Residential Real Estate News

Macau's Residential Sales Continue to Decline in 2024

Residential News » Macau Edition | By Michael Gerrity | July 30, 2024 7:26 AM ET

Data from DSF indicate that the housing market transaction volume decreased by 12.7% year-over-year in the first half of the year, while 172 presale homes were recorded during the same period. Following the launch of 'The Zenith' in Taipa, other developers have become more active in launching new projects such as 'YOHO Twins', 'Waterfront Duet', and 'Le Chun Fok'. To boost inventory sales, developers have adopted a conservative pricing strategy for new properties, aligning them closely with secondary market prices.

In the first half of 2024, two projects were issued presale permits, offering 2,072 new homes with a total gross floor area of 238,505 sqm, mainly on the Macau Peninsula.

The residential leasing market continues to be bolstered by strong demand for rental properties from expatriate employees, with new projects offering rental incentives, leading to an increase in the supply of rental properties in the market.

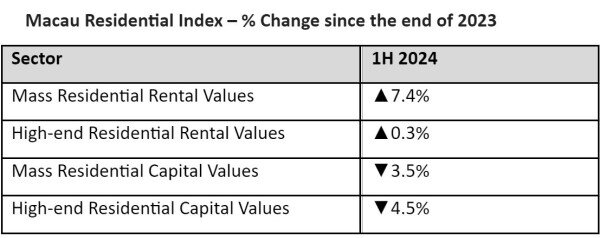

According to the JLL Macau Property Index, rents for luxury residences rose by 0.3% compared to the end of last year, while rents for mass housing increased by 7.4%. However, the performance of assets is trending in the opposite direction, with developers lowering the asking prices of new projects. Prices of luxury and mass residential properties dropped by 4.5% and 3.5%, respectively, in the first half of the year, while investment yields climbed by 1.8% and 2.0%, respectively.

Oliver Tong, General Manager of JLL in Macau and Zhuhai said, "Macau's real estate market experienced significant policy changes this year, including stamp duty reductions, easing luxury property mortgage ratios, and the recent removal of cooling measures. While these actions could potentially restore home sales to healthy levels, they are unlikely to drive home prices higher in the current challenging economic environment. In fact, the home prices correction was exacerbated following the government's decision to lower the maximum loan-to-value (LTV) for first-time buyers, coupled with price cuts in the primary market. Despite the extension of the interest-only repayment option until the year end, Macau's property loan delinquency rate rose to 4.1% in May, a multi-year high. While the market has welcomed the removal of cooling measures, the impact of reducing the down payment mortgage requirement for first-time buyers has been more significant. The government's complex policy changes have further stressed the weak housing market, making it difficult for the market to adapt."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership