Residential Real Estate News

Monaco's Exploding Wealth Immigration Drives Intense Housing Pressure

Residential News » Monaco Edition | By Michael Gerrity | October 1, 2024 7:00 AM ET

According to property consultant Knight Frank, the Principality of Monaco, with a population of 38,367, is home to around 141 nationalities, all within an area just over half the size of Central Park.

Despite its small size, Monaco remains a leading global safe haven and low-tax jurisdiction. Knight Frank's wealth sizing model predicts a 23% increase in ultra-high-net-worth individuals (those with a net worth of $30 million or more) in the next five years, while the number of dollar millionaires is expected to grow by 43% during the same period.

With only 21,123 dwellings--81% of which are privately owned--Monaco faces intense pressure to expand to meet housing demand. After years of undersupply, two significant projects are set to be completed this year, though most units are already sold.

The first project, Bay House, consists of two 25-story towers adding 56 apartments and five rooftop villas. Developed by Groupe Marzocco, the same firm behind Le Tour Odéon, Bay House is part of the larger Testimonio II development, which also includes a nursery and a new campus for Monaco's prestigious International School.

The second project, Mareterra, is a €2 billion land reclamation initiative that will increase Monaco's surface area by 3%. Many units have sold, with some fetching prices of €100,000 per square meter or more. The development offers 110 apartments and 10 villas, six of which are waterfront properties. Designed by renowned architect Renzo Piano, Mareterra will also feature a waterside promenade, a retail plaza, and a small marina.

It's not just the ultra-wealthy experiencing housing challenges. Monegasques, who make up a third of Monaco's 39,000 residents, are also feeling the strain. To address this, Prince Albert initiated a 15-year housing plan in 2019, aiming to increase the number of state-owned apartments by 43%, bringing the total to 4,548 units.

Why Is Monaco So Sought After?

"We're seeing a marked increase in inquiries from buyers considering relocating to Monaco," says James Davies, head of Knight Frank's Monaco Desk.

Rising taxes, geopolitical tensions, and unpredictable policy changes are making Monaco, along with Switzerland, increasingly attractive. A recent survey by Knight Frank revealed that security and privacy are the top reasons high-net-worth individuals (HNWIs) are relocating, followed by employment opportunities and tax benefits.

"With the shifting political and economic landscape, some buyers, after years of consideration, now feel that the time is right to make the move."

The UK Government's decision to end the rules around non-doms--74,000 individuals who live in the UK but don't pay tax on foreign income--and uncertainty over new inheritance tax rules have put Monaco on the radar for many HNWIs. They are also considering Monaco in light of recent wealth and flat tax changes across Europe.

Monaco Market Update

In 2023, Monaco recorded 418 residential sales, with 388 being resales. The resale market saw a 10% year-on-year decline in transactions, with the sharpest drop in sales of smaller apartments, likely due to changes in the residency application process.

Since 2020, Monaco's residency rules have required applicants to rent or purchase a property that matches the size of their household, increasing demand for larger homes.

According to Monaco's statistics agency, IMSEE, over 60% of new build sales and 21% of resales last year were for apartments with three or more bedrooms. Developers have responded by offering larger units in new developments.

Due to limited land for development, new housing delivery in Monaco is highly variable. While no new units were added in 2023, major projects like Bay House and Mareterra are expected to deliver over 180 homes, significantly boosting supply when 2024 figures are published.

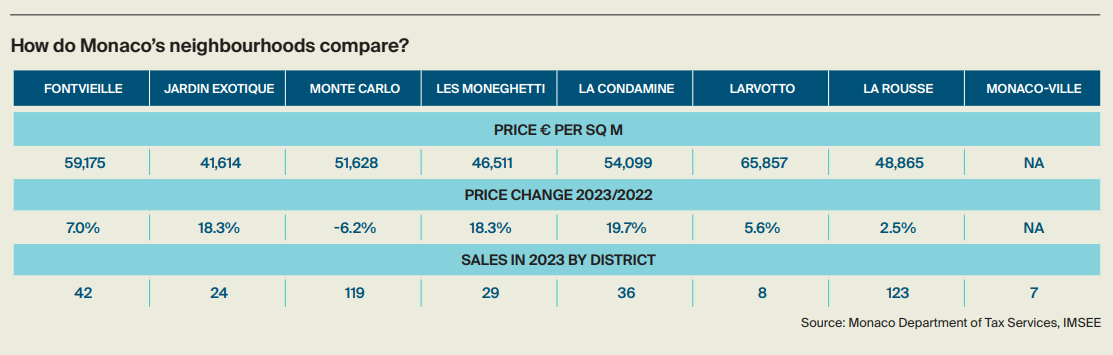

Despite short-term sales declines, property prices in Monaco remain resilient, having grown 38% over the past decade. In 2024, price growth returned to positive territory with a 1% overall increase, while the La Condamine neighborhood saw a 19.7% year-on-year surge in prices based on completed sales.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership