2007 super senior was 186 basis points over swaps.

- Eighteen months ago the average 2007 super senior was 351 basis points over swaps.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More