Commercial Real Estate News

Office Space Users in Asia Pacific Feeling Upbeat in 2021, Despite Covid

Commercial News » Shanghai Edition | By Michael Gerrity | July 26, 2021 8:44 AM ET

Based on findings of CBRE's 2021 Asia Pacific Future of Office Survey, a growing number of corporate occupiers plan to extend their Asia Pacific office footprint in the long-term while adopting strategies featuring greater flexibility and new hybrid working models.

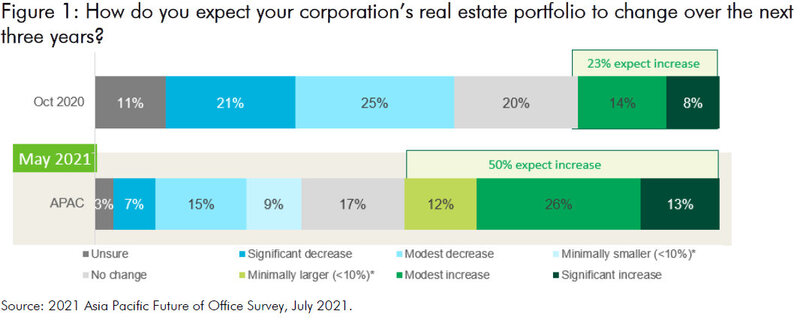

The survey of occupiers across industries and geographies in Asia Pacific saw about 50% of respondents signal their intention to increase the size of their real estate portfolios over the next three years, a substantial increase from just 23% in October 2020.

Leading the charge are Asian companies that are displaying a stronger appetite for expansion, particularly tech companies and some investment and insurance firms. Among multinational companies, while consolidation and flight-to-quality remains a focus, some still possess a healthy long-term appetite for expansion, such as tech firms.

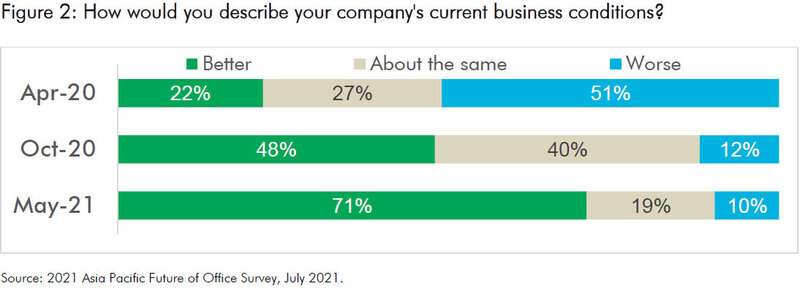

Fueling occupiers' expansion plans is a significant improvement in business sentiment across the region. A significant majority, or 71% of survey respondents believe current business conditions are getting better, marking a substantial improvement from the 22% and 48% of respondents who expressed this sentiment in April 2020 and October 2020, respectively. Confidence was highest in Greater China and the Pacific, while India and Southeast Asia were the least optimistic.

While the unpredictability of infection rates will continue to weigh on the pace of regional recovery for the foreseeable future, growing momentum in vaccination programs across the region are strengthening corporate confidence.

"Expectations of long-term portfolio growth are positive. In a shorter time horizon, occupiers remain focused on lease renegotiation and renewals, cost savings and a flight-to-quality strategy that capitalizes on the rent discounts and concessions available across the regional office leasing market.

As long as pandemic and economic-related uncertainty persists, portfolio flexibility and an increased use of flexible office space will remain high on the occupier agenda," said Manish Kashyap, CBRE's Head of Advisory & Transaction Services, Asia Pacific, and Global Head of Advisory & Transaction Services - Agile. As recovery accelerates and rising vaccination rates support improving confidence among corporate occupiers, companies are keen to bring employees back to the office while offering a greater degree of flexibility and choice.

Once the pandemic is fully under control, respondents expect employees to work from the office more frequently than they work from home, with hybrid working becoming a norm. At the same time, organizations have also begun to establish remote work policies which are subject to guidelines or company approval, enabling managers to determine their employees' work schedules and eligibility for remote work. CBRE believes such a change in working patterns indicates that hybrid working will only have a limited impact on future office demand.

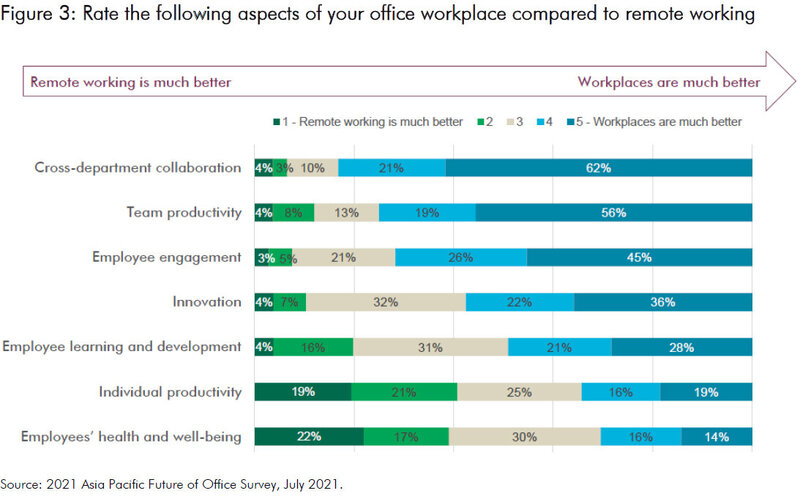

The survey found that compared to remote working, respondents believe the office to be more effective in supporting collaboration, team productivity, employee engagement, innovation and employee learning and development. Accordingly, occupiers are reviewing workplace design to increase informal collaborative spaces for connecting people.

"Offices are set to drive collaboration and connectivity more than ever, and workplace design will need to be adjusted and recalibrate accordingly. CBRE expects demand for space allocated to unscheduled catch-ups and communal space to increase. As a result of hybrid working, companies will consider reducing the number of large meeting rooms as employees do individual work and conduct small project team meetings more frequently. At the same time, occupiers are likely to increase expectation on landlords to provide on-demand solutions and services for large meetings and events," said Ada Choi, CBRE's Asia Pacific Head of Occupier Research, Data Intelligence and Management.

The findings also have far-reaching implications for real estate investors, many of whom are closely monitoring the recovery in office demand and seeking to recalibrate their investment strategies to capitalize on the occupier trends identified in the survey.

"Quality office assets in Asia Pacific currently present an attractive counter-cyclical opportunity for investors. They should take note of the strong occupier intentions to expand over the medium term, particularly among Asian companies. Assets with a good tenant profile catering to market segments benefiting from growth, such as the technology, media and telecommunications (TMT) sector and Asia-based companies are well-placed to outperform. These should be prioritized, as those properties are likely to attract stronger flight-to-quality demand. CBRE also advises investors to track growing occupier demand for assets offering wellness, technology and flexibility, and consider a service offering featuring flexible offices and meeting space on demand," said Dr. Henry Chin, Global Head of Investor Thought Leadership, and Head of Research, Asia Pacific, for CBRE.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.