The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Vacancy Rates in Moscow's Office Market Enjoy 10-Year Low

Commercial News » Moscow Edition | By Michael Gerrity | August 1, 2018 8:15 AM ET

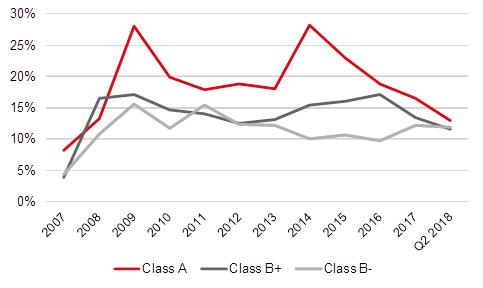

According to JLL, the vacancy rate of Moscow's office market continued to decline in Q2, 2018 amid low completions and rising take-up. The current vacancy, at 12.0%, is the lowest since Q3 2008. The decline began in Q3 2015 when it was 17%. A year ago, the vacancy rate was 16.3%, and 13.1% in Q1.

In Moscow, the vacancy rate was declining since Q3 2015 when the vacancy was 17%. A year ago, the vacancy rate was 16.3%, in Q1 it was 13.1% already.

Lower vacancy rate was recorded in all classes. In H1 2018, the Class A vacancy rate declined to 12.9%, Class B+ to 11.6%, Class B- to 11.9%.

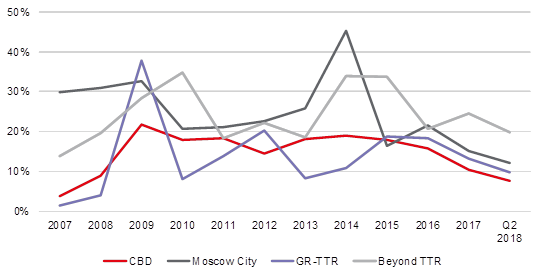

Geographically, the vacancy rate diminished strongly in key Moscow submarkets over the last year, by 6 ppt to 11.4% in the Moscow City and by 4.4 ppt to 8.9% in the Central Business District.

"The vacancy rate in the city centre reached the ten-year minimum, at 7.7% for both Class A and B+ premises there. The Central Business District net absorption was at 75,000 sq. meters in H1 2018, in H1 2017 it was negative," comments Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS. "The key deal was Aeroflot in the Arbat 1 business centre. Moreover, vacancy rates in such centres like Legend or Paveletskaya Tower diminished strongly. Considering the high demand and the lack of completions in the Central Business District, the vacancy rate there will continue to decline. Therefore, we expect the CBD to transition into a landlord market in H2 2018."

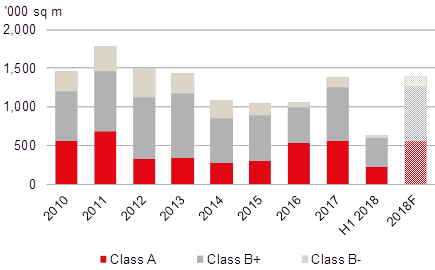

In Q2 2018, only 2,300 sq. meters were delivered to the market. The single business centre completed, Nikolin Park, a part of a residential complex, was located beyond MKAD on Kaluzhskoe Highway.

"In line with recent construction delays, a part of planned H1 completions was postponed to H2 or later," says Alexander Bazhenov, Office Market Analyst, JLL. "The overall H1 2018 completions were only 39,000 sq. meters, although 86% higher YoY. The delays resulted in the downgrade of overall 2018 expected completions to 217,000 sq. meters."

At the same time, the take-up has grown, reaching 633,00 sq m in H1 2018, up 41% YoY. The most significant increase, 48% YoY, was recorded in Class A, to 220,000 sq. meters. The bulk of leased and purchased space was beyond the Third Transport Ring, 46% versus 35% a year ago. Such dynamics shows the current trend of the Moscow market, when companies prefer to occupy quality buildings outside the Central Business District, which is primarily due to the shortage of large Class A premises in the CBD.

Prime office asking rents were USD600-750 sq. meter, Class A rental rates were RUB24,000-40,000 sq m/year. Class B+ rents were RUB12,000-25,000 sq. meter/year. JLL analysts expect rental growth in H2 2018.

In Moscow, the vacancy rate was declining since Q3 2015 when the vacancy was 17%. A year ago, the vacancy rate was 16.3%, in Q1 it was 13.1% already.

Lower vacancy rate was recorded in all classes. In H1 2018, the Class A vacancy rate declined to 12.9%, Class B+ to 11.6%, Class B- to 11.9%.

Geographically, the vacancy rate diminished strongly in key Moscow submarkets over the last year, by 6 ppt to 11.4% in the Moscow City and by 4.4 ppt to 8.9% in the Central Business District.

"The vacancy rate in the city centre reached the ten-year minimum, at 7.7% for both Class A and B+ premises there. The Central Business District net absorption was at 75,000 sq. meters in H1 2018, in H1 2017 it was negative," comments Elizaveta Golysheva, Head of Office Agency, JLL, Russia & CIS. "The key deal was Aeroflot in the Arbat 1 business centre. Moreover, vacancy rates in such centres like Legend or Paveletskaya Tower diminished strongly. Considering the high demand and the lack of completions in the Central Business District, the vacancy rate there will continue to decline. Therefore, we expect the CBD to transition into a landlord market in H2 2018."

In Q2 2018, only 2,300 sq. meters were delivered to the market. The single business centre completed, Nikolin Park, a part of a residential complex, was located beyond MKAD on Kaluzhskoe Highway.

"In line with recent construction delays, a part of planned H1 completions was postponed to H2 or later," says Alexander Bazhenov, Office Market Analyst, JLL. "The overall H1 2018 completions were only 39,000 sq. meters, although 86% higher YoY. The delays resulted in the downgrade of overall 2018 expected completions to 217,000 sq. meters."

At the same time, the take-up has grown, reaching 633,00 sq m in H1 2018, up 41% YoY. The most significant increase, 48% YoY, was recorded in Class A, to 220,000 sq. meters. The bulk of leased and purchased space was beyond the Third Transport Ring, 46% versus 35% a year ago. Such dynamics shows the current trend of the Moscow market, when companies prefer to occupy quality buildings outside the Central Business District, which is primarily due to the shortage of large Class A premises in the CBD.

Prime office asking rents were USD600-750 sq. meter, Class A rental rates were RUB24,000-40,000 sq m/year. Class B+ rents were RUB12,000-25,000 sq. meter/year. JLL analysts expect rental growth in H2 2018.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More