Vacation Real Estate News

European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

Vacation News » Paris Edition | By WPJ Staff | May 1, 2023 8:34 AM ET

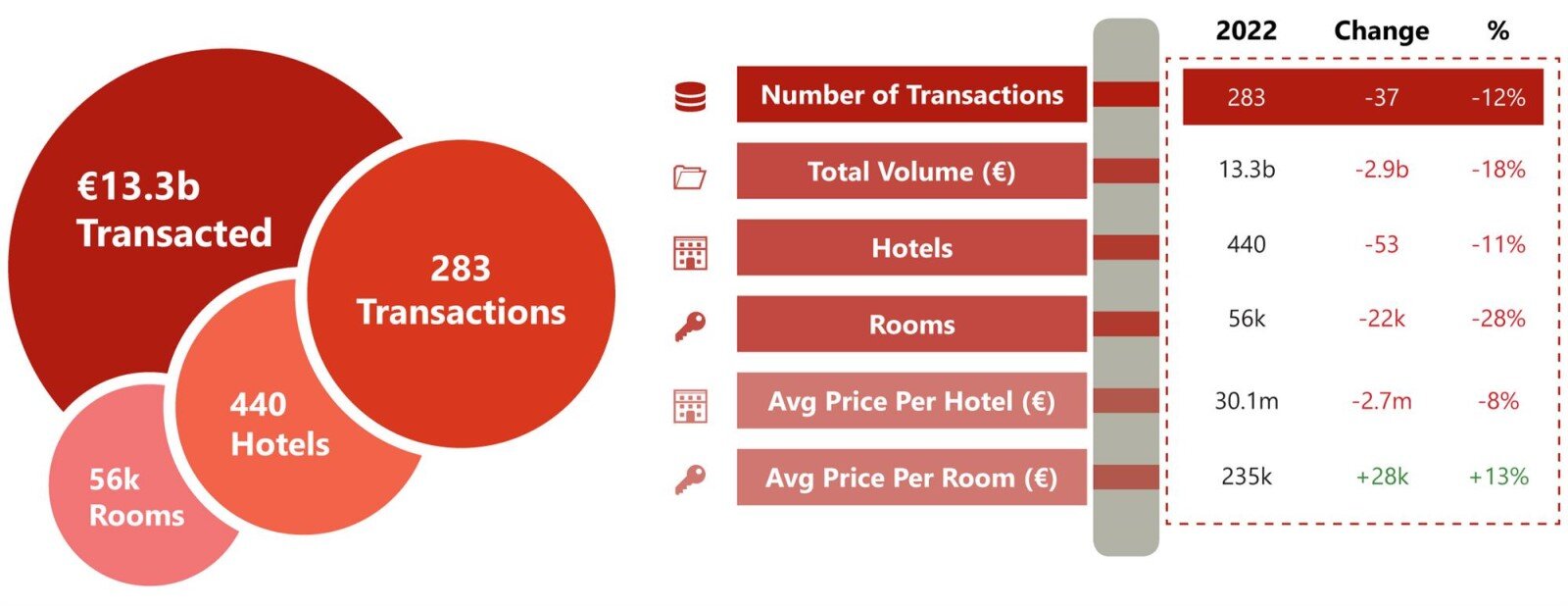

According to HVS' latest annual European Hotel Transaction Report, hotel transactions for 2022 totaled €13.3bn ($14.4bn USD), an 18% fall on the previous year as the impact of the Russian invasion of Ukraine, rising energy and food costs and high interest rates hit investor confidence.

Portfolio sales dropped 25% on the previous year, with total volume at €4.5bn ($4.9bn), with London seeing the highest level of portfolio deals.

The post-COVID era was expected to have been a story of strong recovery in the hotel investment market. However, the Russian invasion of Ukraine in February 2022, which fueled huge increases in energy and food prices, overall inflation and therefore interest rates, resulted in a mixed picture for hotel transactions for the year. Total volume in 2022 fell short of 2021 by 18%, with 37 fewer transactions. Prices per room achieved higher levels on average than in 2021, led by significant price increases in portfolio transactions.

HVS reports Real Estate Investment Companies were the most active investors in 2022, being both the largest buyers and the largest sellers of hotels by volume. Private Equity firms were the second-most-active sellers, with Institutional Investors being the second-most-active buyers.

Institutional Investors were also the largest net buyers in 2022, acquiring €2.0 billion ($2.2bn USD) more than they sold. The largest net sellers were Undisclosed, with more than €2.3 billion ($2.5bn USD) in disposals, followed by High-Net-Worth Individuals with €1.4 billion ($1.54bn USD) in disposals. European groups accounted for 73% of total hotel transactions in 2022.

Investment Volume by European City

Some major European cities attracted substantially more investor attention than they did in 2021, contributing to their respective countries' growth in 2022:

- Madrid climbed to second place, behind London, with a total volume of €498 million ($548 million USD, a 23% increase on 2021), with deals such as the hotel Princesa Plaza Madrid. Paris, where volume increased by an impressive 49%, rising from sixth place in 2021, followed Madrid in third place;

- Italy's single asset hotel prices recorded an average of €560,000 ($616,000 USD) per room (+60%), which was driven by several high-profile acquisitions, including the Rosewood Castiglion del Bosco resort in Tuscany. Rome, in particular, saw a volume increase of 883% versus 2021, including the transaction of the W Rome, lifting the Eternal City to the fourth-highest transaction volume of any European city in 2022;

- Both Amsterdam and Brussels returned as top investment markets in 2022, recording the fifth- and sixth-highest single asset volumes of any European city in 2022, says HVS.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend