The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Hong Kong Commercial Market Sees Sharpest Price Corrections Since 2008 Crash

Commercial News » Hong Kong Edition | By Michael Gerrity | July 16, 2020 9:00 AM ET

But price corrections will be less severe in the second half of 2020

International property consultant JLL is reporting this week that Hong Kong's commercial property leasing and investment markets recorded the sharpest correction in the first half of this year since the global financial crisis in 2008. But JLL forecasts the price correction in coming six months will be less severe and will see green shoots of hope in the medium term.

Capital values of mass residential remain resilient in the first half of 2020, but the rising unemployment rate will weigh on housing prices by the end of this year.

Office Market

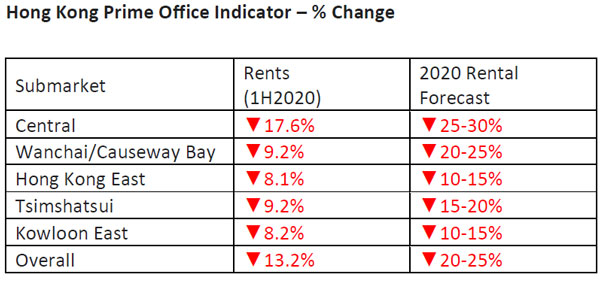

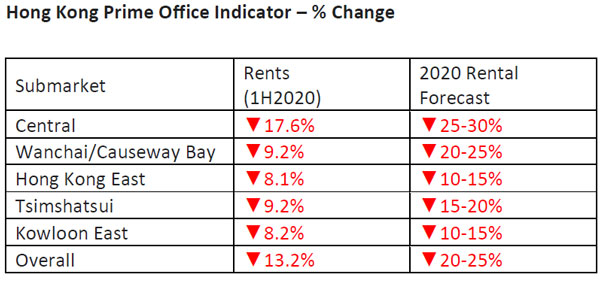

Corporates are delaying decisions on office requirements due to the persisting uncertainty from COVID-19. New lettings in terms of floor area in the overall Grade A office market dropped by 53% in the first half of this year as compared to the same period last year. The overall Grade A office market recorded a negative take-up of 1.42 million sq. ft, among the highest withdrawal in the overall market ever recorded. Leasing demand in decentralized submarkets fared better, benefitting from tenants seeking cost-effective offices to manage real estate costs amid uncertainty.

The vacancy rate in the overall Grade A office market hiked to 7.6%, the highest level since September 2009 due to the weakened leasing demand. Ongoing decentralization and consolidating/downsizing requirements continued to increase vacancy in all traditional core office submarkets.

Surrender space has reached the 18-year record high, amounting to 1.3 million sq. ft with 74% of the space located on Hong Kong Island, due to corporates' cost cutting initiatives.

Central's Grade A office rents dropped 17.6% in the first half of 2020 to HKD 100 per sq. ft, the sharpest rental fall among the office submarkets. It has dropped 23.3% from the peak in April last year on the back of diminished leasing demand.

Alex Barnes, Head of Markets at JLL in Hong Kong, said: "Leasing demand will remain subdued in the second half of this year due to the weakened economy. We expect Grade A office rents will drop 20-25% this year, after dropping 13.2% over the last six months. Central rents will face the strongest downward pressure due to elevated vacancy, dropping 25-30% in 2020. The rental drop will be less severe in the second half."

But there are green shoots of growth in the medium term. "Secondary listing of PRC firms on the HKEx is expected to lead a pick up in leasing demand in the city. Although it may not immediately result in these companies taking on large office requirement, the downstream business opportunities for ancillary finance and business services will support overall business growth," he added.

Rental correction will increase the city's operational competitiveness and encourage medium term growth for a number of industries that may otherwise be constrained by rental cost. The acceleration of workplaces changes brought about by COVID-19 will also support office relocations and additional demand in the medium term.

Retail Market

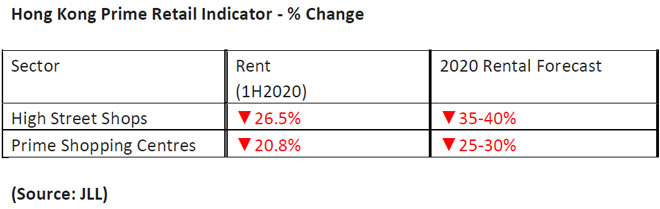

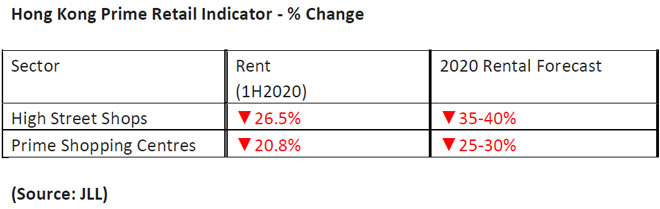

Total visitor arrivals plunged 88.2% y-o-y in the first five months and even hit the historic low of about 4,000 in April due to the travel restrictions and quarantine measures implemented by the local and overseas governments amid the COVID-19 pandemic.

The pandemic has sent retail market into deep winter, particularly the trades which rely heavily on tourist market. Retail sales of jewelry and watches dropped 67% y-o-y during the first five months of the year, the sharpest fall in retail market. Only the retail sales of supermarket recorded growth during the period.

Since retailers still suffered from the severe disruption of COVID-19, many continued to postpone leasing negotiations. The hiking vacancy pressure has led the rents of high street shops in the four major shopping districts to drop 26.5% in the first half of 2020. Rents of prime shopping mall also dropped 20.8% during the same period.

