The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Moscow and St. Petersburg Hotel Markets Deliver Mixed Results in 2017

Vacation News » Moscow Edition | By Monsef Rachid | February 20, 2018 8:02 AM ET

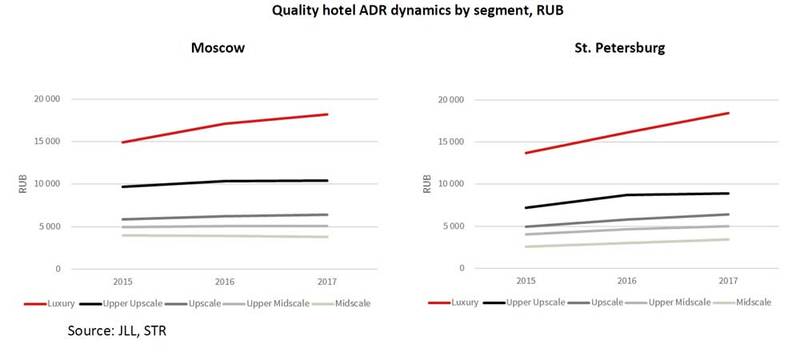

According to global real estate consultant Both Moscow and St. Petersburg luxury segments' Average Daily Revenue (ADR) crossed a threshold of RUB18K for the first time (to RUB18,184 and RUB18,445 respectively). Simultaneously, St. Petersburg's Luxury segment outperformed Moscow, which never happened before. Unexpectedly, St. Petersburg's Upscale and Upper Midscale ADRs almost reached Moscow's (only differing by RUB50 in comparison to RUB400 in 2016).

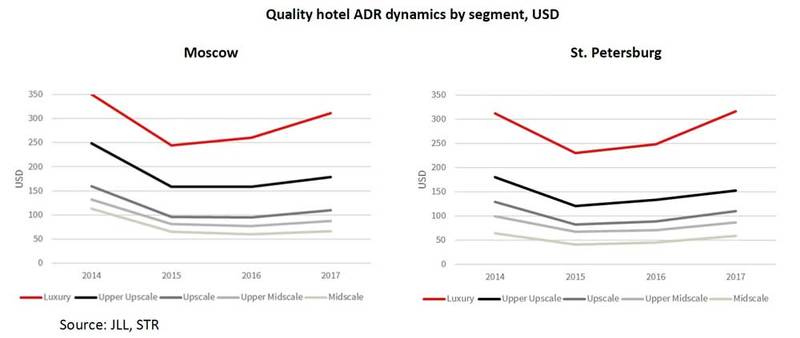

In addition, USD-denominated ADRs started climbing up to 2014 levels (St. Petersburg Luxury segment ADR was the first one to cross the threshold, reaching USD316 in 2017 vs. USD312 in 2014). Luxury segment reports the lowest occupancy rates in Moscow and St. Petersburg (67% and 56% respectively) in comparison to other segments. The highest market weighted average Occupancy index for at least 6 years in Moscow - 74%. The only segment which lost in ADR this year was Midscale segment in Moscow.

"Overall the situation on the Moscow quality hotel market looked quite optimistic in 2017, however the growth slowed down three times in all operational indices compared to 2016", says Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia and CIS.

"Market wide weighted average ADR increased in 2017 vs. 2016 by 2.2% reaching RUB7,567 and occupancy improved by 1.9 ppt resulting in 74% of rooms being occupied in the Russian capital. This is the highest index in at least six years. RevPAR therefore increased by 4.5%, to RUB5,450", notes Veller. "The present slowdown in growth is probably a partial effect of a sizeable additional room stock being introduced to the market in 2017 (almost 1,800 rooms), much more than in 2016 (900 rooms), as well as of the extremely positive market dynamics of the three recent years."

In terms of demand there has been an increase of tourists' arrivals to Moscow by 23% (17.5m in 2016 and 21.6m in 2017 according to the Mayor of Moscow Sergey Sobyanin), while the mix of international and domestic visitors remained like in 2016 (20% and 80%). Number of tourist arrivals to St. Petersburg has also increased by 25% resulting in 7.5m arrivals. The number of visitors here was equally split between international and domestic visitors.

