Residential Real Estate News

Ireland Q2 Residential Rents Jump 12.6 Percent Annually

Residential News » Dublin Edition | By David Barley | August 11, 2022 8:33 AM ET

Based on a new rental report by Daft.ie, Ireland market rents in the second quarter of 2022 were an average of 12.6% higher than the same period a year earlier, as availability of rental homes reached an all-time low.

The average market rent nationwide between April and June was €1,618 per month, up 3.3% on the first three months of the year and more than double the low of €765 per month seen in late 2011.

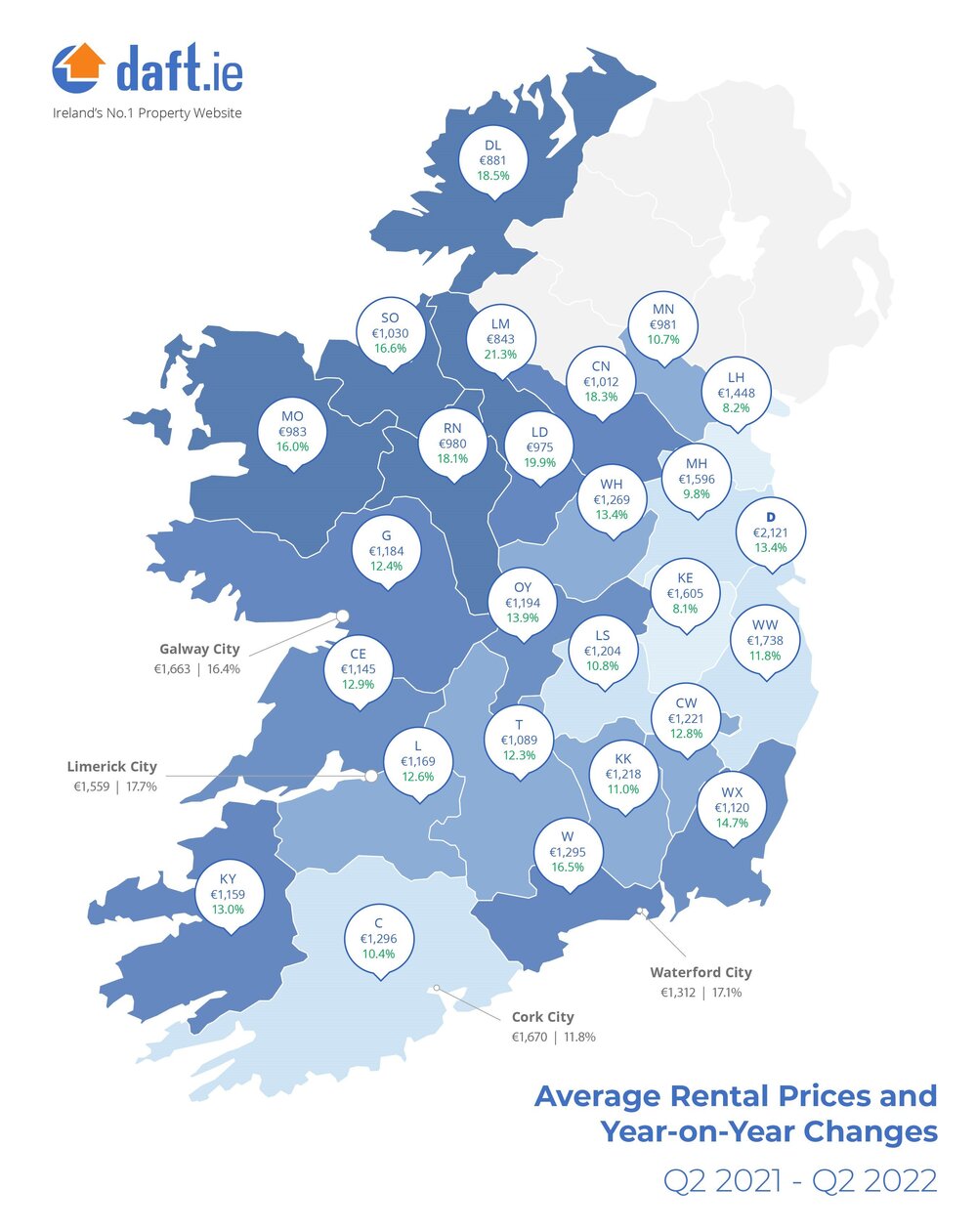

The annual inflation rate of 12.6% nationally is the highest recorded in the Daft.ie Report since its launch in 2006, surpassing the previous peak of 11.8% in late 2016. The rate of inflation in Dublin, at 12.7% was above the national average for the first time 2018, while in Cork city, the annual change in market rents was 11.8%. The rate of inflation in the three other principal cities - Galway, Limerick and Waterford - was higher, ranging from 16.4% in Galway to 17.7% in Limerick. Outside the cities, the average annual increase in market rents was 12%.

As has been consistently the case over much of the past decade, the increase in market rents around the country is driven a further tightening in rental availability. However, the scarcity of rental homes has been unprecedented over the past year. Nationwide, there were just 716 homes available to rent on August 1st, down from almost 2,500 a year ago and another new all-time low in a series that extends back to 2006. Compared to 2009, rental availability has fallen by 97% nationwide.

The report includes an analysis of 75 multi-unit rental developments, which are estimated to have added almost 1,000 new rental homes in the last nine months, or roughly 25 new homes per week. Of the 7,500 homes in these developments, almost 95% are estimated to be occupied, based on publicly available information. Also in the report is an analysis of figures provided by Cortland Consult on the pipeline of new rental homes. Over the past year, the pipeline has increased by approximately 23,000, representing an increase of 13,000 under construction and 28,000 for which a planning application has been submitted - as well as a decrease of 17,500 at pre-planning stage. The stock of rental homes for which planning has been granted but yet to start construction remains steady at 43,000.

Commenting on the report, Ronan Lyons, Associate Professor of Economics at Trinity College Dublin and author of the Daft Report said, "A resurgent economy over the last year has accentuated the chronic shortage of rental housing in Ireland. While the professional rental sector has added over 7,000 new rental homes in the last five years, this is small relative to the fall of 30,000 in rental listings each year in the traditional rental sector in the same period or the fall of 100,000 listings per year since 2012. The shortage of rental accommodation translates directly into higher market rents and this can only be addressed by significantly increased supply. While there are almost 115,000 proposed rental homes in the pipeline, these are concentrated in the Dublin area. Further, while nearly 23,000 are under construction, the remainder are earlier in the process and the growth of legal challenges to new developments presents a threat to addressing the rental scarcity."

Average rents, and year-on-year change, 2022 Q2

- Dublin: €2,170, up 12.7% year-on-year

- Cork city: €1,670, up 11.8%

- Galway city: €1,663, up 16.4%

- Limerick city: €1,559, up 17.7%

- Waterford city: €1,312, up 17.1%

- Rest of the country: €1,255, up 12.0%

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership