The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

9.1 Million U.S. Homes Still Have Negative Equity in Q2

Residential News » North America Residential News Edition | By Michael Gerrity | July 24, 2014 10:00 AM ET

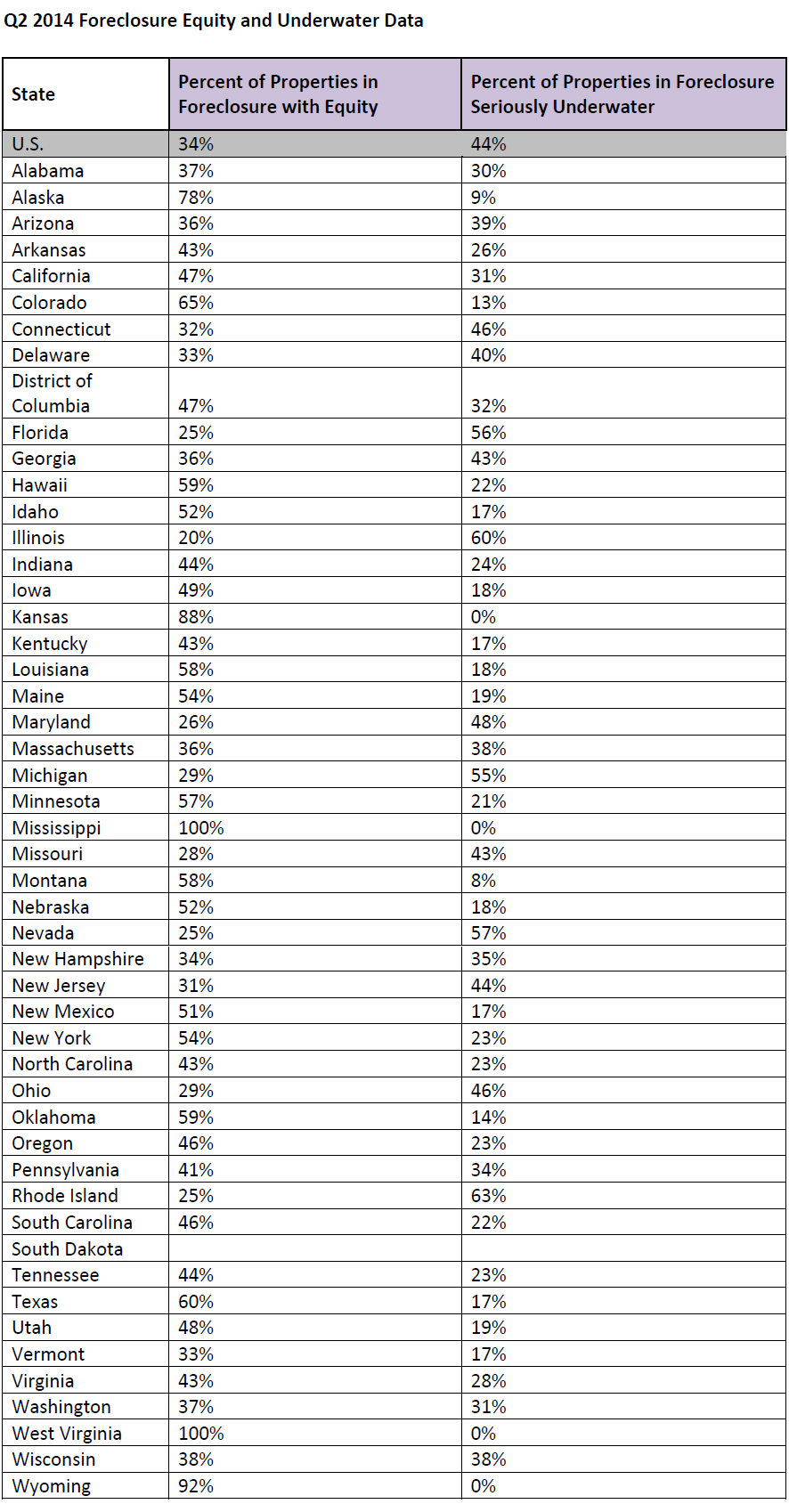

According to RealtyTrac's U.S. Home Equity & Underwater Report for the second quarter of 2014, over 9.1 million U.S. residential properties were seriously underwater -- where the combined loan amount secured by the property is at least 25 percent higher than the property's estimated market value -- representing 17 percent of all properties with a mortgage.