In terms of demand there has been an increase of tourists' arrivals to Moscow by 23% (17.5m in 2016 and 21.6m in 2017 according to the Mayor of Moscow Sergey Sobyanin), while the mix of international and domestic visitors remained like in 2016 (20% and 80%). Number of tourist arrivals to St. Petersburg has also increased by 25% resulting in 7.5m arrivals. The number of visitors here was equally split between international and domestic visitors.Moscow continues to fascinate tourists by introducing more international events for business and leisure, creating extraordinary recreational zones. Festival Journey to Christmas has been reported as one of the most popular celebrations this winter by The Wall Street Journal. Simultaneously, Russia Tourism is working closely with ASEAN committee, which already resulted in more Chinese, Thai and South Korean tourists, for whom Moscow would always remain the primary destination in Russia as a cultural, economic and historic centre of the country. The increased number of Chinese tourists' coming on shopping tours has been additionally stimulated by ruble depreciation over the past three years.

St. Petersburg at large stuck to 2016 trends, with market wide weighted average ADR across segments increasing in 2017 by 11.3% reaching RUB6,550, while occupancy index fell by 1.8 ppt (to 63.2%) that led to RevPAR hike of 8.4% or RUB4,099. Like the year before, there were only two new hotels opened in St. Petersburg in 2017: Hilton St. Petersburg Expoforum (234 rooms) and Lotte Hotel (154 rooms).

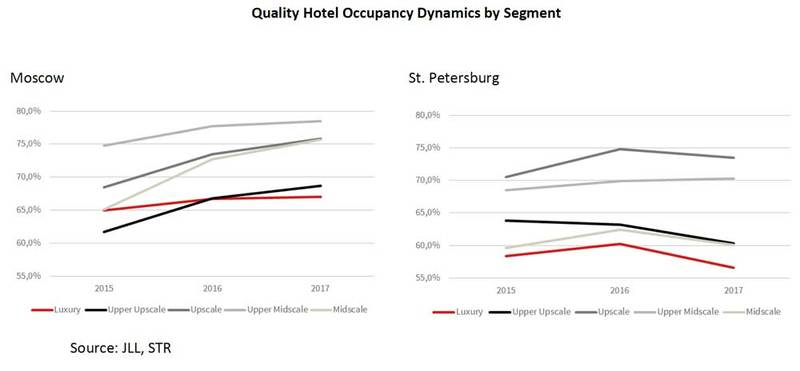

Occupancy dynamics by segment

The front-runner in Moscow terms of occupancy rates is the Upper Midscale segment - 78.5%, closely followed by Upscale and Midscale. "At the same time, in 2018 we expect 1,092 rooms to be introduced into the market (mostly in the Upscale segment), and that could slightly affect the demand in 2019 and on" reports Veller. "The flattest increase has been seen in the Luxury segment, meaning the tourists are more likely to select the Upper Upscale hotels, rather than Luxury ones. Domestic tourists have been more price-conscious over the past few years, and international visitors prefer to spend more on the activities, food or shopping outside of the hotel rather than the room itself."

Despite an insignificant drop, number of occupied rooms in St. Petersburg remains high. This is due to revenue optimization techniques, which are widely practiced on the back of strong demand by branded hotels. In the Northern Capital, similar to Moscow, Upscale and Upper Midscale segments continue leading the pack in terms of occupancy indices, both above 70% (73.5% and 70.3% respectively), while Luxury segment reports the lowest proportion of sold rooms - 56.6%. Both Upper Upscale and Midscale segments are around 60%.

ADR dynamics by segment

ADR dynamics by segmentThe only segment in Moscow, which lost in ADR this year, was Midscale, here rates shrunk to RUB3,822 which nevertheless due to occupancy rises resulted in RevPAR increase by 2%. Upper Midscale, Upscale and Upper Upscale segments report insignificant increases (from 1% to 3%) resulting in ADRs of RUB5,085, RUB6,404 and RUB10,442 respectively. The only sizeable increase reported in ADR (6.3%) was in Luxury segment (crossing for the first time in observable history a threshold of RUB18,000 (to RUB18,184), and thus driving a 6.8% RevPAR boost.

