The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

European Rents Drop Lower in Q2 as Global COVID Crisis Continues

Residential News » Paris Edition | By Michael Gerrity | July 22, 2020 9:00 AM ET

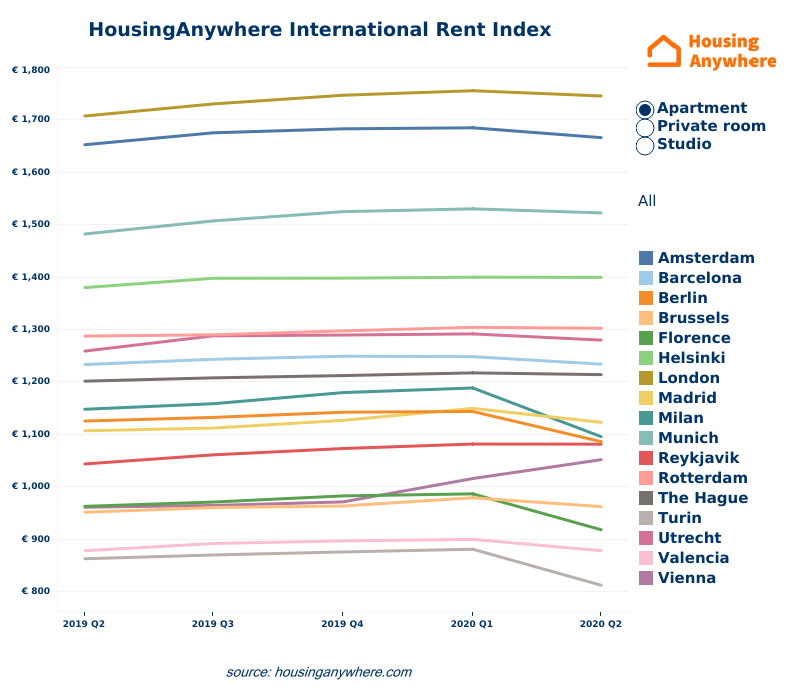

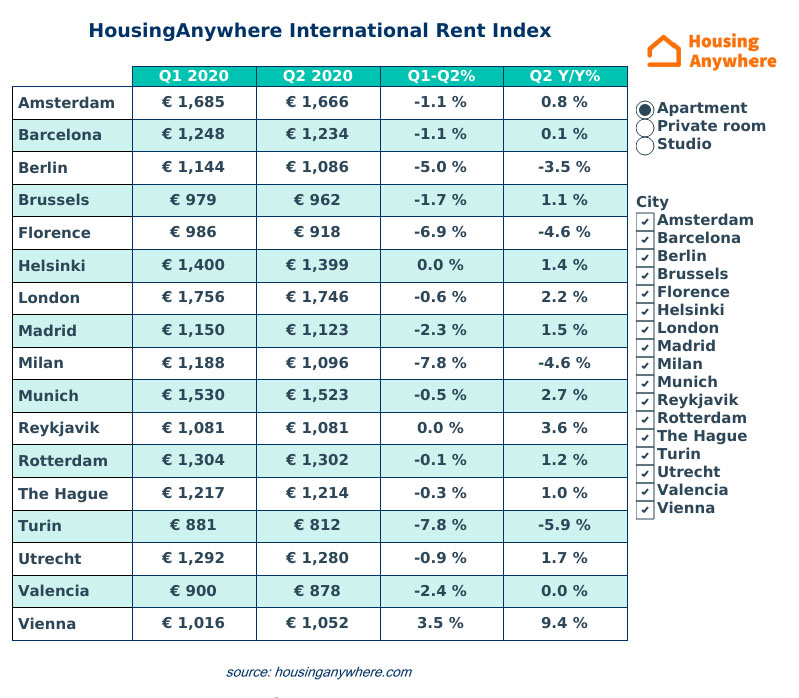

Based on the most recent HousingAnywhere International Rent Index Report for Q2 2020, quarterly rental prices have dropped in Q2 for nearly all European cities. While early signs of the impact of the Covid-19 pandemic on rental prices were already noticeable in the first quarter of 2020, the effects of the travel ban, which was valid from mid-March, are now fully visible.

Rents for single rooms have dropped the most by year-on-year comparison, while prices for apartments and studios are less impacted. This is a result of strengthening local markets: even though demand for these properties has decreased significantly among expats and young international professionals, it remains high among the local inhabitants of larger European cities. More single rooms are left vacant as there is less demand for these properties from international markets. Cities that were less impacted by Covid-19, in countries that were able to reopen their borders in mid-June, are showing smaller drops in rental prices as a result.

Despite the impact on the rental prices being evident, the effects differ per city. London remains the most expensive city to rent in Europe, but the rental price growth seen in the city in recent years is slowing down even further. In Milan, Barcelona, and Berlin, rental prices are now lower than in Q2 2019.

