Residential Real Estate News

Global Home Price Growth Further Slows in Mid-2023

Residential News » U.A.E. (Dubai) Edition | By Michael Gerrity | October 13, 2023 8:22 AM ET

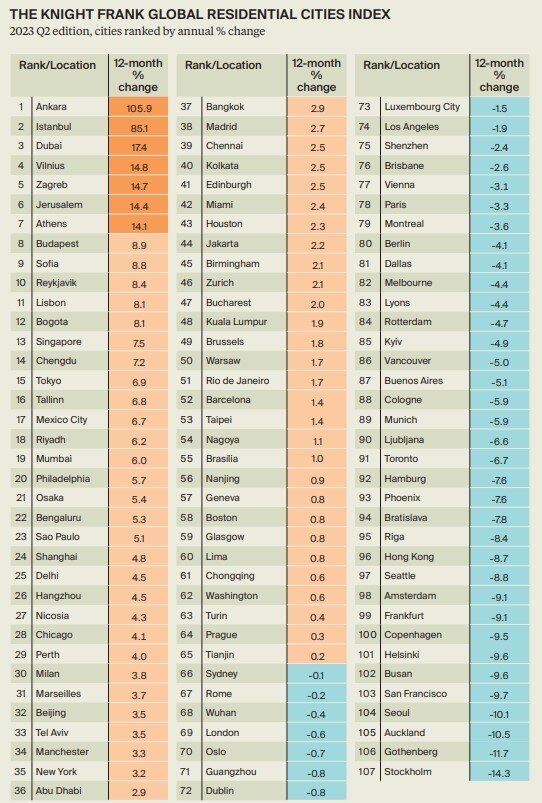

Based on Knight Frank's latest Global House Price Index, average annual price growth slowed across a cohort of world cities in Q2 2023, falling to 1.7% from 3.2% in Q1 of 2023.

However, more timely quarterly price change data reveals the beginnings of a revival in some key global markets. While considerable headwinds remain, Knight Frank anticipates a growing number of cities transitioning from falling to stable prices over the next two quarters.

This quarter's key takeaway is that average annual house price growth continues to slow globally. The shift from 3.2% in Q1 this year to 1.7% in Q2 marks the fourth consecutive quarterly slowdown from the recent peak in Q2 2022 when the post pandemic housing market boom drove annual growth to 11.8%.

Current growth is lower than that experienced in the first wave of the pandemic, when growth reached a low of 2.9% in Q2 2019. In fact, the last time growth was this slow was in Q1 2012, when the European Debt Crisis was putting sharp downward pressure on that region's housing markets.

Liam Bailey, Knight Frank's global head of research says, "There is early evidence that conditions are beginning to improve in a number of key global city markets. While it's likely that rising rates are now behind us, homeowners can expect to contend with current interest rate levels for the foreseeable future, which will limit the pace of the global housing market's recovery."

More recent numbers

However, more timely quarterly price growth shows a more complex story. From a high of 3.7% in Q1 2022, quarterly price growth fell sharply and turned negative in the final quarter last year. But growth has since ticked up with prices higher by 1.3% on average across our city markets in the three months to June 2023.

In the first quarter of this year some 48% of cities were seeing price declines in Q2, but this share had fallen to 40%. Improvements over the last three months are widespread - but the US, Canada, and Australia are standout examples.

At the end of 2022, 10 of the 12 US markets Knight Frank tracks were seeing quarterly price falls, by Q2 this year all 12 were seeing positive price growth. Similarly in Canada, all three of the markets tracked were falling in Q4 last year and are now rising - and at a strong quarterly rate. In Australia it is the same story with all cities in our basket seeing quarterly price growth in Q2.

Other markets have seen improvements - there are several strong examples in Europe with positive quarterly growth - in particular Oslo, Stockholm, and Glasgow.

While some key markets are strengthening, others are experiencing tougher conditions. Chinese mainland city markets have weakened, in Q1 nine of our 10 markets were rising on further slowing in price growth, but signs of recovery emerge 2023 Q2 Edition Knight Frank's Global Residential Cities Index provides a quarterly snapshot of trends in mainstream housing markets across more than 100 world cities Global Residential Cities Index a quarterly basis, this quarter half saw prices fall.

While still very strong, price growth in Turkey slowed sharply this quarter. Singapore saw a moderation in growth, and confirming the mixed nature of global markets, a number of European cities saw pricing conditions tighten further - most notably: Brussels, Marseilles, Athens, Barcelona and Madrid.

What's changed?

Knight Frank can see a number of drivers that are helping to underpin prices that include:

Reduced rate uncertainty: we are moving towards a more certain environment, with rate rises likely behind us, even if rates remain at levels which are high by recent historical standards.

Limited housing stock: a lack of new construction activity in recent years, coupled with lower market liquidity, has created a shortage of available properties to buy. This liquidity squeeze has been prompted by households avoiding moving to retain the benefit of low long-term fixed-rate mortgages.

Demographic shifts: some countries, most noticeably Australia, are experiencing a resurgence in inward migration after a pandemic-induced pause, leading to an increase in housing demand and prices.

Price corrections: some markets have already experienced significant residential market repricing. Eight markets have experienced drops of over 10%, and 25 markets have seen declines of over 5% since their 2022 market peak. Auckland led the way with a 20% fall to date. These adjustments, combined with high inflation rates, mean a number of markets have already seen an adjustment in real terms equivalent to that experienced during the Global Financial Crisis.

The evidence from this quarter's results points to an embryonic improvement in market conditions. As noted above, the impact of higher rates may be stabilising, but it hasn't disappeared. There will be a lagged impact from higher mortgage costs - which will be felt as a rising number of borrowers remortgage over the next 12 to 18 months, says Knight Frank.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years