Residential Real Estate News

Canadian Home Sales Slide in February Amid U.S. Trade Tensions

Residential News » Vancouver Edition | By Michael Gerrity | April 11, 2025 6:50 AM ET

Tariff Uncertainties Keep Canadian Home Buyers Sidelined

Canadian home sales saw a significant decline from January to February 2025, as cautious buyers stepped back during the first full month of the ongoing trade war with the United States.

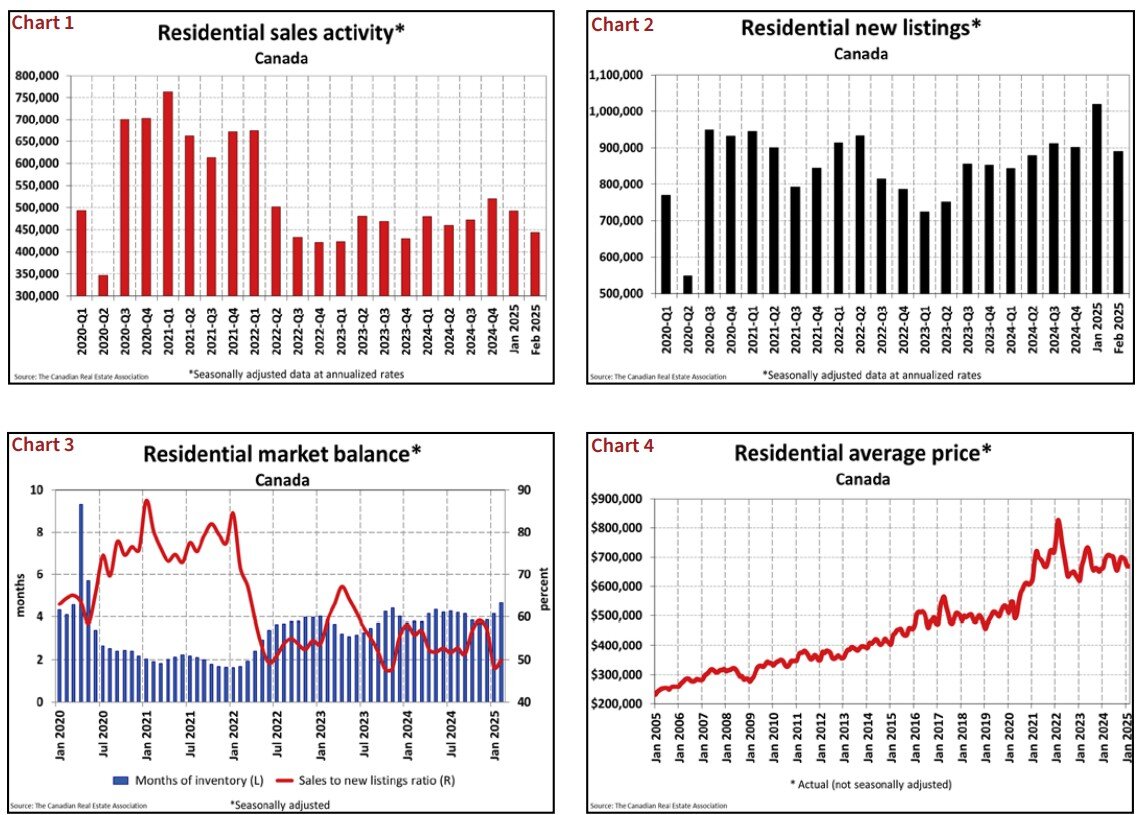

According to data from Canadian MLS Systems, national home sales dropped 9.8% month-over-month in February--the lowest level recorded since November 2023 and the steepest monthly decline since May 2022.

"The gap between this year's and last year's sales activity opened as soon as tariffs were announced on January 20," said Shaun Cathcart, Senior Economist at the Canadian Real Estate Association (CREA). "That gap only grew wider through February, culminating in a substantial, though unsurprising, slowdown. We're already seeing that impact through renewed price weakness, particularly across Ontario's Greater Golden Horseshoe region."

The drop in sales was widespread, affecting about 75% of local markets, including nearly all major urban centers. The sharpest declines were seen in the Greater Toronto Area and surrounding Golden Horseshoe communities.

New listings also fell sharply, down 12.7% compared to January, effectively erasing the unexpected spike seen at the start of the year.

With both sales and listings declining at similar rates, the national sales-to-new listings ratio inched up to 49.9% in February, from 48.3% in January. Historically, a ratio between 45% and 65% suggests a balanced housing market. The long-term national average sits at 55%.

At the end of February 2025, there were 146,250 homes listed for sale across Canadian MLS® Systems--up 13.1% year-over-year, but still well below the seasonal average of around 174,000 listings.

The national inventory level also rose, reaching 4.7 months of supply, up from 4.1 months in January. This approaches the long-term average of five months. Markets are typically considered seller-favored below 3.6 months of inventory, and buyer-favored above 6.5 months.

Home prices softened alongside demand. The National Composite MLS Home Price Index (HPI) declined 0.8% from January to February 2025 -- the largest monthly drop since December 2023.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future