The second quarter of 2014 saw a small percentage decrease in homes that were seriously underwater 17.2 percent versus 17.4 percent in the first quarter of 2014 bringing it to the lowest level since RealtyTrac began reporting negative equity in the first quarter of 2012. The recent peak in negative equity was the second quarter of 2012, when 12.8 million U.S. residential properties representing 29 percent of all properties with a mortgage were seriously underwater.

The universe of equity-rich properties -- those with at least 50 percent equity -- held steady from the first quarter at 9.9 million in the second quarter of 2014, representing 18.8 percent of all properties with a mortgage.

The universe of equity-rich properties -- those with at least 50 percent equity -- held steady from the first quarter at 9.9 million in the second quarter of 2014, representing 18.8 percent of all properties with a mortgage.Another 8.8 million properties were on the verge of resurfacing equity in the second quarter of 2014, with between 10 percent negative equity and 10 percent positive equity, representing 17 percent of all properties with a mortgage, up from 8.5 million representing 16 percent of all properties with a mortgage in the first quarter of 2014.

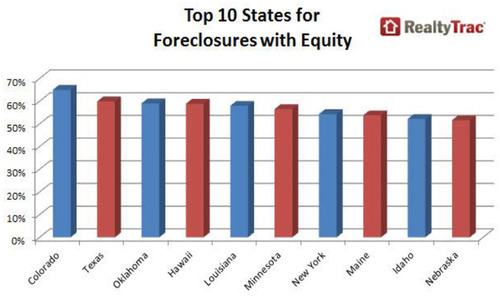

Fewer distressed properties had negative equity in the second quarter, with 44 percent of all properties in the foreclosure process seriously underwater -- down from 45 percent in the first quarter of 2014 and down from 57 percent in the second quarter of 2013. The share of foreclosures with positive equity decreased to 34 percent in the second quarter, down from 35 percent in the first quarter. Top states for foreclosures with equity include Colorado, Texas, Oklahoma, Hawaii and Louisiana.

"Home price appreciation has slowed in the last few months in many of the markets with the most underwater homes, slowing the pace at which homeowners are recovering equity lost during the Great Recession," said Daren Blomquist, vice president at RealtyTrac. "For instance, annual home price appreciation in California was at 16 percent in May 2014 compared to a high of 31 percent in July and August of 2013. In Arizona, home price appreciation has slowed to 6 percent annually compared to a high of 24 percent last year.

"In addition many of the properties that are seriously underwater are in a deep negative equity hole that will take some time to dig out of," Blomquist continued. "The average loan-to-value on the 9.1 million homes seriously underwater was 133 percent, and the average loan-to-value on the homes in foreclosure that are seriously underwater was 134 percent."

Markets with the most negative equity

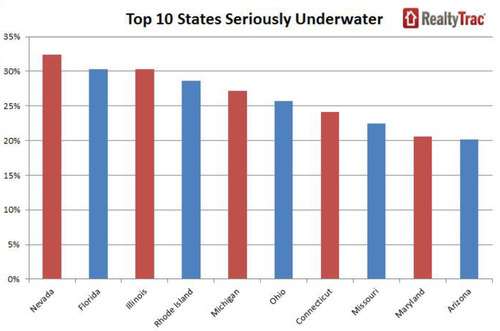

States with the highest percentage of residential properties seriously underwater in the second quarter were Nevada (32 percent), Florida (30 percent), Illinois (30 percent), Rhode Island (29 percent) and Michigan (27 percent).

States with the highest percentage of residential properties seriously underwater in the second quarter were Nevada (32 percent), Florida (30 percent), Illinois (30 percent), Rhode Island (29 percent) and Michigan (27 percent). Major metropolitan statistical areas (population 500,000 or more) with the highest percentage of residential properties seriously underwater were Lakeland, Fla (37 percent), Las Vegas (35 percent), Cleveland (35 percent), Palm Bay-Melbourne-Titusville, Fla (32 percent), Chicago (30 percent), Cape Coral-Fort Meyers, Fla (30 percent), and New Haven-Milford, CT (30 percent).

Markets with the most resurfacing equity

Major metro areas with the highest percentage of resurfacing equity - between negative 10 percent and positive 10 percent - were Colorado Springs, Colo., (28 percent), Albuquerque NM (22 percent), Lancaster, PA (22 percent), El Paso, TX (22 percent), Salt Lake City (22 percent) and Worcester, MA (22 percent).

Markets with the most equity-rich properties

Major metro areas with the highest percentage of equity rich properties - those with at least 50 percent equity - were San Francisco (37 percent), Honolulu (36 percent), Los Angeles (32 percent), New York (29 percent), Oxnard (28 percent), and San Diego (28 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More