Commercial Real Estate News

Hong Kong Office Absorption Dips in July

Commercial News » Hong Kong Edition | By Michael Gerrity | August 23, 2021 9:02 AM ET

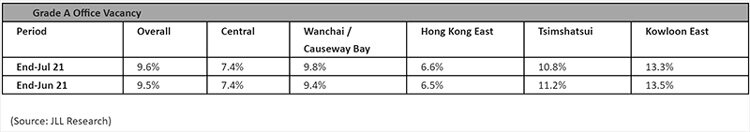

International property consultant JLL's latest Hong Kong Property Market Monitor is reporting this week that net absorption in the overall office market decreased to -89,000 sq. ft in July 2021, as corporate downsizing activities have abated recently.

Meanwhile, the higher availability in the market offered more options to office tenants, some of whom took the opportunity to reconfigure their premises. For instance, healthcare company Bupa leased 92,500 sq. ft (GFA) at The Quayside in Kwun Tong to consolidate its offices.

The vacancy rate in Central stayed at 7.4% as of end-July. Quality office buildings in the submarket have been met with greater occupier demand than the rest of the market. Notably, Henderson Land announced that The Henderson, a premium Grade A office building slated for completion in 2023, has secured its first tenant.

Alex Barnes, Head of Leasing Agency at JLL in Hong Kong commented, "Despite a handful of buildings recording slight rental growth during the month, overall net effective rents fell 0.2% m-o-m as the higher vacancy rate exerted downward pressure on rents. Among the major office submarkets, Wanchai/Causeway Bay and Kowloon East experienced a relatively larger rental decline."

On the retail side, Nelson Wong, Head of Research at JLL in Greater China noted, "Retail leasing momentum continued to improve in July. Retailers were able to take up prime locations at a fraction of the peak level rents. Notably, a watch retailer has reportedly committed to a ground floor shop (1,093 sq. ft) at Aon China Building in Central for a monthly rent of HKD 500,000, 78% less than its peak level rent."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.