Residential Real Estate News

Italy's 2024 Tourism Boom, Tax Perks Energizing Local Home Sales

Residential News » Italy Edition | By Michael Gerrity | August 23, 2024 6:51 AM ET

According to Kate Everett-Allen, Head of European Residential Research of Knight Frank, consumer interest in Italy is gaining momentum, with a rise in tourist numbers boosting investment returns for holiday accommodations. The country's favorable non-dom tax policy is attracting more foreign residents, drawn by the allure of the Mediterranean lifestyle and the financial benefits it offers. Additionally, the post-pandemic increase in hybrid working has led to a wave of mobile workers eager to experience the dolce vita.

Despite stricter monetary policies, prime property prices in Italy have remained strong, supported by limited supply. Sales volumes declined when the European Central Bank began raising interest rates in 2022. However, with rates now easing, we expect a resurgence in demand and sales activity. This recovery is expected to take place within the context of limited new supply, as high construction costs continue to affect developers' profit margins.

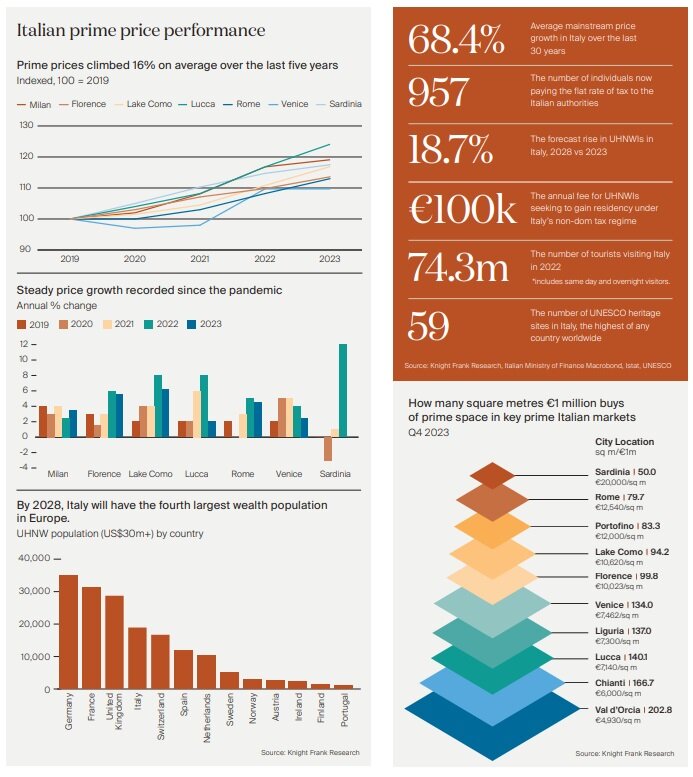

In 2023, prime property prices grew by an average of 4%, standing 16% higher than pre-pandemic levels in 2019. Lake Como and Florence led the way in price growth for 2023, while Lucca and Milan topped the rankings over the past five years.

For non-European Union (EU) residents, including UK citizens since the UK's official departure from the EU in January 2020, long-term stay options in Italy have been limited. However, the unveiling of a new digital nomad visa in April 2024 targeting skilled workers with an annual income of €28,000 or more, is poised to amplify rental demand in tech hubs like Milan and Rome.

While landmark events and visa changes may spark temporary surges in demand, the real game-changer for Italy remains its flat tax or non-dom tax regime. Introduced in 2017, this policy continues to be a significant attraction, putting Italy on a similar footing to Monaco and Switzerland for some individuals. Ultra-high-net-worth individuals (UHNWIs) pay a single flat rate of taxation, €100,000 per annum, on foreign income in return for Italian residency.

Data from Italy's Ministry of Finance reveals some 957 overseas residents have relocated to the country and now pay the single rate of tax.

With global wealth increasingly mobile, driven by geopolitical tensions, economic uncertainty, and a series of elections many of which are likely to trigger significant tax and policy changes, Italy is poised to be a focal point in this shifting landscape.

The number of UHNWIs in Italy, defined as those with a net worth of $30 million or more, is projected to increase by 19% over the next five years. This growth will add 2,977 UHNWIs to Italy's affluent demographic, allowing the country to maintain its lead over neighboring Switzerland, concludes Kate Everett-Allen.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years