Most notable changes: Italian cities drop while Helsinki and Reykjavik remain stable

Italian cities are showing the biggest drops in rental prices of all cities featured in the Rent Index. Milan, the capital of Lombardy and the region where the virus struck the country the hardest, saw the biggest decreases in rent of all the cities in the Rent Index. Compared to the previous quarter, one-bedroom apartments dropped by -7,8% to EUR1,096 per month, a drop of -4,6% compared to Q2 2019. Turin, located 140 km from Milan, is showing a quarterly decrease of -7,8% for one-bedroom apartments to EUR 812 per month, a decrease of -5,9% compared to last year. In Florence, rental prices for one-bedroom apartments dropped by -6,9% to EUR 918, a drop of -4,6% compared to last year.

Helsinki shows a small impact on rental prices compared to the previous quarter: -0.1% for single rooms, -0.07% for studios, and -0.02% for one-bedroom apartments. In Reykjavik, we see a similar trend: -0,06% for single rooms, -0,07% for studios, and -0,02% for one-bedroom apartments, compared to Q1. Both cities have positive year over year rental price increases for apartments. Compared to 2019, rental prices for one-bedroom apartments in Helsinki increased by 1,4% to EUR 1,399. In Reykjavik, the price for one-bedroom apartments increased by 3,6% compared to last year to an average of EUR 1,081 per month. Helsinki had a peak in the number of Covid-19 cases in mid-April. Starting June 15, Finland has reopened its borders for the Baltic countries and the other Nordic countries, except Sweden. Reykjavik's peak also came mid-April and they reopened their borders on June 15.

Germany taking action and an optimistic outlook for Spain

Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5%. As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active. In an effort to boost the economy after the coronavirus pandemic shutdown, the German government has reduced the VAT for 6 months, from July 1 until December 31st. German VAT rates will drop from 19% to 16% (the regular VAT rate) and from 7% to 5% (the rate applied to food, medical supplies, public transport, et cetera).

Apartment prices in Madrid dropped by -2.3% to an average of EUR1123 per month. With the country opening up again for international travel, rents for June have started to recover to January levels again. For Spanish cities, the longer-term expectations are quite favorable. Spanish economists studying the impact on the real estate market agree that the impact of Covid-19 will be most visible in Q3 of this year. However, they also expect a speedy recovery as there is a high demand for accommodation and the country is in a much stronger financial situation than it was in 2008.

More bang for your buck

As a result of people having to (partly) work and study from home, there is a greater demand for higher quality accommodation, outdoor space, and green areas. Tenants are searching for apartments and studios with plenty of space including gardens and balconies. Tenants are also switching places more, in search of an upgrade from their current place. Accommodation that provides a separate study or work area, or that can offer these facilities near the accommodation, are also highly sought after.

As a continuation of a trend already visible in Q1 of 2020, more and more landlords are making the switch from short term rentals to midterm rentals. Also, landlords diversifying their portfolio is a continuing trend that was first visible in Q1.

"We currently see a tenants' market, where supply outnumbers demand," says Djordy Seelmann, CEO of HousingAnywhere. "Whether demand will recover, depends on when and to what degree international mobility will return. With a second wave looming, the international rental market remains turbulent. While international student numbers are expected to drop in the upcoming academic year, educational institutions expect programs to return to normality by January 2021."

Despite the rental market shifting towards tenants, many key university cities still have a housing shortage. With the blended approach universities have announced for September, and the high number of enrolments European universities are expecting in January 2021, it remains to be seen how long rental prices will stay at this level or even start increasing again.

Top 5 biggest rental decreases compared to Q1 2020

1. Florence is showing the biggest decrease in rental prices compared to the previous quarter. Single rooms have dropped by -9.6% to EUR 415, studios by -6.1% to EUR 649, and one-bedroom apartments with -6.9% to EUR918 per month.

2. The second Italian city in this top 5 is Milan, with a decrease of -9.1% to EUR 580 for single rooms, -5,5% for studios to EUR 859, and a decrease in rental prices for one-bedroom apartments of -7.8% to an average of EUR 1,096 per month.

3. Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5% As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active.

4. Madrid's rental prices for single rooms dropped by -5.8% compared to last quarter, resulting in an average rental price of EUR 514 per month. Rental prices for studios dipped by -1,1% to EUR 837, and prices for one-bedroom apartments dropped by -2.3% to an average of EUR 1123 per month.

5. Compared to last quarter, rental prices for single rooms in Valencia dropped by -4.9% to an average of EUR 319 per month. Rental prices for studios decreased by -1.4% to EUR 592, and the rental price of a one-bedroom apartment decreased by -2.4% to EUR 878.

