The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Global Home Price Growth Slows to 2-Year Low Pace in Q3

Residential News » Hong Kong Edition | By Michael Gerrity | December 14, 2018 9:04 AM ET

Hong Kong enjoys highest residential price growth in 2018

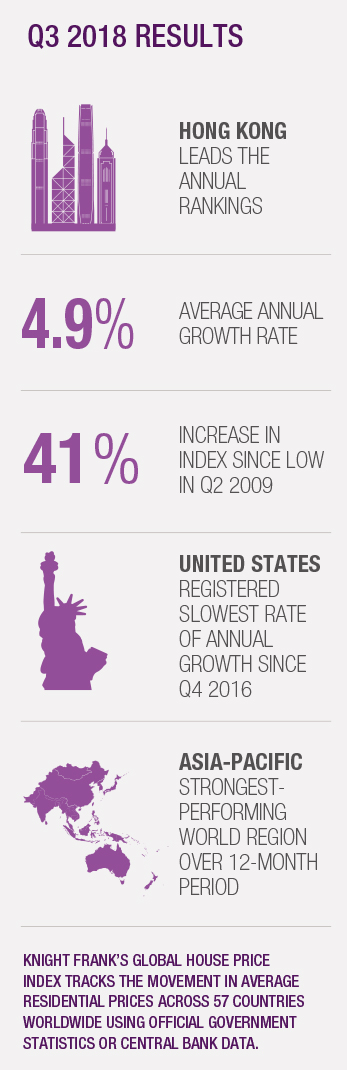

According to International property consultant Knight Frank, the average value of residential property across 57 countries and territories worldwide increased by 4.9% in the year to September 2018, the index's lowest annual rate of growth for two years.

Knight Frank further reports that Hong Kong leads the rankings for annual growth in the year to September 2018 but it may relinquish this top spot in the coming months. The Hang Seng Index, which in the past has acted as a lead indicator for the property market, recently slipped 12%, and add to this global trade disputes, a strengthening currency and the proposed vacancy tax for developers, we expect price growth to soften in 2019.

Last quarter's frontrunner, Malta, has shifted down a gear with annual price growth of 15.7% but only 1% over the three-month period from June to September 2018.

Of the 57 countries tracked, eight recorded annual price declines with Sweden falling into this camp for the first time in six years. Low interest rates and strong population growth fuelled price inflation for several years before a surge in the delivery of new apartments and tighter lending rules saw a reversal in price movements. Only two years ago prices were rising at 11% per annum.

Central and Eastern Europe (CEE) is an area of growth, with its countries accounting for three of the top ten rankings this quarter. CEE economies on average registered a 7.6% price rise, whilst western Europe recorded an average of 4.3% growth year-on-year. Slovenia, Lithuania and Hungary all recorded double-digit price growth in the year to September 2018. Rising wages and greater access to mortgage finance are pushing prices higher.

Mexico is the strongest performer in Latin America with prices up 9.9% on average. Consumer sentiment is rising on the back of a strengthening economy and supply remains constrained.

New Zealand, where a ban on non-residents purchasing existing homes came into force in July, saw annual price growth decline from 6.6% to 4.9% over the three months from June to September. High rates of net migration combined with limited new supply is expected to halt a slide into negative territory.

Knight Frank further reports the US housing market registered its slowest rate of annual growth since the final quarter of 2016. Higher mortgage rates on the back of eight rate rises since late 2015 has led to affordability constraints. Sales of existing homes have fallen 9.3% while housing starts have declined 8.7% since November 2017 according to S&P CoreLogic Case Shiller.

According to International property consultant Knight Frank, the average value of residential property across 57 countries and territories worldwide increased by 4.9% in the year to September 2018, the index's lowest annual rate of growth for two years.

Knight Frank further reports that Hong Kong leads the rankings for annual growth in the year to September 2018 but it may relinquish this top spot in the coming months. The Hang Seng Index, which in the past has acted as a lead indicator for the property market, recently slipped 12%, and add to this global trade disputes, a strengthening currency and the proposed vacancy tax for developers, we expect price growth to soften in 2019.

Last quarter's frontrunner, Malta, has shifted down a gear with annual price growth of 15.7% but only 1% over the three-month period from June to September 2018.

Of the 57 countries tracked, eight recorded annual price declines with Sweden falling into this camp for the first time in six years. Low interest rates and strong population growth fuelled price inflation for several years before a surge in the delivery of new apartments and tighter lending rules saw a reversal in price movements. Only two years ago prices were rising at 11% per annum.

Central and Eastern Europe (CEE) is an area of growth, with its countries accounting for three of the top ten rankings this quarter. CEE economies on average registered a 7.6% price rise, whilst western Europe recorded an average of 4.3% growth year-on-year. Slovenia, Lithuania and Hungary all recorded double-digit price growth in the year to September 2018. Rising wages and greater access to mortgage finance are pushing prices higher.

Mexico is the strongest performer in Latin America with prices up 9.9% on average. Consumer sentiment is rising on the back of a strengthening economy and supply remains constrained.

New Zealand, where a ban on non-residents purchasing existing homes came into force in July, saw annual price growth decline from 6.6% to 4.9% over the three months from June to September. High rates of net migration combined with limited new supply is expected to halt a slide into negative territory.

Knight Frank further reports the US housing market registered its slowest rate of annual growth since the final quarter of 2016. Higher mortgage rates on the back of eight rate rises since late 2015 has led to affordability constraints. Sales of existing homes have fallen 9.3% while housing starts have declined 8.7% since November 2017 according to S&P CoreLogic Case Shiller.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More