Press Releases

Enertiv closes $9 million funding round to lead the decarbonization of commercial real estate

» Press Releases Edition | By Author | May 20, 2022 12:05 PM ET

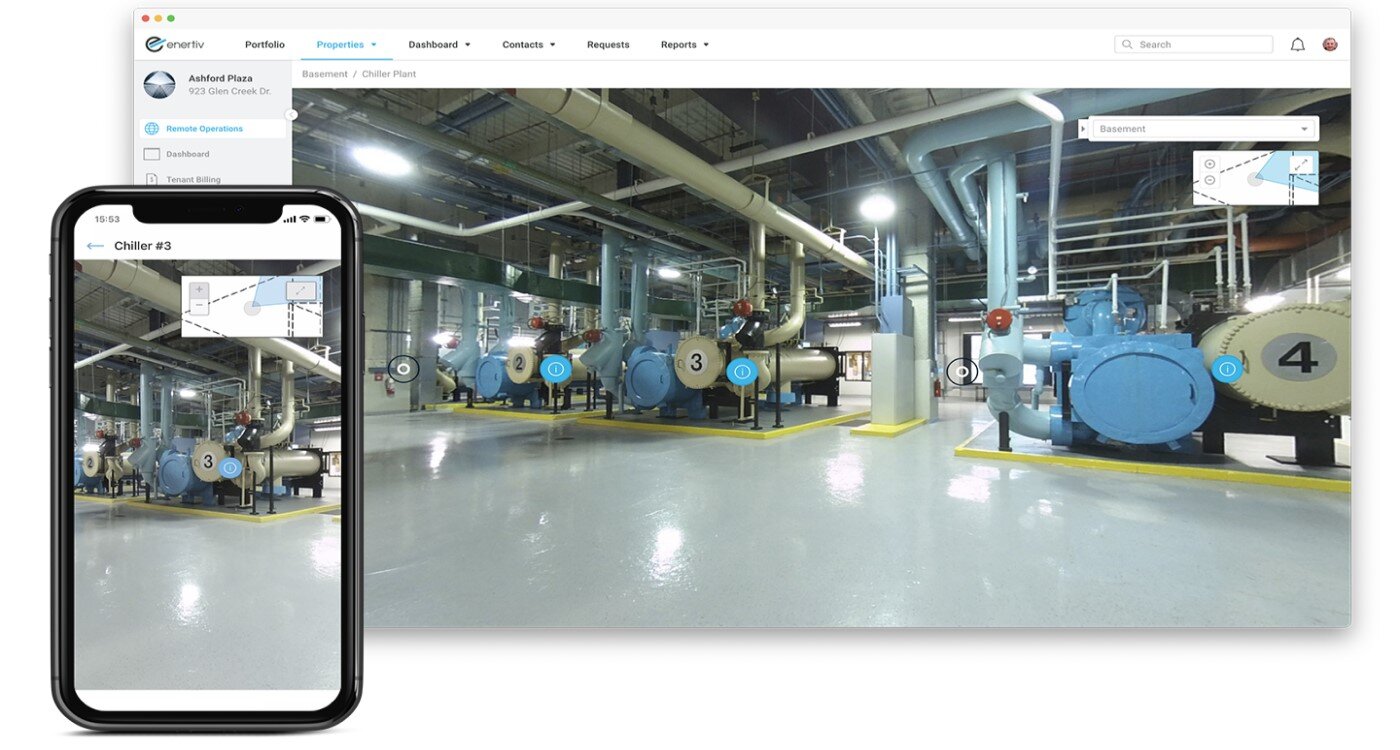

Enertiv, the operational intelligence platform for commercial real estate, has announced the completion of its latest preferred equity financing, as new and existing investors backed the company to play a leading role in the decarbonization of the commercial real estate industry. Co-led by Commonweal Ventures and GroundBreak Ventures, the new capital allows Enertiv to accelerate the development of the industry's most comprehensive ESG solution.

With building operations responsible for around 28% of all global carbon emissions, owners and operators are under increasing pressure to decarbonize their portfolios and work towards net zero targets. Enertiv's building operations experts work hand in hand with property teams to reduce resource consumption and operational expenditure. The latest raise positions Enertiv to meet a growing demand for its platform and to further develop the first end-to-end ESG solution, which is built to support a transition from portfolio-level benchmarking, to achieving quantifiable carbon reductions. Enertiv's ESG module goes beyond utility meter data, providing radical transparency into equipment and BMS performance, the indoor environment for health and safety, tenant resource consumption, capital investment decision making, and quantifying how assets are being run by in-house property teams and 3rd party vendors.

The new capital will also allow Enertiv to expand existing core software offerings, including Maintenance, Tenant Billing and Capital Planning, and enhance the company's AI algorithms to further automate insights related to asset level optimization. With Enertiv committed to leading the decarbonization of commercial real estate, any customer adopting Enertiv's software platform will get the ESG module at no cost through 2022.

Connell McGill, CEO of Enertiv, said:

"We're the first generation that's feeling the effects of global warming and the last that will be able to address the problem. As a major carbon emitter, the real estate industry simply has to take action now. To achieve net zero targets, measuring and reporting carbon emissions is not nearly enough. Owners and operators absolutely need to benchmark, report and set targets, but they also need to act, and act fast. At Enertiv, we want to encourage as many owners and operators as possible to shift from measurement to action. That is why we are offering our ESG module at no additional cost this year, and continually developing the tools the industry needs to tackle the climate crisis head on."

Said Nate Loewentheil, Founder and Managing Partner of Commonweal Ventures:

"As the commercial real estate industry races to reduce carbon emissions and comply with local and state climate regulations, building owners need the right tools in hand. That's why we are excited to invest in Enertiv."

For more information about Enertiv's ESG offer visit: www.Enertiv.com/get-started-esg-promotion