The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Industrial Sector Emerges as Oman's Top Commercial Market Performer

Commercial News » Oman Edition | By Michael Gerrity | April 30, 2015 9:18 AM ET

According to international real estate consultancy, Cluttons, Oman's continued investment in the development of infrastructure is aiding its transformation into a major logistics hub in the southern Gulf, and has been the main driver behind activity in the industrial property market during the first quarter of 2015.

Cluttons' Spring 2015 Muscat Commercial Property Outlook Report singles out the warehouse sector as being a stand out performer in the commercial market, with improved infrastructure and connectivity driving demand from occupiers, and catalyzing the development of modern warehouse estates.

Cluttons' Spring 2015 Muscat Commercial Property Outlook Report singles out the warehouse sector as being a stand out performer in the commercial market, with improved infrastructure and connectivity driving demand from occupiers, and catalyzing the development of modern warehouse estates. According to Philip Paul, head of Cluttons Oman, "We are recording an increase in warehouse developments coming to market to meet the current demand. In Rumais, which is located to the west of Muscat International Airport, First Logistic Services is developing warehousing units ranging in size from 500-1,000 sqm on an 81,000 sqm site. The first phase, comprising of 36 units is due to complete in May. The development is strategically positioned for occupants looking to service Muscat and interior markets in the wake of the closure of Port Sultan Qaboos.

"The developer is also offering "build to suit" opportunities within the second phase of the scheme in response to the success of the first phase, highlighting the depth of demand in the market."

The Cluttons report reveals that the country's various transport infrastructure project investments and upgrades are playing an important role in boosting connectivity across the country, which is subsequently improving Oman's attractiveness as a regional logistics and distribution centre.

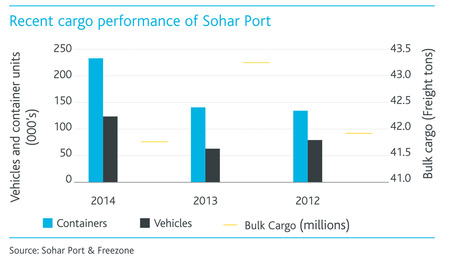

International research and business development manager at Cluttons, Faisal Durrani said, "Due to Oman's high scores for market connectedness and compatibility, the Sultanate has maintained its ranking of 13th in Agility's Emerging Markets Logistics Index for 2014 and this is reflected in the requirements we are currently receiving from shipping and logistics firms. At Sohar Port City for instance, these firms remain the most active group. The growing importance of Sohar Port is mirrored in the number of containers and vehicles handled by the port, which rose by 61% and 99% respectively during 2014."

Sohar's connectivity is also expected to be further bolstered by the Muscat to Barka section of the Batinah Expressway, which is due to open in June this year, while progress on Oman's rail network is gathering pace, with the construction contract expected to be awarded in mid-2015, covering the 207km stretch between Sohar and Buraimi.

Cluttons' report indicates that in the office market, rents across the main submarkets remained unchanged last year and during Q1 2015, marking the fifth consecutive quarter of rental stagnation.

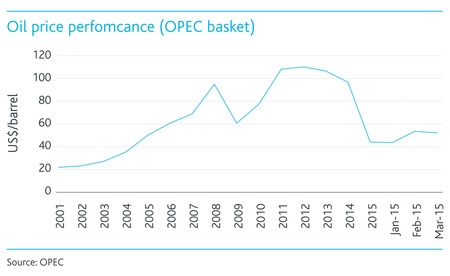

Durrani commented, "With the fall in oil prices, and hydrocarbon linked occupiers still forming the backbone of demand for office space, we are slowly starting to see this impact the rate of take up as global oil businesses assess their finances. We believe that take up activity may be subsequently impacted and is something we will be monitoring closely as the year progresses and the low oil price environment lingers."

Paul added, "Grade A rents however are still holding in the OMR 7-10 psm range across Muscat and occupiers remain focussed on this higher quality space, which is relatively limited. At Beach One for instance, we continue to record a high level of interest in the building, which has achieved over 85% occupancy.

Paul added, "Grade A rents however are still holding in the OMR 7-10 psm range across Muscat and occupiers remain focussed on this higher quality space, which is relatively limited. At Beach One for instance, we continue to record a high level of interest in the building, which has achieved over 85% occupancy."With the government's infrastructure investment program progressing to schedule, for this year at least, a number of construction and engineering firms continue to expand operations and enquire about space. We are also seeing landlords who adapt their properties to suit the demand of these occupiers, benefit across Muscat."

The prolonged strong demand for Grade A space has translated into the development of schemes designed to tap into this, with several high quality office buildings now on the verge of completion. These include the new Omnivest Building (OMR 12 psm) in Shatti Al Qurm, the Panorama Building (OMR 9 psm) in central Muscat and the Public Authority for Social Insurance (PASI) Building (OMR 9.5 psm). All of these schemes are due to complete shortly and have already attracted inquiries from technology-media-telecoms (TMT), financial services, construction and engineering firms.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More