Commercial Real Estate News

Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

Commercial News » Hong Kong Edition | By Michael Gerrity | April 28, 2025 9:05 AM ET

The looming threat of President Trump's China tariffs in the first quarter of 2025, coupled with Hong Kong's strong economic ties to China, contributed to a decline in commercial rents and capital values across nearly all sectors of the city's property markets, driven by weak demand and abundant supply, according to JLL's recently released Preliminary Market Summary for Q1 2025.

"Tariffs will have an impact on the macroeconomic landscape, but the magnitude will depend on how policy evolves," said Cathie Chung, Senior Director of Research at JLL. "Any direct effect on Hong Kong's real estate market remains uncertain as the situation continues to unfold. In the near term, lingering tariff issues and unclear interest rate trends are expected to keep investors cautious."

Chung added that the industrial and logistics sectors could face additional headwinds in the coming months.

Office Market Under Pressure as Vacancies Rise

Hong Kong's office market recorded negative net absorption of 143,400 square feet in the first quarter, mainly due to large spaces re-entering the market following previous consolidations and relocations.

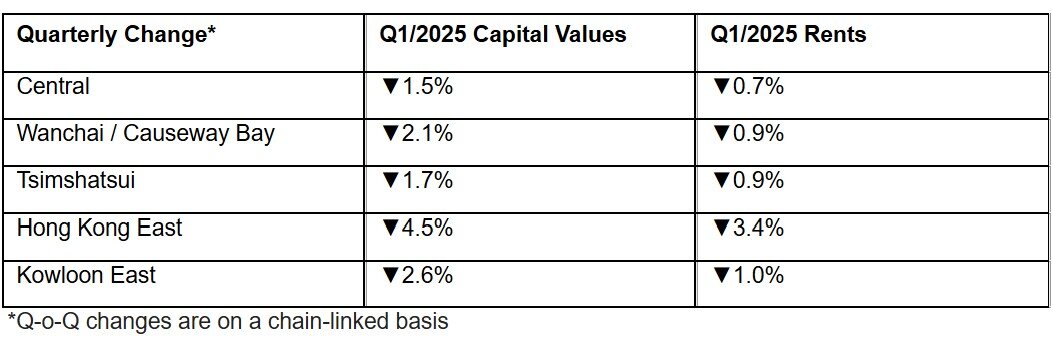

The overall office vacancy rate rose to 13.7% by the end of March. Kowloon East saw a significant increase in vacancies, climbing from 18.6% at the end of 2024 to 21.3%. Conversely, Central's vacancy rate edged down to 11.5%, while Wanchai/Causeway Bay and Tsimshatsui improved to 9.5% and 8.3%, respectively.

Office rents across the city fell 1.3% quarter-on-quarter, with all submarkets posting declines. Rents in Central dropped 0.7%, while Hong Kong East saw the sharpest fall at 3.4%.

"The office leasing market remained under pressure in the first quarter due to abundant new supply," said Sam Gourlay, Head of Office Leasing Advisory, Hong Kong Island at JLL. "Despite signs of improving sentiment, Grade A office rents are forecast to decline by 5-10% this year."

Retail Market Stable but Rents Slip

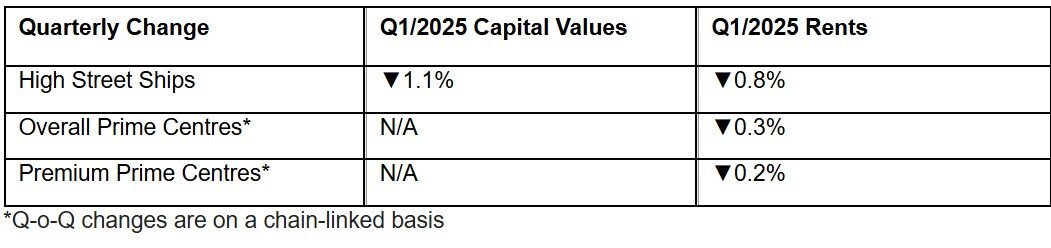

Retail vacancies crept up slightly in early 2025, with high street shop vacancies reaching 10.6% by the end of March, up from 10.5% in December. Vacancies in prime shopping centres also ticked higher to 9.2%.

Despite this, leasing activity in core areas remained active, particularly among mass-market retailers, fitness centres, and securities firms, according to Jeanette Chan, Senior Director of Retail at JLL.

Retail rents continued to soften as landlords offered discounts to attract tenants amid challenging sales conditions. High street shop rents fell 0.8% quarter-on-quarter, while rents for Overall Prime and Premium Prime shopping centres dipped 0.3% and 0.2%, respectively.

Chan projected that retail rents for High Street shops and Prime shopping centres could decline by up to 5% over the course of 2025.

Industrial Sector Faces Mounting Challenges

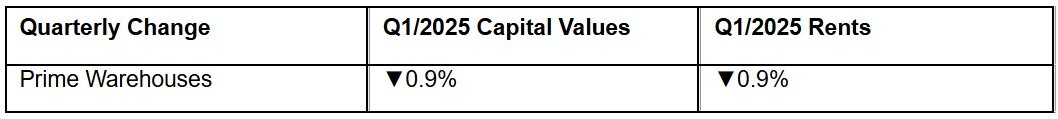

Hong Kong's industrial property market also showed signs of strain in the first quarter. The warehouse vacancy rate rose to 8.9% by March, up from 7.9% at the end of 2024, as leasing activity was largely driven by renewals rather than new demand.

Prime warehouse rents dropped 0.9% quarter-on-quarter.

"The vacancy rate for prime warehouses, which stayed below 2% during the pandemic, has now surged to over 8%," said Ricky Lau, Head of Industrial at JLL. "With more than 60 million square feet of prime warehouse stock, that equates to over 5 million square feet of vacant space."

Lau attributed the sharp rise in vacancies to weakening demand from trade-related businesses and the domestic market, amid ongoing US-China trade tensions and a slowing global economy.

Looking ahead, Lau warned that structural changes in the global economy would likely force Hong Kong's import-export industries to undergo significant transformation, a process that "will take time and inevitably face challenges."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023