Top 5 biggest rental increases, compared to Q2 2019

1. In Q2 of 2020, Vienna saw the highest overall year-over-year increase in rental prices: 9.5% for apartments, bringing the monthly rent to an average of EUR 1052, an increase of 3.1% for studios, to EUR 814, and an increase of 0.9% for single rooms, to EUR 478 per month. Similar to our last report, Vienna is ranked first as the city with the biggest increase in rental prices. This is the direct outcome of a changing market in the city, where zoning regulations cause short term providers to make the switch to midterm rental. As a result, there is a big increase in supply in the higher price segment. Mid-March, rental prices started dropping, a trend that continued until the end of May, when the borders of Austria opened up again. Currently, rental prices in Vienna are back to the same level they were in January.

2. Munich saw the second-highest overall increase in rent prices year over year. Apartment prices increased by 2.7% to EUR 1,523. Prices for studios crept up by 1.4% to EUR 1,031 and single rooms by 3.7% to EUR 686. This city, known for its high rental prices and its large shortage of accommodation, continues to be one of the most expensive cities in the Rent Index.

3. In third place ranks Reykjavik, with an increase in rental prices of one-bedroom apartments of 3.6% to EUR 1,081 and studio prices by 14% to EUR 902. The average rental price for a single room increased by 1.7% compared to last year to EUR 625.

4. Average rental prices for one-bedroom apartments rose in Rotterdam by 1.2% to EUR 1,302 per month. Studio prices increased by 2.4% to EUR 803, and prices for single rooms saw an increase of 2.2% to an average of EUR 559 per month. This is the second time Rotterdam is featured in the list of cities with the biggest increases in rental prices. However, the pace at which prices are increasing has been slowing down since Q3 2019.

5. Brussels saw rental prices for apartments creep up by 1.1% to EUR 962. Studio prices increased by 2% to EUR 690, and single rooms by 2% to EUR 582. In 2019, Brussels showed moderate rental increases in apartments, ranging from 3.9% to 5.4%. Near the end of 2019 and in Q1 of 2020, the increase in rental prices for one-bedroom apartments in Brussels approached 7%.

Rents for single rooms have dropped the most by year-on-year comparison, while prices for apartments and studios are less impacted. This is a result of strengthening local markets: even though demand for these properties has decreased significantly among expats and young international professionals, it remains high among the local inhabitants of larger European cities. More single rooms are left vacant as there is less demand for these properties from international markets. Cities that were less impacted by Covid-19, in countries that were able to reopen their borders in mid-June, are showing smaller drops in rental prices as a result.

Despite the impact on the rental prices being evident, the effects differ per city. London remains the most expensive city to rent in Europe, but the rental price growth seen in the city in recent years is slowing down even further. In Milan, Barcelona, and Berlin, rental prices are now lower than in Q2 2019.

Most notable changes: Italian cities drop while Helsinki and Reykjavik remain stable

Italian cities are showing the biggest drops in rental prices of all cities featured in the Rent Index. Milan, the capital of Lombardy and the region where the virus struck the country the hardest, saw the biggest decreases in rent of all the cities in the Rent Index. Compared to the previous quarter, one-bedroom apartments dropped by -7,8% to EUR1,096 per month, a drop of -4,6% compared to Q2 2019. Turin, located 140 km from Milan, is showing a quarterly decrease of -7,8% for one-bedroom apartments to EUR 812 per month, a decrease of -5,9% compared to last year. In Florence, rental prices for one-bedroom apartments dropped by -6,9% to EUR 918, a drop of -4,6% compared to last year.

Helsinki shows a small impact on rental prices compared to the previous quarter: -0.1% for single rooms, -0.07% for studios, and -0.02% for one-bedroom apartments. In Reykjavik, we see a similar trend: -0,06% for single rooms, -0,07% for studios, and -0,02% for one-bedroom apartments, compared to Q1. Both cities have positive year over year rental price increases for apartments. Compared to 2019, rental prices for one-bedroom apartments in Helsinki increased by 1,4% to EUR 1,399. In Reykjavik, the price for one-bedroom apartments increased by 3,6% compared to last year to an average of EUR 1,081 per month. Helsinki had a peak in the number of Covid-19 cases in mid-April. Starting June 15, Finland has reopened its borders for the Baltic countries and the other Nordic countries, except Sweden. Reykjavik's peak also came mid-April and they reopened their borders on June 15.

Germany taking action and an optimistic outlook for Spain

Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5%. As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active. In an effort to boost the economy after the coronavirus pandemic shutdown, the German government has reduced the VAT for 6 months, from July 1 until December 31st. German VAT rates will drop from 19% to 16% (the regular VAT rate) and from 7% to 5% (the rate applied to food, medical supplies, public transport, et cetera).

