The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Ireland's Housing Market Comes to Grinding Halt from Coronavirus Outbreak

Residential News » Dublin Edition | By David Barley | April 3, 2020 8:00 AM ET

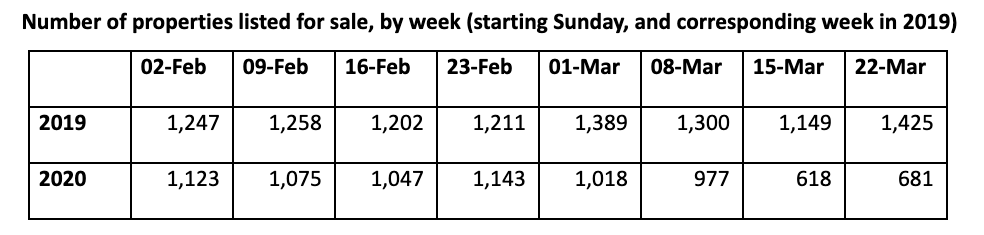

Ireland property portal Daft.ie's newly released Property Sales Report says the number of homes listed for sale in Ireland has fallen dramatically, in the wake of the Covid-19 pandemic and the restrictions of everyday life. There were just under 1,300 properties posted for sale nationwide between March 15 and March 28, 2020, half the total for the same two-week period a year earlier.

The report also outlines trends in list prices for housing over the entire January-March period. With Covid-19 not affecting day-to-day life until the final two weeks of March, there was little sign of any price effect. Nationwide, housing prices rose by 2.2% in the first quarter of 2020 to reach an average of €256,338. However, having fallen in both the third and fourth quarters of 2019, the average price nationally in the first quarter of 2020 was 1.7% lower than the same time a year ago.