"All segments reported ADR growth in St. Petersburg. For the first time in history, Luxury hotels in St. Petersburg sold at a higher price than in Moscow - ADR in Northern Capital culminated at RUB18,445 level", says Veller. "An additional surprise was delivered by the Upscale and Upper Midscale segments, whose numbers differ from Moscow's by a meager RUB50 gap (reaching RUB6,381 and RUB5,036 correspondingly). Midscale ADR was RUB3,452 (around RUB350 lower than in Moscow)."

USD ADR dynamics

USD ADR dynamicsAs JLL experts have highlighted in 2016, USD-denominated rates continue to rebound. "ADR index have not yet reached the numbers equal to 2014, last year of more or less stable domestic currency; however, this could be the case for 2018, mainly because of the hoteliers' anticipated ability to drive rates during the FIFA World Cup", says Veller. "The only exception to this rule is Luxury segment in St. Petersburg, which achieved the ADR of USD316, higher than in 2014 (USD312). Moscow's Luxury segment is also getting close (USD312 in 2017 vs. USD351 in 2014).

Moscow Region operational performance overview

Despite the slight drop in occupancy by 1 ppt (to 48.7%), there has been an ADR increase by 3.3% (to RUB5,094) leading to RevPAR growth by 1.1% (to RUB2,480). ADR rise was especially notable in the first quarter of the year, probably because there have been more winter entertainment activities offered by the hotels, and they became the weekend escape destinations for locals, as well as in September, when Muscovites tried to utilize the warm shoulder season by taking short breaks in the close vicinity of their main residences.

Russian Hotel Investment overview

Russian Hotel Investment overviewAccording to Tatiana Veller, in terms of hotel transactions, the market is stable. "There are hotels or aparthotels being offered for sale mainly because the owners are looking for liquidity to develop new projects or are exiting non-core assets" she comments. "The main notable deals for 2017 in Moscow were: Vesper buying a land plot for development of a luxury hotel (Fairmont) with apartments next to Mayakovskaya metro station; VTB Group selling Tourist and Ostankino hotels to Osnova group of companies, and Sovietsky hotel is rumored to have been sold. In St. Petersburg Alliance-Invest has sold apart-hotel project to St. Petersburg Construction Company in the second quarter of 2017."

Russia Hotels Outlook for 2018

"In 2017, the occupancy rates have mainly been growing in Winter and Fall (business seasons); this will be evened out by FIFA World Cup in Summer 2018. Both Moscow and St. Petersburg hotel markets look well balanced and satisfy the demand of different visitors' classes. The potential niche that seems still open is the quality economy hotels", says JLL's Tatiana Veller.

There is only one hotel in the economy segment scheduled to enter the market in each city in 2018 - Holiday Inn Express Khovrino (170 rooms) in Moscow and Holiday Inn Express Sadovaya (244 rooms) in St. Petersburg. While two economy branded hotels already exist in Moscow: Ibis Budget Panfilovskaya (114 rooms) and Holiday Inn Express Moscow Paveletskaya (243 rooms), for St. Petersburg market this would be the newcomer.

"We see the expansion of all three airport clusters in Moscow in terms of accommodation offer over the past years; that would continue in 2018", says Veller. "There will be two branded hotels opened in Vnukovo Airport: DoubleTree by Hilton Vnukovo (432 rooms) and Four Points by Sheraton Moscow Vnukovo Airport (250 rooms). Sheremetyevo airport will have a new entrant in the only category still missing there - quality economy under international management - Holiday Inn Express Moscow Sheremetyevo (198 rooms). 2018 has already welcomed a new player in the Domodedovo airport vicinity - ibis Domodedovo (152 rooms) opened in January."

"In terms of alternative accommodation product, there is an increased number of hostels being introduced, as well as aparthotels or serviced apartments. Interestingly, there is demand from the investors' side for branded residences and hotel-managed residences in different mixed-use complexes, where hotel is seen not as just the place to sleep for tourists, but as a focal point of the complex, serving many needs of the local community", concluded Veller.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend

- High Prices, Rising Rates, Economic Uncertainty Ends Vacation Home Boom in America

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More