According to the retailer survey conducted by JLL in Q1, about 42% of the interviewees adopted a 'wait-and-see' approach on retail leasing. About 10% of the retailers will stick with their original expansion plan, with international F&B and supermarket operators being the keenest. Lifestyle, fitness and education are also in good mood to secure better locations.

Oliver Tong, Head of Retail at JLL in Hong Kong, said: "Leasing demand will remain weak in the second half of this year due to the ongoing pandemic and economic uncertainties. But mass to mid-market operators from overseas remain keen to expand in Hong Kong, while luxury retailers will continue to consolidate their portfolio or relocate for cost-efficiency. We will see more diversity in the leasing market and retailers are trying to bring in more experiential elements into their stores to attract and engage shoppers. The retail market will rely on local spending, as a full return of tourist might not take place this year. We expect high street shops rents to drop 35% to 40% this year, while prime shopping centre rents will drop 25% to 30%,"

"In the medium to long run, we expect to see a more diverse and healthy market environment, where retailers and landlords will further develop exciting concepts to create better customer experience, bringing the Hong Kong retail scene to the next level," he added.

International property consultant JLL is reporting this week that Hong Kong's commercial property leasing and investment markets recorded the sharpest correction in the first half of this year since the global financial crisis in 2008. But JLL forecasts the price correction in coming six months will be less severe and will see green shoots of hope in the medium term.

Capital values of mass residential remain resilient in the first half of 2020, but the rising unemployment rate will weigh on housing prices by the end of this year.

Office Market

Corporates are delaying decisions on office requirements due to the persisting uncertainty from COVID-19. New lettings in terms of floor area in the overall Grade A office market dropped by 53% in the first half of this year as compared to the same period last year. The overall Grade A office market recorded a negative take-up of 1.42 million sq. ft, among the highest withdrawal in the overall market ever recorded. Leasing demand in decentralized submarkets fared better, benefitting from tenants seeking cost-effective offices to manage real estate costs amid uncertainty.

The vacancy rate in the overall Grade A office market hiked to 7.6%, the highest level since September 2009 due to the weakened leasing demand. Ongoing decentralization and consolidating/downsizing requirements continued to increase vacancy in all traditional core office submarkets.

Surrender space has reached the 18-year record high, amounting to 1.3 million sq. ft with 74% of the space located on Hong Kong Island, due to corporates' cost cutting initiatives.

Central's Grade A office rents dropped 17.6% in the first half of 2020 to HKD 100 per sq. ft, the sharpest rental fall among the office submarkets. It has dropped 23.3% from the peak in April last year on the back of diminished leasing demand.

Alex Barnes, Head of Markets at JLL in Hong Kong, said: "Leasing demand will remain subdued in the second half of this year due to the weakened economy. We expect Grade A office rents will drop 20-25% this year, after dropping 13.2% over the last six months. Central rents will face the strongest downward pressure due to elevated vacancy, dropping 25-30% in 2020. The rental drop will be less severe in the second half."

But there are green shoots of growth in the medium term. "Secondary listing of PRC firms on the HKEx is expected to lead a pick up in leasing demand in the city. Although it may not immediately result in these companies taking on large office requirement, the downstream business opportunities for ancillary finance and business services will support overall business growth," he added.

Rental correction will increase the city's operational competitiveness and encourage medium term growth for a number of industries that may otherwise be constrained by rental cost. The acceleration of workplaces changes brought about by COVID-19 will also support office relocations and additional demand in the medium term.

Retail Market

Total visitor arrivals plunged 88.2% y-o-y in the first five months and even hit the historic low of about 4,000 in April due to the travel restrictions and quarantine measures implemented by the local and overseas governments amid the COVID-19 pandemic.

The pandemic has sent retail market into deep winter, particularly the trades which rely heavily on tourist market. Retail sales of jewelry and watches dropped 67% y-o-y during the first five months of the year, the sharpest fall in retail market. Only the retail sales of supermarket recorded growth during the period.

Since retailers still suffered from the severe disruption of COVID-19, many continued to postpone leasing negotiations. The hiking vacancy pressure has led the rents of high street shops in the four major shopping districts to drop 26.5% in the first half of 2020. Rents of prime shopping mall also dropped 20.8% during the same period.

According to the retailer survey conducted by JLL in Q1, about 42% of the interviewees adopted a 'wait-and-see' approach on retail leasing. About 10% of the retailers will stick with their original expansion plan, with international F&B and supermarket operators being the keenest. Lifestyle, fitness and education are also in good mood to secure better locations.

Oliver Tong, Head of Retail at JLL in Hong Kong, said: "Leasing demand will remain weak in the second half of this year due to the ongoing pandemic and economic uncertainties. But mass to mid-market operators from overseas remain keen to expand in Hong Kong, while luxury retailers will continue to consolidate their portfolio or relocate for cost-efficiency. We will see more diversity in the leasing market and retailers are trying to bring in more experiential elements into their stores to attract and engage shoppers. The retail market will rely on local spending, as a full return of tourist might not take place this year. We expect high street shops rents to drop 35% to 40% this year, while prime shopping centre rents will drop 25% to 30%,"

"In the medium to long run, we expect to see a more diverse and healthy market environment, where retailers and landlords will further develop exciting concepts to create better customer experience, bringing the Hong Kong retail scene to the next level," he added.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More