The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

India's Office Market Hits 500 Million Square Foot Mark

Commercial News » Mumbai Edition | By Michael Gerrity | January 17, 2017 9:03 AM ET

Office Absorption in India Hits Record Levels

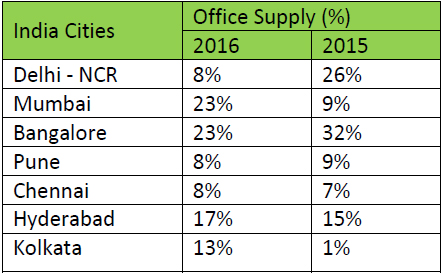

According to CBRE India's latest India Office MarketView Report Q4 2016, India's office market witnessed an all time high annual absorption of over 43 million square feet in 2016, registering a growth of 9% on a year-over-year basis. New office supply during 2016 touched 35 million square feet, with India's office stock reaching a milestone of over 0.5 billion square feet (as of Q4 2016) - higher than several East Asian economies.

Commenting on the findings of the report, Mr. Anshuman Magazine, Chairman - India & South East Asia, CBRE said, "The commercial real estate market in India has been performing well for the past two years. This is evident in the record absorption levels witnessed in 2016. India continues to show positive movement, despite global uncertainties. Policy initiatives undertaken by the Government in the recent past is expected to bring transparency into the sector, which is a much needed step towards enhancing consumer and investor confidence."

India Office Market Highlights (Q4, 2016)

National Capital Region

- Quarterly leasing almost doubled with Gurgaon continuing to lead leasing activity in the NCR, constituting a share of 61%

- Rents across micro-markets remained stable with the exception of DLF Cyber City.

- Leasing activity occurred mostly in the form of small-medium sized transactions (10,000 - 50,000 sq. ft.)

- Transaction activity was largely stable, as compared to the previous quarter

- Leasing activity in Peripheral markets of Vikhroli, Goregaon, Malad and Airoli accounted for almost 60% of office take up in the city

- Rental and capital values continued to remain stable across most micro-markets

- Hyderabad, witnessed a steep rise in occupier demand, with absorption more than doubling to cross 6 million sq. ft. during 2016

- More than 80% leasing activity was concentrated in the IT Corridor

- About 2-7% rental increase reported in CBD, IT Corridor and Extended IT Corridor

- Rise in quarterly demand, mainly in ORR, PBD and NBD

- Supply completion also largely concentrated in ORR, PBD and NBD;

- Continued rental escalation across most micro-markets

- Strong leasing activity reported in 2016, OMR Zone I and OMR Zone II contributed to over 60% of the leasing activity

- Rentals continued to strengthen across major micro-markets; supply addition restricted to small-sized IT/ non-IT developments

- Small-to-medium sized transactions drove demand for office space

- Supply completion in the form of small to medium-sized non-IT and SEZ developments

- Rental values grew in the IT and non-IT segments across most micro-markets

- PBD micro-markets of Salt Lake V and Rajarhat continued to lead leasing activity

- Rental values remained stable across all micro-markets

- Supply addition mainly in SBD and PBD

"Commercial activity and occupier demand is expected to remain steady in the coming months, backed by corporates looking to expand/consolidate operations. Regulatory clearances in key locations are also likely to boost leasing activity in the coming quarters. Occupier enquiries for medium to large sized office spaces are expected to be closed in forthcoming quarters, adding to the transaction momentum. Due to the limited availability of ready to move in Grade A supply, occupiers with medium and large size requirements will focus on pre-commitments in under construction/built-to-suit developments across key micro-markets in the leading cities in the country. Occupiers, while expanding their footprint, are likely to keep a strong check on city infrastructure and focus on space utilization ratios and innovation in workplace strategies", said Mr. Ram Chandnani, Managing Director - Advisory & Transaction Services, CBRE South Asia.

"Commercial activity and occupier demand is expected to remain steady in the coming months, backed by corporates looking to expand/consolidate operations. Regulatory clearances in key locations are also likely to boost leasing activity in the coming quarters. Occupier enquiries for medium to large sized office spaces are expected to be closed in forthcoming quarters, adding to the transaction momentum. Due to the limited availability of ready to move in Grade A supply, occupiers with medium and large size requirements will focus on pre-commitments in under construction/built-to-suit developments across key micro-markets in the leading cities in the country. Occupiers, while expanding their footprint, are likely to keep a strong check on city infrastructure and focus on space utilization ratios and innovation in workplace strategies", said Mr. Ram Chandnani, Managing Director - Advisory & Transaction Services, CBRE South Asia.On the supply front, a significant quantum of space is expected to be released in the decentralized locations of leading cities over the next few quarters. Most of this supply is concentrated in peripheral locations of leading cities, which is likely to attract enhanced enquiries and strong pre-commitment activity in the coming months. The Government's policy initiatives (RERA and REIT), coupled with the impact of the recent demonetization drive is likely to result in the formalization and regulation of the sector. This in turn, is expected to boost transparency and investment flows into the commercial real estate sector, going forward.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More