Residential Real Estate News

26 Percent of World's Ultra Wealthy Plan to Buy New Home in 2021

Residential News » Monaco Edition | By Michael Gerrity | March 5, 2021 9:06 AM ET

According to Knight Frank's latest edition of The Wealth Report 2021, 26% of ultra-high-net-worth individuals (UHNWIs) globally are planning to buy a new home in 2021, a sharp increase from the 21% revealed in 2020. This demand will help fuel price rises of up to 7% in key markets over the course of the year.

Liam Bailey, global head of research at Knight Frank said, "The Wealth Report confirms a clear rise in demand for residential property - with 26% of global UHNWIs looking to buy a new home in 2021, a sharp increase from the 21% we revealed in 2020. Demand is especially strong for rural and coastal properties, with access to open space being the most highly desired feature. The pandemic is super-charging demand for locations that offer a surfeit of wellness - think mountains, lakes, and coastal hot-spots. Demand will help fuel price rises of up to 7% for our key markets this year."

Kate Everett-Allen, head of international residential research at Knight Frank also commented, "Expectations on second homes are increasing. With greater flexibility around remote working, owners are lengthening their stays with many now viewing them as 'co-primary' homes. From fast broadband to cinema rooms, gyms and A-grade technology, a second home now has a longer wish list to fulfill."

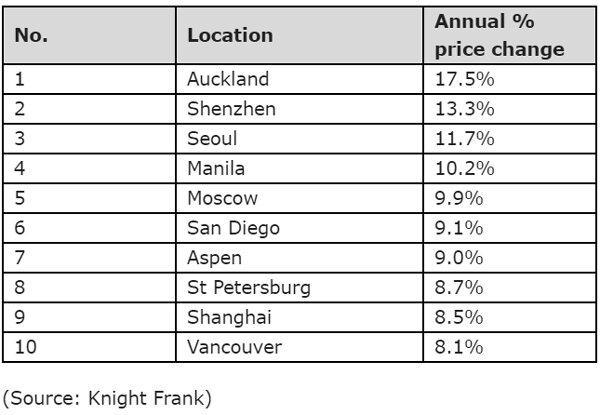

Auckland leads Knight Frank's Prime International Residential Index with price rises of 18% in 2020. New Zealand's handling of Covid-19, its rapid economic recovery, ultra-low mortgage rates and limited supply of stock were behind the surge.

The index, which tracks the movement of luxury residential prices in 100 cities and second home markets globally for the 12-months to the end of December 2020 also reveals:

- Asian cities occupy the next three rankings: Shenzhen (+13%), Seoul (+12%) and Manila (+10%)

- Australasia (4.9%) and North America (6.3%) were the top-performing regions in 2020. Both regions saw a surge in pent-up demand as lockdowns eased and homeowners re-evaluated their lifestyles

- Perth (+4%) was Australia's frontrunner and Sydney (+1%) registered its highest volume of prime sales ever in the third quarter of 2020

- Ten of the 11 North American markets tracked in the index sit within the top 20 rankings. Palm Beach was a key super-prime hotspot recording 20 sales above $20m in 2020, up from 10 in 2019

- 2020 marked a watershed moment for Vancouver. After three years of declining house prices - in part linked to higher taxes - it's luxury market got a reboot with prices rising by 8%

- The European prime property market was stop-start in 2020. Despite cities leading the results - Zurich (8%), Stockholm (6%) and Amsterdam (6%) - the focus of transactional activity from June onwards was firmly on coastal, rural or alpine resorts. Second home hotspots of Tuscany, Provence and the South of France saw successive bursts of activity each time lockdown rules eased

- In the UK, an eight-week Spring shutdown during the nation's traditional peak selling season saw London (-4%) playing catch-up over the summer. Once the property market was allowed to resume, a release of pent up demand boosted by a welcome stamp duty holiday buoyed the market

TOP 10 luxury residential market's performance, annual price change December 2019 to December 2020

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years