Commercial Real Estate News

Hong Kong Office Market Enjoys Positive Absorption in February

Commercial News » Hong Kong Edition | By Monsef Rachid | March 23, 2023 8:17 AM ET

Chinese travelers restart growth engine of Hong Kong's retail market

According to JLL's latest Hong Kong Property Market Monitor report, Hong Kong's Grade A office market recorded positive net absorption in February 2023 after it recorded negative net absorption for three consecutive months.

The overall market recorded a positive net absorption of 16,900 sq ft last month, with activities and inspections picking up during the month.

Among a handful of new lettings, professional service company Deloitte leased two floors with a total gross floor area of 38,800 sq ft at The Millennity in Kwun Tong, to consolidate a part of their office space at Admiralty. Its newly acquired business unit will also move to the building from Tai Kok Tsui.

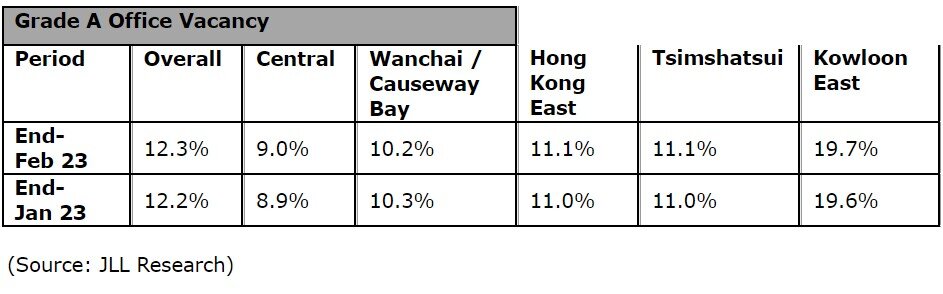

Alex Barnes, Managing Director at JLL in Hong Kong commented, "The overall vacancy rate climbed to 12.3% as at end-February, partly due to the completion of S22 in Wong Chuk Hang by Empire Group. The office leasing market continued to improve; we received more leasing enquiries from insurance and financial institutions. We also saw more tenants looking for new office buildings to upgrade their workplace, which could help to absorb new office supply."

The overall net effective rents dropped by 0.7% m-o-m last month. Among the major office submarkets, rentals in Central and Wanchai/ Causeway Bay dropped by 0.8% and 1.2%, respectively, while Tsimshatsui's rent remained flat.

In the retail market, total retail sales rose by 7.0% y-o-y in January, thanks largely to the resumption of cross-border travel. Among the retail categories, jewelry, watches and clocks, and valuable gifts saw the biggest growth in sales by 23.1%. However, online sales declined by 4.2% y-o-y in January - the first drop in three years.

Nelson Wong, Executive Director of Research at JLL said, "There were nearly 500,000 arrivals in January, compared to around 160,000 in December last year. This, however, only represents about one-tenth of the peak level in the pre-Covid period. The tourism level is expected to rise more visibly following the scrapping of quotas on inbound arrivals in February, which is the reason the leasing sentiment picked up last month, with several transactions being registered in prime high streets,"

Notably, the ground floor shop (1,000 sq ft) at 14 Canton Road in Tsimshatsui was reportedly leased to a chain pharmacy for a monthly rent of HKD 500,000, representing a 55% discount from the rentals of the last long-term lease tenant - Puyi Optical.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.