Apartment prices in Madrid dropped by -2.3% to an average of EUR1123 per month. With the country opening up again for international travel, rents for June have started to recover to January levels again. For Spanish cities, the longer-term expectations are quite favorable. Spanish economists studying the impact on the real estate market agree that the impact of Covid-19 will be most visible in Q3 of this year. However, they also expect a speedy recovery as there is a high demand for accommodation and the country is in a much stronger financial situation than it was in 2008.

More bang for your buck

As a result of people having to (partly) work and study from home, there is a greater demand for higher quality accommodation, outdoor space, and green areas. Tenants are searching for apartments and studios with plenty of space including gardens and balconies. Tenants are also switching places more, in search of an upgrade from their current place. Accommodation that provides a separate study or work area, or that can offer these facilities near the accommodation, are also highly sought after.

As a continuation of a trend already visible in Q1 of 2020, more and more landlords are making the switch from short term rentals to midterm rentals. Also, landlords diversifying their portfolio is a continuing trend that was first visible in Q1.

"We currently see a tenants' market, where supply outnumbers demand," says Djordy Seelmann, CEO of HousingAnywhere. "Whether demand will recover, depends on when and to what degree international mobility will return. With a second wave looming, the international rental market remains turbulent. While international student numbers are expected to drop in the upcoming academic year, educational institutions expect programs to return to normality by January 2021."

Despite the rental market shifting towards tenants, many key university cities still have a housing shortage. With the blended approach universities have announced for September, and the high number of enrolments European universities are expecting in January 2021, it remains to be seen how long rental prices will stay at this level or even start increasing again.

Top 5 biggest rental decreases compared to Q1 2020

1. Florence is showing the biggest decrease in rental prices compared to the previous quarter. Single rooms have dropped by -9.6% to EUR 415, studios by -6.1% to EUR 649, and one-bedroom apartments with -6.9% to EUR918 per month.

2. The second Italian city in this top 5 is Milan, with a decrease of -9.1% to EUR 580 for single rooms, -5,5% for studios to EUR 859, and a decrease in rental prices for one-bedroom apartments of -7.8% to an average of EUR 1,096 per month.

3. Rental prices are dropping for rooms, studios, and apartments evenly for Berlin with -5% As a popular destination for internationals, the city was hit hard by the travel ban. At the same time, rents have been decreasing since February when the Mietendeckel (rent cap) became active.

4. Madrid's rental prices for single rooms dropped by -5.8% compared to last quarter, resulting in an average rental price of EUR 514 per month. Rental prices for studios dipped by -1,1% to EUR 837, and prices for one-bedroom apartments dropped by -2.3% to an average of EUR 1123 per month.

5. Compared to last quarter, rental prices for single rooms in Valencia dropped by -4.9% to an average of EUR 319 per month. Rental prices for studios decreased by -1.4% to EUR 592, and the rental price of a one-bedroom apartment decreased by -2.4% to EUR 878.

Top 5 biggest rental increases, compared to Q2 2019

1. In Q2 of 2020, Vienna saw the highest overall year-over-year increase in rental prices: 9.5% for apartments, bringing the monthly rent to an average of EUR 1052, an increase of 3.1% for studios, to EUR 814, and an increase of 0.9% for single rooms, to EUR 478 per month. Similar to our last report, Vienna is ranked first as the city with the biggest increase in rental prices. This is the direct outcome of a changing market in the city, where zoning regulations cause short term providers to make the switch to midterm rental. As a result, there is a big increase in supply in the higher price segment. Mid-March, rental prices started dropping, a trend that continued until the end of May, when the borders of Austria opened up again. Currently, rental prices in Vienna are back to the same level they were in January.

2. Munich saw the second-highest overall increase in rent prices year over year. Apartment prices increased by 2.7% to EUR 1,523. Prices for studios crept up by 1.4% to EUR 1,031 and single rooms by 3.7% to EUR 686. This city, known for its high rental prices and its large shortage of accommodation, continues to be one of the most expensive cities in the Rent Index.

3. In third place ranks Reykjavik, with an increase in rental prices of one-bedroom apartments of 3.6% to EUR 1,081 and studio prices by 14% to EUR 902. The average rental price for a single room increased by 1.7% compared to last year to EUR 625.

4. Average rental prices for one-bedroom apartments rose in Rotterdam by 1.2% to EUR 1,302 per month. Studio prices increased by 2.4% to EUR 803, and prices for single rooms saw an increase of 2.2% to an average of EUR 559 per month. This is the second time Rotterdam is featured in the list of cities with the biggest increases in rental prices. However, the pace at which prices are increasing has been slowing down since Q3 2019.

5. Brussels saw rental prices for apartments creep up by 1.1% to EUR 962. Studio prices increased by 2% to EUR 690, and single rooms by 2% to EUR 582. In 2019, Brussels showed moderate rental increases in apartments, ranging from 3.9% to 5.4%. Near the end of 2019 and in Q1 of 2020, the increase in rental prices for one-bedroom apartments in Brussels approached 7%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More