The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Air Quality a Concern for Beijing Office Market Tenants

Commercial News » Beijing Edition | By Miho Favela | April 9, 2015 9:40 AM ET

To address the question of how poor air quality in Beijing is impacting China's commercial office markets, a subject of much local and international scrutiny in recent years, CBRE has just released a new report titled Property and Pollution: The Impact of Smog on the Beijing Office Market. The report analyzed how the deteriorating air quality will affect Beijing's real estate market; how occupiers and landlords will respond; as well as the opportunities and challenges for the city's office sector. CBRE's report key findings included:

Air Quality is the Second Biggest Concern for Office Occupiers in Beijing

Around 66% of the respondents identified air pollution as a key disadvantage for Beijing as an office location, second only to rising rents. On the various impacts of air pollution, 68% of the respondents believe that "air pollution threatens employees' health and work efficiency". In addition, 60% of the respondents believe that "air pollution has made senior expatriates less willing to work in Beijing". A further 29% believes that air pollution has "a significant impact".

Poor Air Quality Has Not Negatively Impacted Beijing's Appeal as an Office Location

Occupiers' concern over the poor air quality in Beijing has increased significantly in recent years. At the same time, leasing activity and net absorption of office space have both declined. This has led to speculations on whether or not these two situations are directly related. However, CBRE's research findings and key data of the office market shows that demand for office space in Beijing remains strong. There is no evidence that suggests any direct link between lower net absorption and poor air quality.

Tin Sun, Associate Director, CBRE Research Northern China, commented, "Whilst poor air quality is a major concern, Beijing remains a top choice for when corporate occupiers choose locations for their regional or national headquarters. The major concerns of the companies surveyed focus on their employees' health and the increasing difficulties of relocating senior expatriates to work in Beijing. However, no evidence shows that there's direct link between the poor air quality and the declining office leasing activity over the past two years or so."

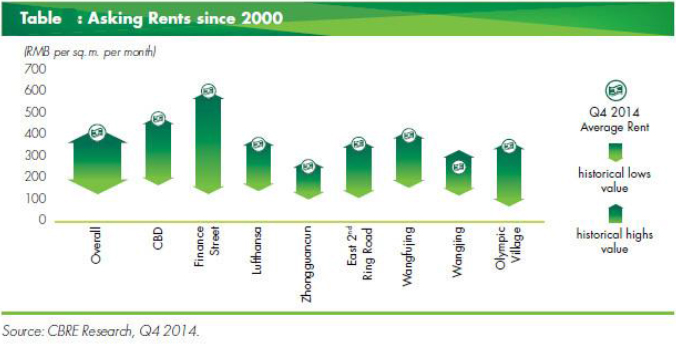

Leasing activity in Beijing was subdued in recent years by the shortage of supply and the increasing rental costs. Vacancy has remained low since 2011, standing at 4.4% as of Q4 2014, or the lowest among the 17 key domestic office markets that CBRE monitored. New supply was limited over the past two years and could not satisfy the potential demand from the market. The shortage of office space available in Beijing has led to the constant rise in rents.

Office rents for Beijing's Financial Street and Beijing's CBD ranked third and fourth, respectively, in CBRE's latest ranking of the most expensive global office locations. Rents in most other submarkets in Beijing have also reached record high since the end of 2012. Consequently, respondents cited "rising rents in Beijing" as the biggest concern when making decisions for office locations. A majority of occupiers, therefore, have chosen to adopt a more cautious leasing strategy due to the current economic uncertainties and budget constraints. These factors affect the overall office leasing activity, much more than the poor air quality in Beijing.

New office supply in Beijing is expected to climb in 2015. This will improve overall availability of office space for tenants whilst posing greater pressure on landlords to reduce rents, ultimately generating more leasing activity and better net take-ups throughout the year.

New office supply in Beijing is expected to climb in 2015. This will improve overall availability of office space for tenants whilst posing greater pressure on landlords to reduce rents, ultimately generating more leasing activity and better net take-ups throughout the year.Buildings with Green Features will Help Retain Tenants

As employees' concerns over their personal health and working environment are increasing, indoor air quality is coming into play when companies make leasing decisions. Buildings with green features will help retain tenants by increasing occupier satisfaction and loyalty. As the white paper reveals, only 37% of the respondents are very satisfied or satisfied with "indoor environment and air quality". Around 14% are dissatisfied or very dissatisfied, recording the second lowest point in the satisfaction portion of the survey.

Virginia Huang, Regional Managing Director, CBRE Northern China, commented, "In the context of tight space availability and high rents in Beijing, companies have to rely on traditional index when making leasing decisions. These fundamental elements include office rent level, location, availability of public transportation, profile of the office area and property management. However, as new supply comes on stream and occupiers have more choices, green buildings are expected to be popular leasing targets as they possess unique selling points. "

CBRE has categorized prime office buildings in Beijing's CBD, Lufthansa and Financial Street, into two groups. CBRE evaluated the differences between LEED and non-LEED certified buildings, and how LEED certifications--which closely measure the effectiveness of air purification systems--affect the indoor air quality, and the relationship between air quality and rental level. CBRE found that LEED-certified buildings demonstrate much better rental performance, and this is particularly true when the market sees over-supply, higher vacancy rate and more intense competition.

Catherine Xiong, Senior Director, Project Management, CBRE, commented, "To meet occupiers' increasing demand for higher indoor air quality, more landlords have started to improve their air purification systems. Currently, some of the effective measures include setting up PM2.5 filters on the mainframe or terminal units of central air conditioners, improving the air tightness in buildings, using air quality monitors that are more precise and sensitive, adopting fit-out materials and procedures configured to meet higher environmental specifications requirements."

Looking forward, as the Chinese government continues to issue more measures to tackle air pollution issues, CBRE predicts that growth in the tertiary sector is expected to create additional demand for office space. In the long term, the renovation of manufacturing sites to become office space is likely to create more office supply and support a more balanced supply and demand structure. Furthermore, the synergized development of the Beijing-Tianjin-Hebei region is expected to transform the demand patterns for the overall office market in Beijing.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More