The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Japanese Hotels Enjoy Profit Boost From Yen Devaluation

Vacation News » Tokyo Edition | By Michael Gerrity | October 31, 2016 10:03 AM ET

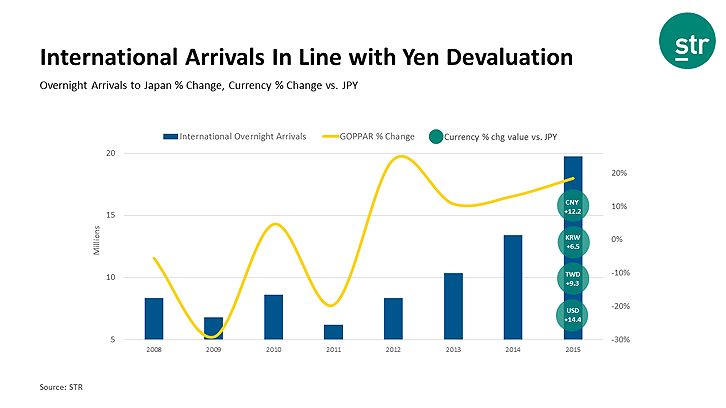

According to global hotel consultant STR, Japan's hotel industry has benefited substantially from the devaluation of the Japanese yen, experiencing four consecutive years of double-digit percentage growth in gross operating profit per available room (GOPPAR).

As reported in STR's Profitability Review, Japan's GOPPAR reached JPY12,512.18 in 2015, the country's highest GOPPAR value since the time of the global financial crisis in 2008.

STR analysts point to a clear correlation between the devaluation of the yen and Japan's increase in international arrivals. According to Tourism Economics, the country welcomed nearly 20 million overnight tourists in 2015, a 47% increase compared with the previous year. Of those arrivals, the main source markets were China, South Korea, Taiwan and the U.S. Currencies for the aforementioned countries all gained in value against the Japanese yen in 2015 (example: U.S. dollar, +14.4%), making travel to Japan cheaper.

Although the yen has regained some value in 2016, Tourism Economics is projecting an increase of 17.8% in overnight tourist arrivals for the year. In terms of hotel performance, Japan posted a 4.6% increase in revenue per available room (RevPAR) through the first nine months of 2016, driven by a 6.5% rise in average daily rate (ADR) to JPY15,226.89. Occupancy declined slightly (-1.8% to 82.0%) compared with the same year-to-date time period last year, but 2015 marked Japan's highest full-year occupancy level on record. Thus, the comparison base is exceptionally strong.

"Interest in Japan as a destination has dramatically increased in recent years," said Shiori Sakurai, STR's business development manager for Japan. "The extended period of cheaper travel to the country has created long-term benefits for the tourism and hospitality industries, which will hopefully continue as the yen picks up in value along with the demand increase of overseas travel from Asia to Japan."

Looking ahead, Japan currently has 61 hotel projects and 16,426 rooms in the three phases of the development pipeline (In Construction, Final Planning and Planning). Almost half of that development is in Tokyo, with 23 projects and 6,001 rooms, as the city prepares to host the 2020 Summer Olympics.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend

- High Prices, Rising Rates, Economic Uncertainty Ends Vacation Home Boom in America

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More