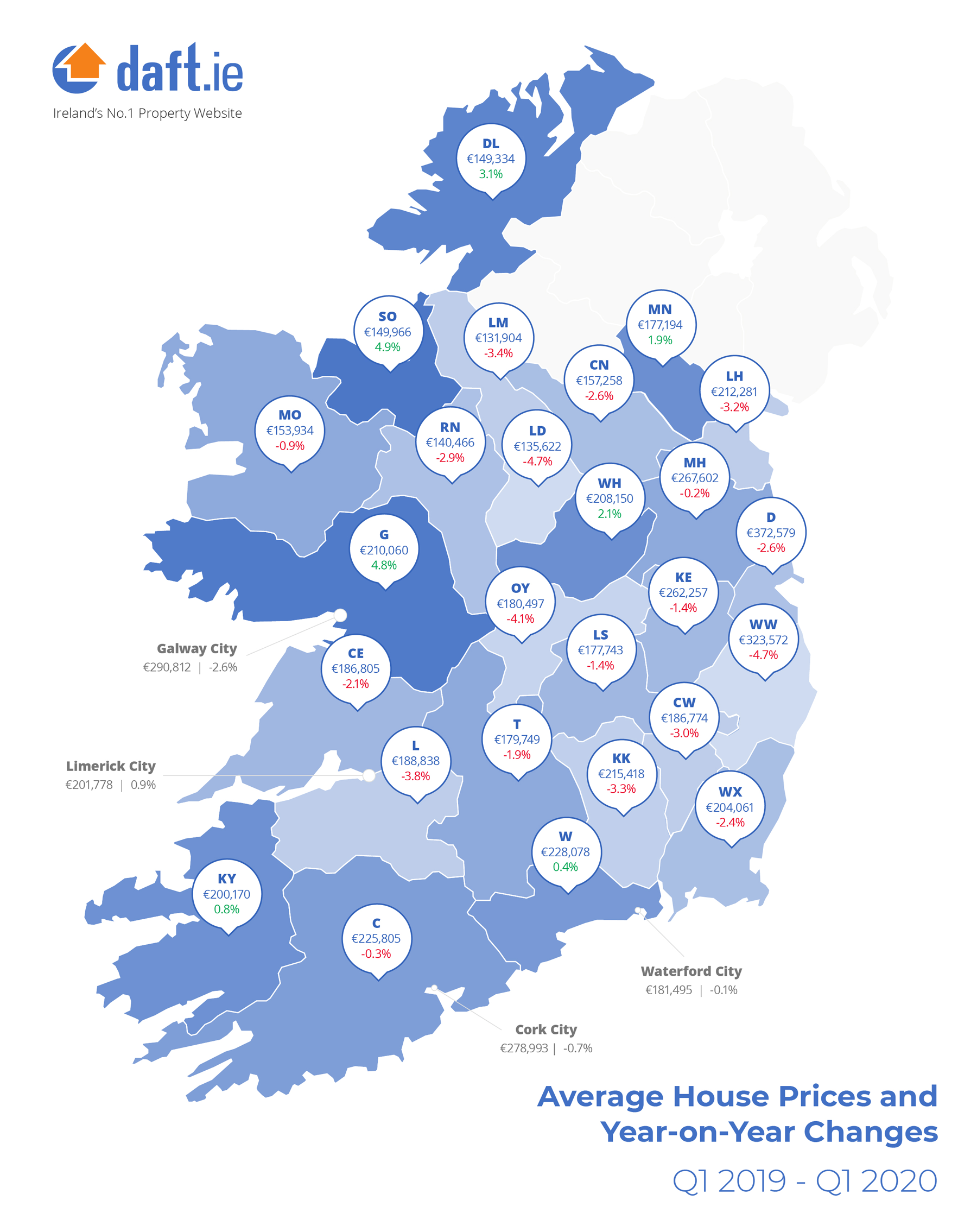

In Dublin, prices fell by 2.6% in the year to March 2020, as did prices in Galway city, while prices were also lower in year-on-year terms in Cork city, by 0.7%. In Limerick city, prices were 0.9% higher while in Waterford city, prices were largely unchanged on a year ago (down 0.1%). Outside the cities, prices have fallen in Leinster by 2.2% and in Munster by 1%, but are 1.6% higher in Connacht-Ulster.

The number of properties available to buy on the market nationwide was just under 19,900 in March December, down almost 12% year-on-year and the first time since late 2006 that fewer than 20,000 homes have been on the market. Following nearly a year and a half of improving availability, this marks the seventh consecutive month where stock on the market has fallen. The fall in availability is seen in all parts of the country, but is most pronounced in Dublin, where availability has fallen over 20% in a year.

The report also outlines trends in list prices for housing over the entire January-March period. With Covid-19 not affecting day-to-day life until the final two weeks of March, there was little sign of any price effect. Nationwide, housing prices rose by 2.2% in the first quarter of 2020 to reach an average of €256,338. However, having fallen in both the third and fourth quarters of 2019, the average price nationally in the first quarter of 2020 was 1.7% lower than the same time a year ago.

In Dublin, prices fell by 2.6% in the year to March 2020, as did prices in Galway city, while prices were also lower in year-on-year terms in Cork city, by 0.7%. In Limerick city, prices were 0.9% higher while in Waterford city, prices were largely unchanged on a year ago (down 0.1%). Outside the cities, prices have fallen in Leinster by 2.2% and in Munster by 1%, but are 1.6% higher in Connacht-Ulster.

The number of properties available to buy on the market nationwide was just under 19,900 in March December, down almost 12% year-on-year and the first time since late 2006 that fewer than 20,000 homes have been on the market. Following nearly a year and a half of improving availability, this marks the seventh consecutive month where stock on the market has fallen. The fall in availability is seen in all parts of the country, but is most pronounced in Dublin, where availability has fallen over 20% in a year.

Commenting on the report, its author Ronan Lyons, economist at Trinity College Dublin, said, "Just three months ago, I wrote of there being a relatively good balance in sales segment, for the first time in a long time, even if the rental and social housing sectors remained broken. The last few weeks have changed the prospects for the Irish housing market entirely, with the Covid-19 pandemic reaching Ireland and completely disrupting everyday life for weeks and possibly months to come. There is, as of now, very little evidence of this affecting prices of property for sale but that is unsurprising. In such uncertain times, the first reaction will be through quantities, not prices, with both buyers and sellers holding off until the future becomes a little clearer.

"The number of properties listed for sale in the final two weeks of March 2020 was 1,299, barely half the total seen in the same two weeks of 2019. This is likely to continue as long as everyday life is suspended in Ireland, with consequences for the number of transactions that will take place in the second half of the year. The scale of the fall in prices is still unclear at this point. Ultimately, the effect on the property market will depend on a number of factors, including the extent of disruption, the speed of recovery and the impact on numbers employed, average incomes and whether Ireland's business model - acting as a base for North American firms to access the European market - is in any way affected in the long run."

Commenting on the report, its author Ronan Lyons, economist at Trinity College Dublin, also commented, "Just three months ago, I wrote of there being a relatively good balance in sales segment, for the first time in a long time, even if the rental and social housing sectors remained broken. The last few weeks have changed the prospects for the Irish housing market entirely, with the Covid-19 pandemic reaching Ireland and completely disrupting everyday life for weeks and possibly months to come. There is, as of now, very little evidence of this affecting prices of property for sale but that is unsurprising. In such uncertain times, the first reaction will be through quantities, not prices, with both buyers and sellers holding off until the future becomes a little clearer.

"The number of properties listed for sale in the final two weeks of March 2020 was 1,299, barely half the total seen in the same two weeks of 2019. This is likely to continue as long as everyday life is suspended in Ireland, with consequences for the number of transactions that will take place in the second half of the year. The scale of the fall in prices is still unclear at this point. Ultimately, the effect on the property market will depend on a number of factors, including the extent of disruption, the speed of recovery and the impact on numbers employed, average incomes and whether Ireland's business model - acting as a base for North American firms to access the European market - is in any way affected in the long run."

Average list price and year-on-year change - major cities, 2020 Q1

- Dublin City: €372,579 - down 2.6%

- Cork City: €278,993 - down 0.7%

- Galway City: €290,812 - down 2.6%

- Limerick City: €201,778 - up 0.9%

- Waterford City: €182,092 - up 0.2%

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More