The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Kraków's Office Market at Historic Highs

Commercial News » Kraków Edition | By WPJ Staff | November 4, 2014 8:00 AM ET

It's a good year for Krakow's commercial office market.

With the highest tenant and developer activity in several years, as well as the lowest vacancy rate countrywide, 2014 is proving to be a record-breaking year for the Kraków office market, says JLL.

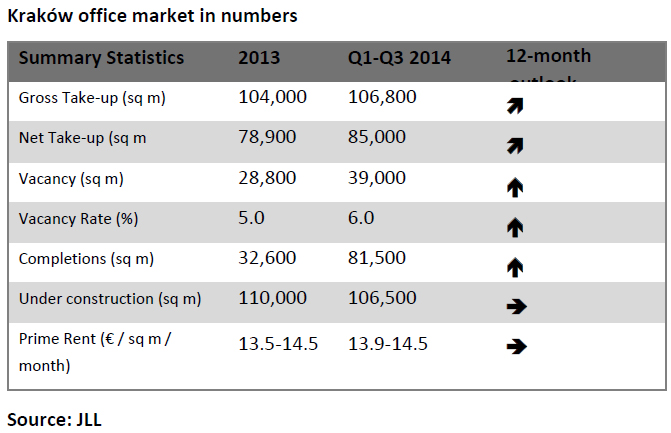

Kraków remains the biggest office market in Poland outside of Warsaw. Total modern office stock in the city is estimated at approximately 648,000 sq m and looks set to exceed 671,000 sq m this year. In total, around 105,000 sq m will be commissioned for use in 2014 and this will be the highest new supply in the history of Kraków's office market. Currently, there is over 106,000 sq m of office space under construction. If the developers' plans remain unchanged, the office market in Kraków will increase by a further 83,000 sq m in 2015 and 93,000 sq m in 2016.

Q3 of 2014 saw the completion of five buildings, notably Kapelanka A (17,300 sq m), Enterprise Park II C (13,600 sq m), Quattro Business Park D (12,200 sq m), Orange Office Park I (8,100 sq m) and Futuro (1,100 sq m). In addition, Avia will come onto the market in Q4 2014 along with the refurbished K1 office block.

RafaŠOprocha, Head of JLL's Kraków Office said, Kraków remains a key location for the business services sector. According to ABSL, business services centers with foreign capital employ ca. 30,600 people in Kraków, which is the highest number of any Polish city. This is the place where new investors locate their businesses, and where companies that are already active on the market expand their structures and conduct vast recruitment processes. The development of this sector translates into a high office space take-up, which in turn generates the activity of developers who answer the growing demand with new investments. The business services tenants' share of occupied office space in Kraków is 55%. It is also worth noting that 70% of all registered take-up in 2013 was down to companies from this segment of the economy".

2012 & 2013 saw exceptional levels of net take-up , amounting to 80,000 sq m p.a. It is worth underlining that tenants' activity during Q1-Q3 of 2014 had already outperformed these results and reached a record-breaking 85,000 sq m. What is more, since the beginning of the year, gross take-up has reached 107,000 sq m. The largest lease transaction from Q3 was AON Hewitt's renewal in Diamante Plaza (4,400 sq m), and the largest new deals were signed by a confidential tenant in Kapelanka 42B (4,200 sq m); Luxoft Poland (2,900 sq m) and Google (2,600 sq m) in Quattro Business Park D; and Getinge (2,300 sq m) in Orange Office Park I.

Kraków has the lowest vacancy rate in Poland (6%). According to JLL, this rate is likely to remain stable until the first half of 2015. Currently, companies looking for ready-to-use space over 3,000 sq m may have a problem with finding a proper module in an A class building. The majority of vacant office space is concentrated in B class offices. Furthermore, it is worth pointing out that the vacancy rate will grow due to the large volume of new space with completion scheduled for the second half of 2015.

Prime headline rents in Kraków remain relatively stable and vary between â¬13.9 and â¬14.5 / sq m / month. The average headline rents range from â¬13.5 to â¬14 / sq m / month.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More