The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Retail Sector Boosting Portugal's Spiking $2.2 Billion of Commercial Investment in 2015

Commercial News » Lisbon Edition | By Miho Favela | December 3, 2015 12:40 PM ET

International real estate consultant Knight Frank is reporting this week that Portuguese commercial property investment totaled $1.42 billion during the first nine months of 2015, and is forecast to reach a record $2.2 billion by the year-end - an exceptional 178% year-on-year increase.

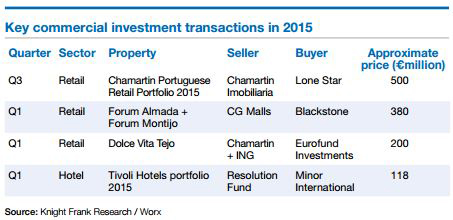

Investment activity during the first three quarters of the year was dominated by an active retail sector, which accounted for 57% of total market activity. Transaction volumes were boosted by the sale of two large retail portfolios to US equity funds Lone Star and Blackstone. As a result of the strong international interest in Portuguese real estate, cross-border capital accounted for 95% of commercial investment during Q1-Q3. The strength of demand led to a significant hardening of prime retail yields, which reached a record low of 5.0% in Q3 2015.

Investment activity during the first three quarters of the year was dominated by an active retail sector, which accounted for 57% of total market activity. Transaction volumes were boosted by the sale of two large retail portfolios to US equity funds Lone Star and Blackstone. As a result of the strong international interest in Portuguese real estate, cross-border capital accounted for 95% of commercial investment during Q1-Q3. The strength of demand led to a significant hardening of prime retail yields, which reached a record low of 5.0% in Q3 2015.Boosted by the country's continued economic recovery, Lisbon's occupier market also improved significantly in Q1-Q3 2015, with office take-up increasing by 49% year-on-year to c. 105,000 sq m. With confidence in Lisbon's office market slowly being restored, the demand for new stock is relatively high. However, development activity remains at low levels, and the city-wide vacancy rate fell for the fifth consecutive quarter to 11.3% in Q3.

Heena Kerai, Research Analyst at Knight Frank commented, "Investor appetite for assets in Portugal is forecast to remain strong in the coming months. The retail sector is expected to remain the most active, while office volumes are likely to stay relatively subdued, as the availability of investment product remains at low levels. Nevertheless, prime yields in Lisbon are forecast to harden further across both sectors by mid-2016, to reach new record lows for the market."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More