The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong's Steep Office Rental Decline Moderates in November

Commercial News » Hong Kong Edition | By Michael Gerrity | December 31, 2020 8:03 AM ET

According to JLL's latest Property Market Monitor released this week, Hong Kong's office market rental decline has abated in recent months, as the initial phase of sharp rental corrections is over.

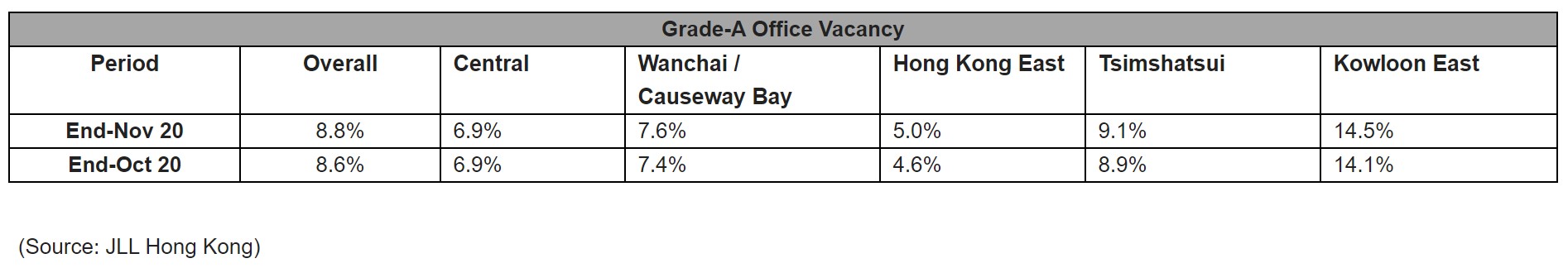

Rents extended the downward trend across all major office submarkets in Hong Kong with the overall market recording a 0.7% m-o-m drop in November 2020. Wanchai / Causeway Bay experienced the most significant contraction in rents during the month, while decentralized submarkets remained relatively resilient.

Overall Grade-A office negative net absorption was 130,500 sq. ft in November as contraction among corporate occupiers continued. Nevertheless, some instances of tenant expansion were seen as rents corrected to more affordable ranges. For instance, insurance company FWD reportedly expanded at 14 Taikoo Wan Road in Quarry Bay, leasing 19,300 sq. ft (LFA).

The vacancy rate in Central stayed at 6.9%, with a considerable amount of surrender space in addition. Leasing activity mainly revolved around small spaces. Notably, local law firm Tanner De Witt Solicitors reportedly leased a floor at Lippo Centre Tower 1 in Admiralty, taking 9,800 sq. ft (GFA).

Alex Barnes, Head of Markets at JLL in Hong Kong said, "Tenants started to make longer term real estate decisions, which will help the gross leasing volume pick up in 2021. And the rental fall would be moderate. We expect overall Grade A office rents to drop 5-10% next year. However, office rents in Tsimshatsui will under greatest pressure and will drop by 10-15%."

With respect to the retail market, Nelson Wong, Head of Research at JLL in Greater China also noted, "Leasing demand continued to be driven by retailers targeting local consumption, in particular Food and Beverage (F&B) operators. For instance, Japanese sushi restaurant Sushiro committed to a new branch at Infinitus Plaza (9,005 sq. ft) in Sheung Wan. This is their fifth new branch opened during the year, marking the fast-growing expansion trend for certain F&B operators."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More