The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Ireland Industrial Leasing Activity Moderates in First Quarter

Commercial News » Dublin Edition | By WPJ Staff | May 5, 2016 8:00 AM ET

According to JLL, Ireland's industrial take-up in the first quarter of 2016 was 550,233 square feet. This is 48% lower than take-up in Q4 2015 and 55% lower than Q1 2015.

There were 2 transactions greater than 50,000 square feet compared to 6 last quarter, which has impacted totals. 80% of deals were for space less than 20,000 square feet and the average deal size was 13,756 square feet compared to 20,865 square feet in Q4 2015.

Prime rents have experienced further growth in Q1 and now stand at â¬7.50 per square feet.

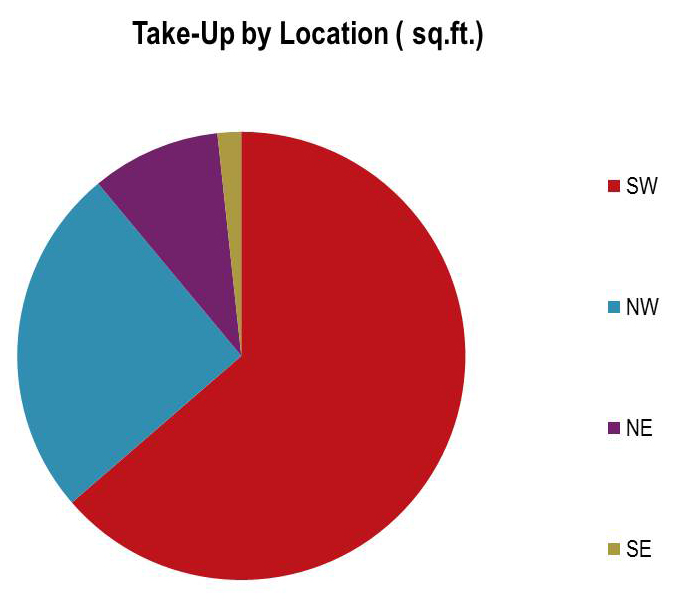

Hannah Dwyer, Associate Director and Head of Research tells World Property Journal, "2016 has started steadily for the industrial sector. Take-up for Q1 was lower than the previous quarter, but this is not surprising as Q4 2015 was one of the strongest quarters ever recorded. Plus, we saw fewer larger deals occurring, which has impacted total volumes. Occupiers continue to be focused on prime quality space in key SW and NW locations but the limited availability of space is impacting choice, and therefore the active demand is not fairly reflected in take-up trends"

Nigel Healy, Director Industrial also commented, "2016 is set to be another strong year for the industrial sector but the greatest threat to the market is the lack of availability of prime stock. This impacts occupier decisions, with limited choice, and in some instances, no choice, for prime space in key locations. This has also impacted rental growth, and we are expecting rents to increase further over the year. Prime rents may achieve â¬8.75 per square feet by the end of 2016, which would be a 25% increase in the last 12 months. Increases in rents will hopefully trigger some much-needed supply pipeline, and hopefully, we will see more developers submitting planning submissions for industrial development in the short-term."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More