The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

E-Commerce Driving U.S. Industrial Development in 2014

Commercial News » North America Commercial News Edition | By Michael Gerrity | September 26, 2014 8:00 AM ET

According to the latest report from CBRE Group, Inc., Where Are the Big Boxes? The State of U.S. Industrial Development Activity, demand for newer, Class A industrial space in the U.S. is outpacing supply, encouraging more build-to-suit and speculative development activity across the U.S

Much of this demand stems from the rapidly growing e-commerce sector, which is actively seeking large, big-box distribution centers near major metropolitan areas and distribution hubs to speed up delivery times.

"Despite the warming economic conditions, the amount of new supply that has been added to the market since 2010 is well below the levels seen during previous expansionary periods, as developers have been cautious over the past few years," said Scott Marshall, Executive Managing Director, Industrial Services, Americas, CBRE. "However, as availability rates continue to fall, higher rents will incentivize developers to commission more new projects."

See related story: Jury is Out: E-Commerce vs Brick-and-Mortar

Development activity has steadily increased every year since the beginning of the recovery cycle in 2010, when only approximately 7 million sq. ft. of new supply was added per quarter. By Q2 2014, the U.S. industrial market was delivering more than 25 million sq. ft. per quarter. However, completion levels remain well below historical averages. Prior to the recession, around 50 million sq. ft. of new industrial space per quarter was added to the market, approximately twice the levels seen during the first half of 2014.

Development activity has been largely concentrated in tier-one distribution markets in the South and West. In Q2 2014, six markets--Dallas/Ft. Worth, Houston, Phoenix, Chicago, Columbus and the Inland Empire--accounted for more than 61 percent of the nation's total construction deliveries. Overall, markets that have strong industrial fundamentals and solid infrastructure near ports, like Inland Empire, Dallas/Ft. Worth and Houston, have been expanding their industrial footprints more quickly than the national average.

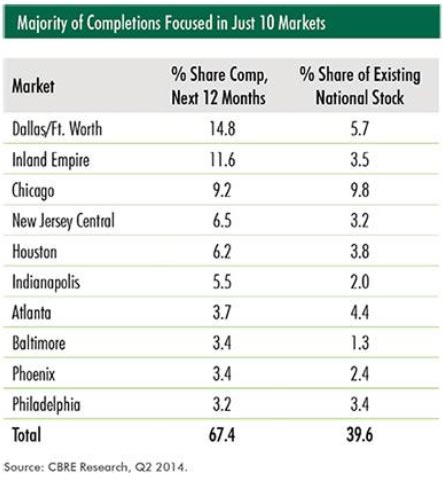

Development activity has been largely concentrated in tier-one distribution markets in the South and West. In Q2 2014, six markets--Dallas/Ft. Worth, Houston, Phoenix, Chicago, Columbus and the Inland Empire--accounted for more than 61 percent of the nation's total construction deliveries. Overall, markets that have strong industrial fundamentals and solid infrastructure near ports, like Inland Empire, Dallas/Ft. Worth and Houston, have been expanding their industrial footprints more quickly than the national average.Of the 125 million sq. ft. of new supply expected to deliver over the next four quarters, 67 percent is located in just 10 markets, including Chicago, Dallas/Ft. Worth, Baltimore and Indianapolis. One common theme among these markets is that they are all critically important for managing the import and distribution of goods throughout the nation's supply chain.

Big-box distribution centers (350,000 sq. ft. and greater) represent around two-thirds of all new industrial facilities expected to be delivered between Q3 2014 and Q2 2015. This focus is chiefly due to the optimization of supply chains to meet increasing demand from e-commerce users, a trend the report expects to continue throughout the coming years.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More