The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Coronavirus Significantly Impacting Hong Kong's Office Market Demand

Commercial News » Hong Kong Edition | By Michael Gerrity | February 25, 2020 9:04 AM ET

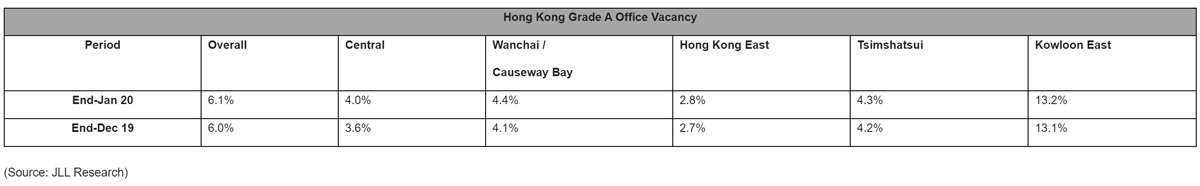

According to JLL's latest Hong Kong Office Market Monitor Report, Central's Grade A office rents dropped the sharpest among Hong Kong's core business districts as its vacancy rate reached 4% in January 2020, the first time in more than five years.

Office vacancies in major business districts continued to be on the rise, causing rents in the overall market to edge down by 0.9% m-o-m last month. The most severe decline occurred in Central's office market, which dropped 1.1% m-o-m to HKD 120.0 per sq. ft as the vacancy rate reached 4%, the highest since August 2014.

In Central, office leasing demand was weak as new lettings dropped 49% m-o-m. Activities were primarily driven by small expansions within the submarket. For instance, China Guangfa Bank has leased 13,000 sq. ft at One Exchange Square to relocate and expand out of another Grade A building within Central.

In Central, office leasing demand was weak as new lettings dropped 49% m-o-m. Activities were primarily driven by small expansions within the submarket. For instance, China Guangfa Bank has leased 13,000 sq. ft at One Exchange Square to relocate and expand out of another Grade A building within Central.

Alex Barnes, Head of Markets at JLL in Hong Kong commented, "The overall Grade A office market recorded a net withdrawal of 173,600 sq. ft last month. Immediate demand has weakened off the back of the coronavirus, as a number of businesses put decision making on hold. Some pockets of activity exist, with the majority of demand in decentralized locations."

In the investment property market, the sales of office and retail properties remained very slow. Nelson Wong, Head of Research at JLL in Greater China and Hong Kong said, "Only a limited number of offices changed hands for relatively small lump sums. The few transactions predominantly took place outside of Central. Investors in the retail market have grown more cautious. Their interests are largely focused on small lump sum assets in non-core areas, pricing below HKD 30 million."

In the investment property market, the sales of office and retail properties remained very slow. Nelson Wong, Head of Research at JLL in Greater China and Hong Kong said, "Only a limited number of offices changed hands for relatively small lump sums. The few transactions predominantly took place outside of Central. Investors in the retail market have grown more cautious. Their interests are largely focused on small lump sum assets in non-core areas, pricing below HKD 30 million."

Office vacancies in major business districts continued to be on the rise, causing rents in the overall market to edge down by 0.9% m-o-m last month. The most severe decline occurred in Central's office market, which dropped 1.1% m-o-m to HKD 120.0 per sq. ft as the vacancy rate reached 4%, the highest since August 2014.

Alex Barnes

Alex Barnes, Head of Markets at JLL in Hong Kong commented, "The overall Grade A office market recorded a net withdrawal of 173,600 sq. ft last month. Immediate demand has weakened off the back of the coronavirus, as a number of businesses put decision making on hold. Some pockets of activity exist, with the majority of demand in decentralized locations."

Nelson Wong

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More