Residential Real Estate News

Macau Property Market Remains Stagnant in 2021, Despite Reopening Borders

Residential News » Macau Edition | By Michael Gerrity | August 2, 2021 8:48 AM ET

According to JLL in its Macau Mid-year Review 2021, Macau's visitor arrivals have been picking up since the reopening of the border with China last year. The city's economy showed signs of recovery in 1H21, however, its property market remained stagnant with no significant improvement.

According to the DICJ statistics, Macau's gaming revenue recorded at MOP 49.02 billion in 1H21, up 45.4% y-o-y. The gaming industry has been recovering since February 2021, with its monthly gaming receipts seeing gradual y-o-y growth, driven mainly by the pickup of visitor arrivals that lead to an increase in the revenue of the mass market. The revenue of the VIP market grew by 8.1% y-o-y to MOP 17.63 billion in 1H21, accounting for 33.5% of the city's total gaming revenue.

Macau's GDP totaled MOP 57.53 billion in 1Q21, down 0.9% y-o-y. The expenditure-based GDP showed that the contraction was mainly due to the y-o-y decrease of 33.0% in the balance of trade. Based on the gaming revenues recorded in 2Q21, the balance of trade will have a chance to see a rebound in 1H21. The fixed capital formation, private consumption expenditure and government consumption expenditure all recorded a growth in 1Q21, up 22.0%, 14.8% and 0.2% y-o-y respectively.

According to the DSEC statistics, Macau's total visitor arrivals totaled approx. 3,928,000 as of June 2021, up 20.2% y-o-y. The majority of visitors were from Mainland China, accounting for 90.7% of Macau's total visit arrivals, while the number of visitors visiting Macau under the Individual Traveller Scheme (ITS) made up about 38.3%. As of end May 2021, the total supply of hotel rooms in Macau recorded at 36,400, up 6.8% from end 2020. The cumulative occupancy rate of hotel rooms in Macau rebounded to 51.8%, while the average length of stay of guests was about 1.7 nights.

Ongoing outflow of expatriate employees from Macau's labor market was observed in 1H21. According to the DSEC statistics, the number of imported labor recorded at about 172,970 as of end May, a drop of 4,693 or about 2.6% from end 2021, attributable to mainly the decrease in imported labor in the gaming (-1,356), domestic helper (-1,463) and hotel (1,372) sectors. The unemployment rate slightly rose to 3.0% in May while the underemployment rate recorded at about 4.2%. The overall median monthly income rose a bit to MOP 15,300 as of end 1Q21. The total resident deposit in Macau recorded at MOP 683.80 billion as of end May 2021, slightly up 1.5% from end 2020.

"In 1H21, Macau's economy gradually stepped out of the shadow of the Covid-19 pandemic as it was brought largely under control. However, the new wave of pandemic in Guangdong in June that led to a tightening of border control with China hindered the pace of economic recovery. Despite the fact that the global economy is still facing the impact of the Covid-19 pandemic, the extraordinary good performance of the US economy may speed up the pace of the expected interest rate hikes. More countries or regions are expected to relax their travel restrictions in the future to help boost economic recovery and focus on epidemic prevention measures like stringent screening at borders and vaccination programs. Recently Hong Kong and Macau are exploring ways to ease the travel restrictions between the two cities. This will create a positive effect to Macau's tourist and business sectors, and it's especially important for the recovery of the city's economy, retail and real estate markets. In the short term, central banks across the globe are expected to continue to adopt quantitative easing monetary policies. With the new normal post pandemic, the pent-up property demand will be released gradually. We expect Macau's property market to remain stable in 2H21," says Mark Wong, Director of Valuation Advisory Services at JLL Macau.

The total residential sales transaction volume in Macau picked up in 1H21 with most of the transactions recorded in the first five months. The sales market slowed down in June due to the new wave of COVID-19 pandemic in Guangdong. According to the DSEC statistics, a total of 3,297 residential sales transactions were registered as of June 2021, up 8.5% y-o-y. Presale transactions totaled 225, accounting for only 6.8% of the total residential sales volume, lower than the average levels recorded in the past.

The fall in the number of presale transactions is mainly attributable to the fact that new residential supply has been gradually digested by the market. As there will be no new supply of large-scale private residential projects in the coming five years, the market is expected to remain the same. In 1H21, 11 projects provided a total of 203 residential units with a total GFA of approx. 12,863.3 sqm were issued with pre-sale permits.

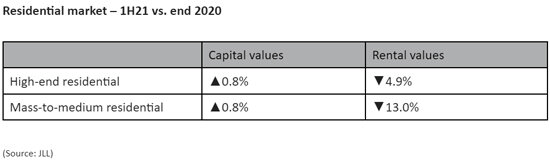

In 1H21, the capital values of high-end and mass-to-medium residential properties each rose by 0.8% from end 2020, with secondary residential transactions being the key growth driver. The leasing market slowed down due to the decrease in imported labor and the completion of a few residential projects that brought new supply to the market. The rental values of high-end residential properties and mass-to-medium residential properties fell by 4.9% and 13.0% respectively in 1H21 from end 2020, while yields recorded at 1.6% and 1.5% respectively.

"The overall residential transaction volume recorded in 1H21 was similar to that in 2020, with most transactions recorded in the secondary market. Buyers were mostly local first-time homebuyers, making up more than 70% of the overall residential sales. The property prices in the peripheral areas have been surging, as residential properties in Macau remain the most preferred option for local homebuyers. Residential units worth not more than MOP 8 million remain popular. Due to the COVID-19 pandemic, residential buyers in general have a bigger bargaining power and transaction prices are largely close to the appraised values. Couple with the current low mortgage rate environment, it's now a good time for homebuyers to enter the market. Though unemployment and underemployment rates remain high, we expect them to move down when the travel restrictions between Macau and the neighboring regions are eased or lifted, and a further increase in residential demand," comments Gregory Ku, Managing Director at JLL Macau.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years