Commercial Real Estate News

Despite Draconian Covid Lockdowns in 2021, Australia Enjoys Record Commercial Sales Activity

Commercial News » Sydney Edition | By Michael Gerrity | February 4, 2022 9:03 AM ET

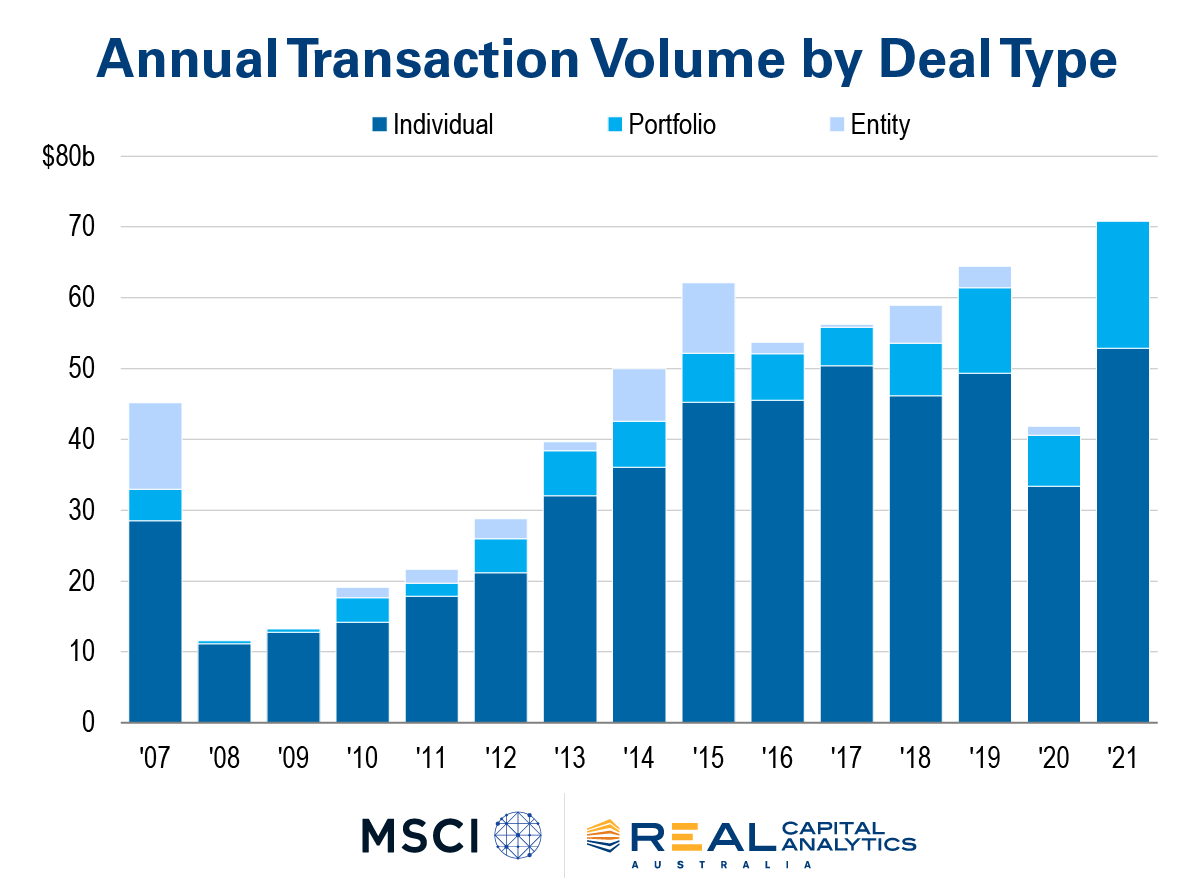

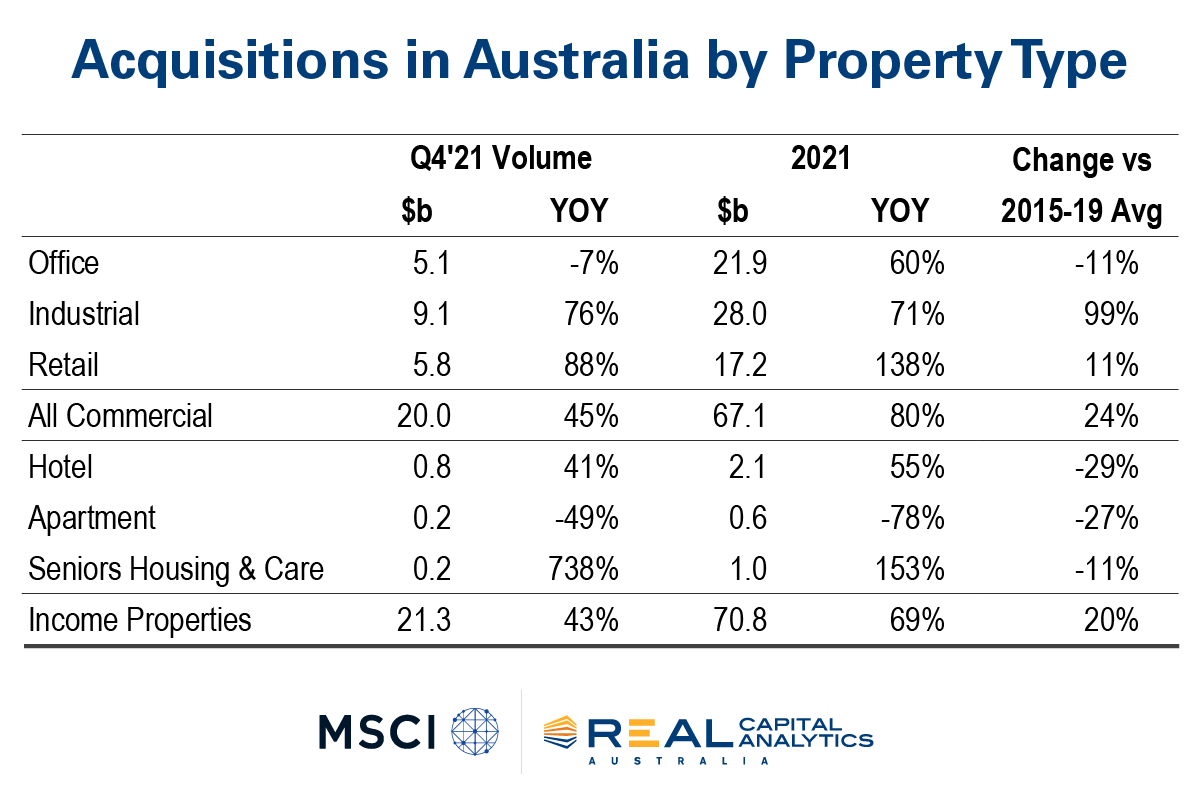

According to Real Capital Analytics the latest Australia Capital Trends report, Australian commercial property sales activity set a new annual record in 2021 of $70.8 billion, climbing 69% on a subdued 2020 deal total as industrial megadeals and sizable retail transactions returned some vigor to the market.

Office and retail buildings dominated the list of biggest single asset transactions for the year, but it was portfolio deals, which took the spotlight in 2021. Blackstone and GIC were involved in the two largest industrial portfolio deals: Blackstone purchased GIC's 49% share of the Dexus Australia Logistics Trust (DALT) for over $2 billion and sold its Milestone Logistics Portfolio to GIC for $3.8 billion, the largest direct sale in Australian commercial property history. For the fourth quarter and the year in total, industrial sector deal volume surpassed that of offices.

The retail sector ended the year on a high with several significant shopping centres changing hands. Deal volume for the fourth quarter rose to $5.8 billion, bringing the annual spend in the sector to $17.2 billion, above the annual average seen in the five years before Covid struck.

Benjamin Martin-Henry, RCA's Head of Real Estate Research commented, "The retail sector has seen significant increases in acquisition volume in 2021 compared to previous years; but, overseas buyers have demonstrated limited interest. The near 140% increase in retail transactions is almost purely driven by domestic investors who appear to be warming to the sector once again."

After a slow start to 2021, the Sydney office market ended the year as the number one investment market in Australia once again despite persistent uncertainty surrounding the future of offices. Sydney office sales increased 48% on 2020 volumes, with overseas investors accounting for around 60% of the total, their highest share in over a decade.

The five most significant office deals involved offshore buyers, such as Blackstone acquiring a 50% share in Grosvenor Place for $925 million and U.K.-based investor M&G Real Estate teaming up with Mirvac to acquire EY Centre for $579 million.

Benjamin Martin-Henry said, "Investors have shown a lot of faith in the Sydney office market with some significant transactions over the last year. We also have another $2 billion worth of Sydney offices awaiting settlement, which is a promising sign."

