Commercial Real Estate News

Large Opportunity to Transform Australia's Office Market in Play

Commercial News » Sydney Edition | By WPJ Staff | June 28, 2023 12:38 PM ET

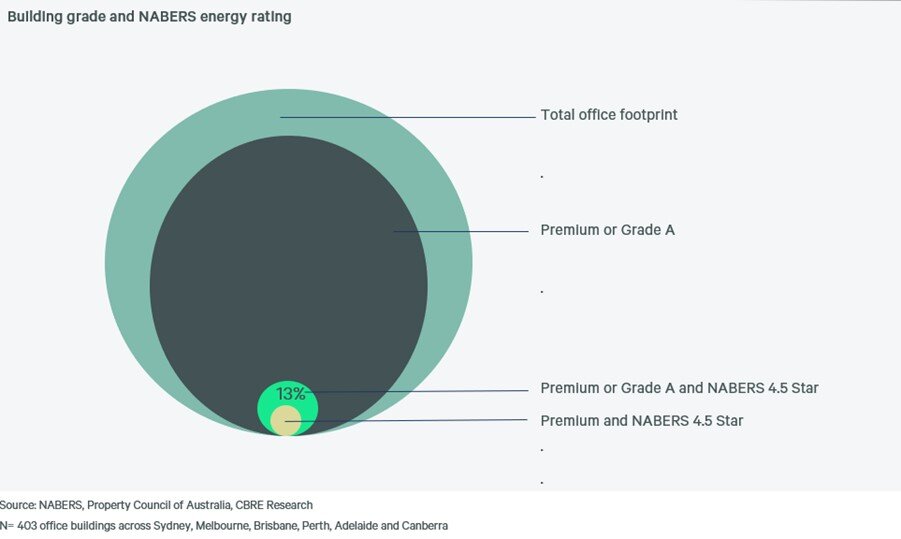

According to CBRE Australia, more than 1.2 million square meters of premium and Grade A office space in Australia is ripe for energy efficiency upgrades to attract office occupiers prioritizing ESG in their lease decision making.

That's one of the conclusions from CBRE's latest NABERhood Watch research report, which highlights that, while there's been 22% uplift over the past five years in Australian office buildings with a NABERS Energy rating of 5 Star or above, circa 13% of the country's Premium and Grade A office stock has a rating of only 4.5 Stars.

"This represents more than 1.2 million square meters of office space where there's an opportunity to both "do good" and tap into the growing pool of office occupiers prioritizing ESG," Mr. Chopra said.

"It's also apparent that age is no barrier when it comes to ESG upgrades, with circa 43% of the NABERs rated "vintage" offices built pre 2000 having a rating of 5 Stars or above."

Rising energy costs are expected to put even more emphasis on NABERS upgrades, given that energy makes up 10-15% of the operational cost of office building.

"In today's high energy cost environment, the business case is easier to justify," Mr. Chopra said.

"Competition to attract the best tenants is another driver, with our analysis showing a 7% spread between the occupancy rates of buildings with 4 Star NABERS Energy ratings compared to their 5.5 Star and 6 Star peers. That widens to 24% for buildings rated 3 Star or less."

From a dollars and cents perspective, the report highlights a 2-4% rent advantage for each additional NABERS star when comparing buildings within each city CBD location.

There is particularly strong evidence of rental premiums in Perth, with the potential for that differential to grow given the heightened Resources and Mining Services sector focus on ESG outcomes.

"Our analysis also highlights a slight correlation between cap rates and NABERS ratings. There is a slight premium for 6 Star rated buildings and a slight discount for 4.0 Star rated buildings, although valuations are also impacted by location and cashflow strength," Mr. Chopra noted.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.