Commercial Real Estate News

Hong Kong Office Market Aided by Flex Space Operators Continued Expansion

Commercial News » Hong Kong Edition | By Michael Gerrity | October 28, 2022 8:10 AM ET

Based on JLL's latest Hong Kong Property Market Monitor Report released this week, Hong Kong's Grade A office market recorded net absorption of 157,000 sq ft in September 2022. Flex space operators remained active in the office leasing market and continued to expand their footprints in core business locations.

One of the major transactions in September was IWG leased 25,600 sq ft (GFA) at LKF Tower in Central, whereas The Great Room leased a mid-zone floor (21,300 sq ft, LFA) at Cheung Kong Center for expansion.

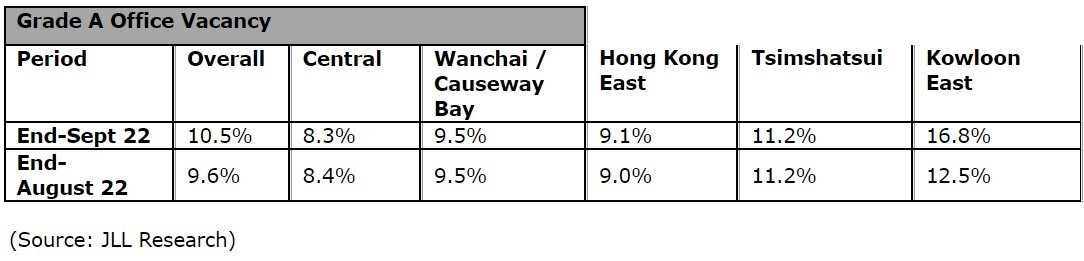

The overall vacancy rate rose to 10.5% at the end of September, mainly due to new completions during the month, namely Boton Technology Innovation Centre in Kwun Tong, and AIRSIDE in Kai Tak, in which household appliances manufacturer SEB Asia committed to a mid-zone floor of 37,500 sq ft (GFA). The vacancy rate in core business districts remained stable, while Central's vacancy rate improved from 8.4% to 8.3%.

Alex Barnes, Managing Director at JLL in Hong Kong, said: "In the face of global economic uncertainties and hybrid work becoming more popular, some tenants are turning to spaces that offer more flexibility. This has supported the expansion of flexible offices in the city. With the shift from traditional offices to hybrid work, companies need to rethink the design of their offices to accommodate the changing needs. The role of the office is no longer simply a place to work, but a communal space enabling collaboration, fostering innovation and supporting high-performing teams."

Nelson Wong, Executive Director of Research at JLL, said: "Overall net effective rents dropped further by 1.0% m-o-m in September. Among the major office submarkets, rentals in Central and Wanchai / Causeway Bay dropped by 0.4% and 0.1%, respectively, while rentals in Hong Kong East registered the largest drop of 1.1%."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.