Residential Real Estate News

Monaco's Property Market: A Tale of Two Cities

Residential News » Monaco Edition | By Michael Gerrity | March 4, 2025 8:27 AM ET

A new report by Knight Frank reveals a striking divergence in Monaco's property market. In 2024, the average price of newly built properties skyrocketed to €36.4 million -- six times higher than the €6 million average for resales. While overall sales in the Principality rose by 12%, this growth was almost entirely fueled by new developments, according to fresh data from IMSEE, Monaco's Statistics Office.

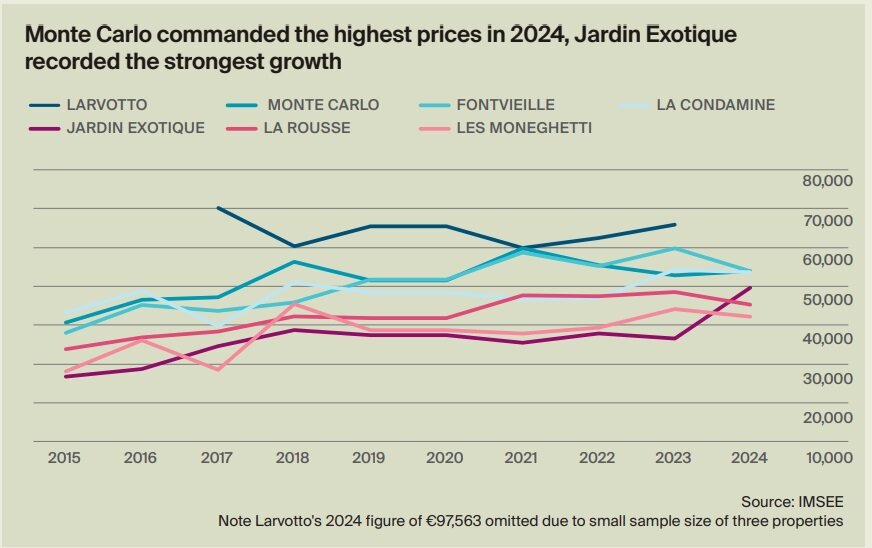

The secondary market experienced its weakest year since 2012, with only 365 transactions--a 6% decline year-over-year. Monte Carlo remained the most active district, accounting for a third of these sales.

In stark contrast, new-build sales surged to 101 units in 2024, up from just 28 the previous year--the highest figure since records began in 2006. This boom was largely driven by the completion of two landmark developments: Mareterra and Bay House.

Mareterra, a €2 billion land reclamation project, has expanded Monaco's territory by 3% and is setting new pricing benchmarks. Designed by renowned architects Renzo Piano and Lord Norman Foster, some units have reportedly exceeded €100,000 per square meter--more than double the Principality's average resale price. Meanwhile, Groupe Marzocco's Bay House, part of the Testimonio II project, introduced 56 luxury apartments and five villas, alongside a state-of-the-art campus for the International School of Monaco.

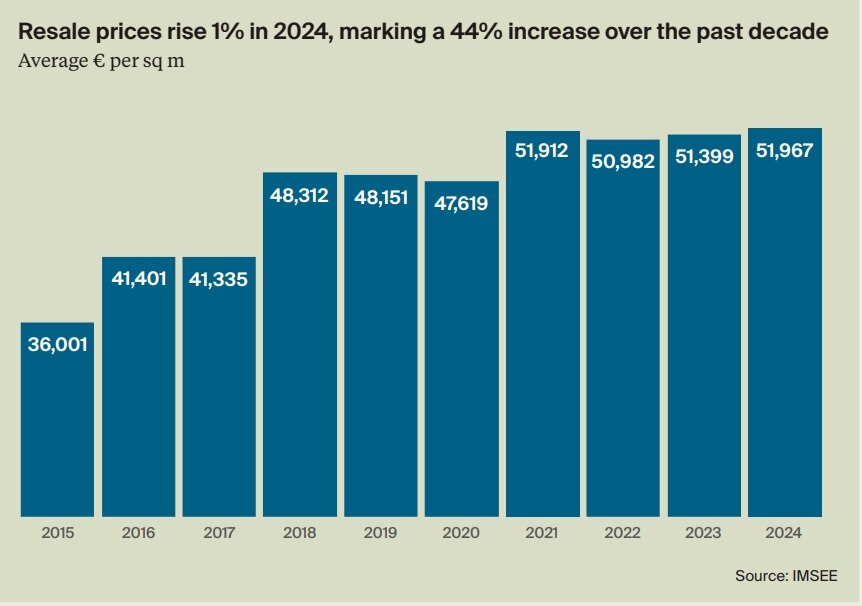

Despite subdued transaction volumes, Monaco's resale market reached record-high prices in 2024. The average resale price per square meter climbed to €51,967, reflecting a 1.1% annual increase and a 44.3% rise over the past decade.

Smaller properties saw the sharpest appreciation, with studio prices up 5.7% and two-bedroom apartments rising 7.6%. However, it is the ultra-prime segment that continues to break records.

The number of resale properties exceeding €10 million grew by 10.6%, while 19 sales surpassed the €20 million mark--twice as many as a decade ago. New-builds saw even more dramatic figures: of the 101 sales, 57 exceeded €20 million, and seven surpassed €100 million.

Monaco delivered 159 new apartments in 2024--the highest completion rate since 1993--with Mareterra alone contributing 130 units in the Larvotto district.

Demand for larger homes is also rising. In 2024, 71% of new homes sold were three-bedroom properties or larger, reflecting Monaco's updated residency rules, which require applicants to secure housing that matches their household size.

"Demand continues to outstrip supply," says Kate Everett-Allen of Knight Frank. "Despite an increase in new completions, the development pipeline remains limited, which will likely sustain upward pressure on prices. With the UK abolishing its non-dom regime in April, Italy doubling its flat tax, and growing concerns over a potential trade war, Monaco is poised to see even stronger demand. However, the extent of this demand will depend on UK policy shifts, government tax strategies, and the broader geopolitical landscape."

For UHNWIs, Monaco remains an unrivaled sanctuary. The absence of income and capital gains tax, no wealth or inheritance tax, world-class healthcare, political stability, privacy, security, and seamless connectivity via Nice Airport and Monaco's heliport all contribute to its enduring appeal.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024