Commercial Real Estate News

Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

Commercial News » Hong Kong Edition | By Michael Gerrity | September 6, 2024 7:24 AM ET

Conversely, Hong Kong office vacancy rates improve in July

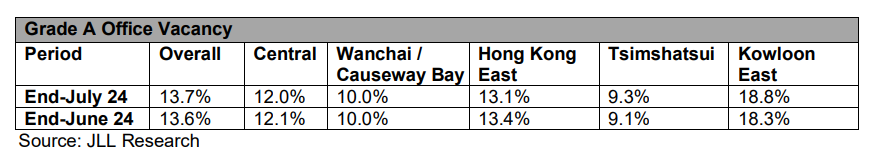

According to JLL's latest Hong Kong Property Market Monitor report, vacancy rates of Grade A offices in Central and Hong Kong East improved in July 2024, but office rents continue to slip.

The overall vacancy rate of Grade A offices rose to 13.7% as at the end of last month. But the vacancy rates in Central and Hong Kong East decreased to 12.0% and 13.1% respectively.

In contrast, the vacancy rate in Kowloon East saw an increase of 0.5 percentage points. The overall market also recorded a negative net absorption of 128,900 sq ft, primarily due to a large space in Kowloon East returning to the market.

Alex Barnes, Managing Director and Head of Office Leasing Advisory at JLL in Hong Kong said, "The trend of flight-to-quality continues to drive the office leasing market, with office rents having dropped 36.5% from the market peak in 2019. It has reached a level that attracts upgrading demand, as more occupiers currently focus on high-quality space to upgrade their working environment,"

Notably, data analytics company Dun & Bradstreet leased a lettable floor area of 7,300 sq ft at Six Pacific Place in Wanchai, relocating from Kowloon East.

"In July, the overall net effective rent decreased by an additional 0.7% on a month-over-month basis. Central and Kowloon East saw further rent declines, dropping 0.8% and 0.6%, respectively. Rents also fell in the Wanchai / Causeway Bay and Hong Kong East submarkets, declining by 0.6% and 1.0%, respectively," said Cathie Chung, Senior Director of Research at JLL.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3