The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Global Property Investors' Focus on Europe Intensifies in 2015

Commercial News » Barcelona Edition | By Michael Gerrity | April 27, 2015 10:28 AM ET

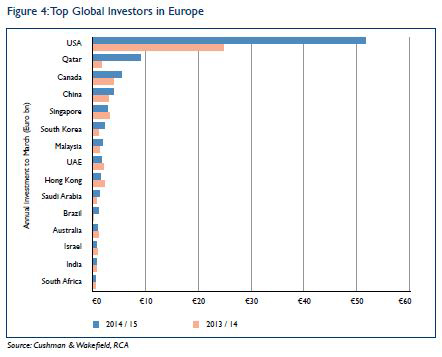

According to a new report by Cushman & Wakefield, European real estate is set to stay firmly in the spotlight for global investors with a resulting two-year window of high activity and attractive relative pricing driven by improved property investment supply, portfolio restructuring, rising prices and the impact of quantitative easing.

Their report, Capital Views - The Allure of Europe, says while activity has spread rapidly around all corners of Europe from the core, on to the South and now towards Central Europe, global money has lagged behind, staying close to the biggest hub markets. The UK, Germany and France took three quarters of all global money in Europe in the past year for example. According to Cushman & Wakefield, this is now changing however, Southern Europe in particular coming on to the global radar. Spain for example is now the only country other than UK to draw capital from all global regions. This change is expected to accelerate in 2015 as global investors turn to more new markets across the region.

Jan Willem Bastijn, head of EMEA Capital Markets at Cushman & Wakefield comments, "The overall choice open to investors is increasing as banks deleverage, portfolios are turned and development comes back to the agenda. This heightened availability in a stabilizing economy will continue to underpin activity for domestic and foreign buyers, with potential for the market to deliver a new peak for trading in excess of the previous record of â¬275bn."

Jan Willem Bastijn, head of EMEA Capital Markets at Cushman & Wakefield comments, "The overall choice open to investors is increasing as banks deleverage, portfolios are turned and development comes back to the agenda. This heightened availability in a stabilizing economy will continue to underpin activity for domestic and foreign buyers, with potential for the market to deliver a new peak for trading in excess of the previous record of â¬275bn."In terms of opportunities the Cushman & Wakefield report points to three clear tiers of potential where liquidity, an improving occupier and / or attractive pricing point to better than average gains. In the first tier, core markets of London, Paris and Germany continue to lead the way, followed in the second tier by a focus on the leading cities of smaller countries notably Madrid, Barcelona, Milan and Brussels. In the third tier meanwhile, the focus is shifting East and not just to the main hubs of Poland and the Czech Republic.

David Hutchings, head of EMEA Investment Strategy at Cushman & Wakefield says, "Europe has been the global market of choice for some time now and even though risk aversion has eased somewhat and other markets are looking more appealing from a macro perspective, particularly the US, Europe has an edge that has kept it in the spotlight. Quantitative easing has only added to that and with the macro drivers for demand growing more positive and starting to close the gap between the occupier and the capital cycle, the market could have a two-year window of high activity and attractive relative pricing."

Bastijn concludes, "The make-up of investors heading into Europe is if anything going to get even more global and we're expecting record trading volumes in Europe this year. However to achieve that, the demand side is to be honest the easy part of the equation - it's supply that will decide whether we're right or not. Actually having stock to buy is a key reason why Europe is attracting global capital and is also important in shaping where that capital goes once it gets here."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More