The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong Class A Office Rent Growth Slows

Commercial News » Hong Kong Edition | By Michael Gerrity | November 27, 2018 9:10 AM ET

Hong Kong's Central District Office Demand Softens

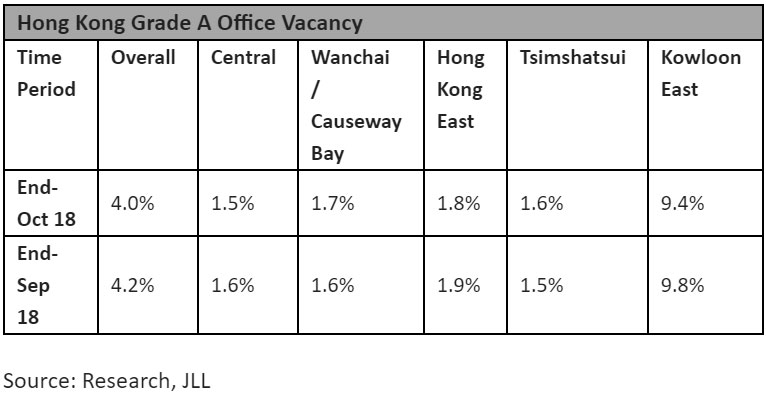

According to JLL's latest Hong Kong Property Market Monitor, rents in the overall Grade A office market continued to rise albeit at a slower pace last month. Average rent of Grade A office climbed 0.5% m-o-m in October, compared to a 1.0% m-o-m growth in September 2018.

Leasing demand in Central continues to show signs of easing with the amount of surrender space in October has climbed to 337,000 sq. ft. The companies decided to surrender are mainly because of the relocation needs. Nonetheless, banking and financial services firms remained active in the market. China Merchants Bank will relocate to Three Exchange Square after leasing five floors (59,4000 sq. ft) to accommodate expansion plans. The space was previously leased by HNA.

Alex Barnes, Head of Markets at JLL says, "Net absorption in the overall Grade A office market amounted to 188,100 sq. ft in October, bolstered by tenant movement to decentralized areas, especially to Hong Kong East and Wong Chuk Hang. The Kowloon East office market also benefited from the trend with rents growing a market leading 1.0% m-o-m in October. The stronger growth was supported by a 1.3% m-o-m increase in Grade A1 offices as more decentralizing tenants targeted higher quality office buildings."

Denis Ma, Head of Research at JLL also commented, "Investment volume remained subdued against the backdrop of falling stock market and escalating uncertainties brought about by the trade war. Still, a number of smaller Grade A office units transacted at extremely high prices. A 2,930-sq-ft unit on the 30/F of 9 Queen's Road Central reportedly being sold for HKD 163.5 million or HKD 55,800 per sq. ft, amongst the highest ever transacted in the building."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More