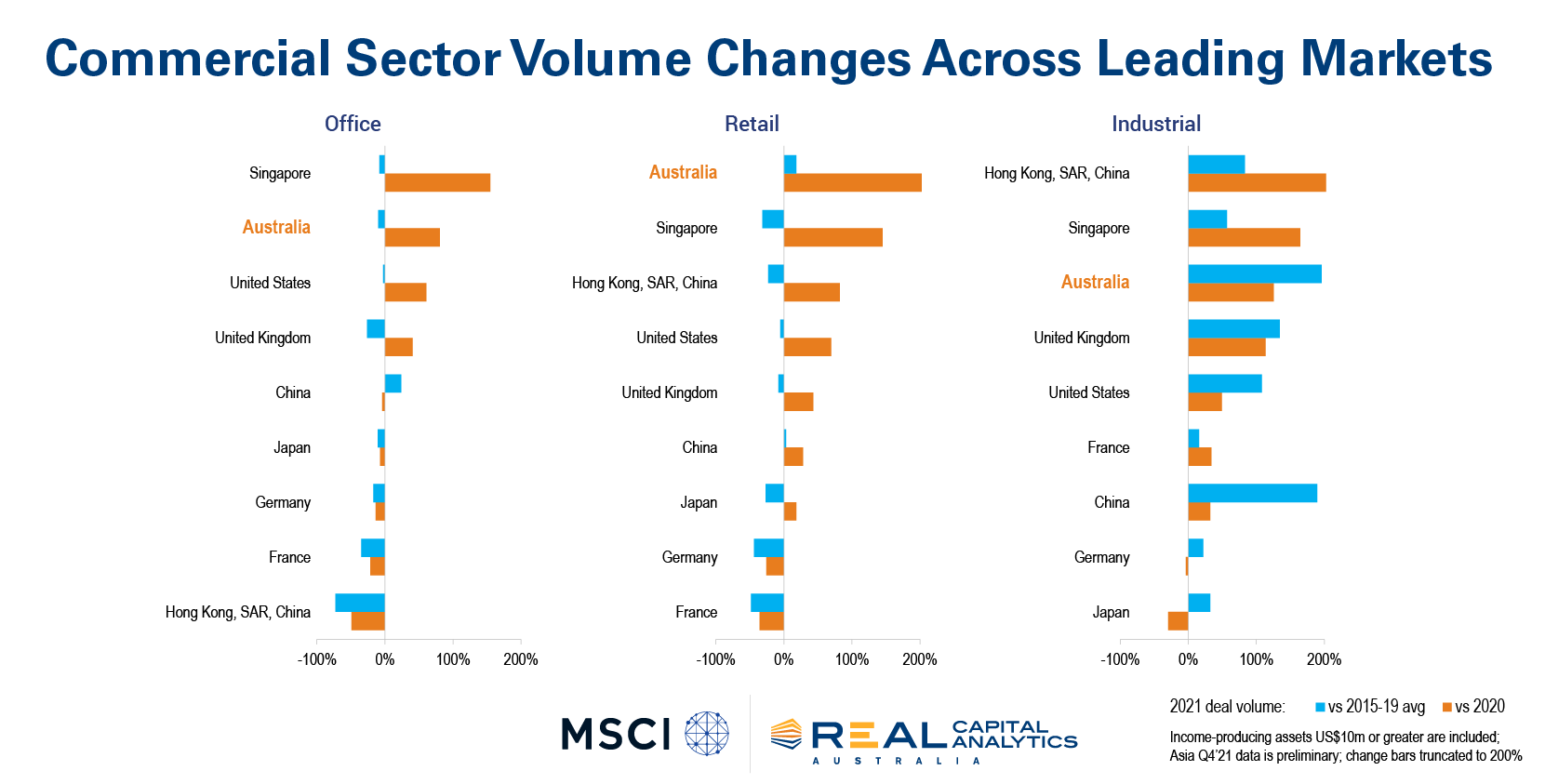

Overall, Australia was a top performer in 2021 compared to its global counterparts. Based on RCA's global deal size floor of US$10 million, Australian volumes were double those of 2020, which is a similar increase to that recorded by the United States. Closer to home, Singapore has been the standout performer, with volumes up over 170%. Hong Kong and China recorded double-digit growth.

David Green-Morgan, RCA's Head of Real Estate Research, Asia Pacific said, "The Australian market has bounced back significantly better than many of our global peers, particularly in the office and retail sector. Australia is one of the very few major markets that saw retail volumes increase on pre-Covid averages."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.