Residential Real Estate News

Caribbean Islands Enjoying a New Era of Luxury Property Developments

Residential News » Mustique Edition | By Michael Gerrity | November 8, 2024 7:16 AM ET

According to global property consultant Knight Frank, the Caribbean has become a hot destination for property buyers during the pandemic, drawn by its scenic beauty and favorable tax structures. This influx has spurred a wave of high-end development, elevating the standard of luxury on the islands.

On Cable Beach in the Bahamas, one can see new luxury developments like the Rosewood Residences at Baha Mar, offering condominium owners access to five-star hotel amenities without the need for check-outs. Nearby, the Four Seasons' Ocean Club provides potential buyers with a mix of apartments, penthouses, and villas amidst picturesque gardens inspired by Versailles, stretching along Paradise Island's eight-kilometer beach. These developments illustrate the pandemic's impact on the Caribbean real estate market, attracting younger, more mobile buyers who are free from traditional office schedules.

"We're seeing a real shift toward condos in the $1 million to $5 million range," says Susie Vazquez, General Manager at The Isles Group. "Buyers want that lock-and-leave lifestyle close to the beach or prefer condos over dealing with the upkeep of a standalone property during hurricanes." Even buyers with $10 million budgets are opting for condos over traditional homes.

Some pandemic-driven market influences have faded, like executives working remotely, but favorable tax regimes remain a strong draw. The Bahamas has no income, capital gains, inheritance, or wealth taxes, and Barbados offers low-income tax rates without capital gains tax. As other countries, like the UK and Canada, raise taxes on the wealthy, these Caribbean tax advantages are even more appealing. Additionally, both Barbados and the Bahamas provided generous visa conditions to remote workers, many of whom stayed and became permanent residents. Vazquez notes, "We've seen families, especially from Canada, buy homes over Zoom, moving here for a change and staying because of the quality of life and access to international schools."

The popularity of condos has also been driven by skyrocketing home values in the Bahamas. Vazquez estimates that standalone home prices have roughly doubled since 2020. Homes in desirable gated communities that once sold for $3 million in 2019 are now selling for $6 million or more. While some sellers continue to aim for higher prices, market activity has slowed, with more properties lingering on the market.

This trend spans the Caribbean. In Barbados, Terra Luxury, Knight Frank's local partner, has seen record years. Luxury properties on the island's West Coast, priced at $20 million or more, are in high demand, leaving limited availability for prime land. "Larger parcels on the West Coast are nearly impossible to find," says Betty Cathrow of Terra Luxury.

Unlike the Bahamas, Barbados lacks large branded residences, and wealthy buyers often prefer to rebuild homes to suit their tastes. Tarik Browne of Terra Caribbean notes, "Many buyers are demolishing existing properties to create custom homes, showing a desire to make Barbados their permanent escape." Developers in Barbados are now focusing on "just off beach" locations a bit inland to appeal to buyers priced out of waterfront properties. This includes new villa developments like Callidora, near Gibbs Beach, where prices reach up to $3.25 million.

For those seeking greater privacy, Mustique -- a private island owned by The Mustique Company -- is an attractive option, albeit with limited inventory. With just 100 properties, only a handful become available each year, with entry-level villas priced around $6 million and higher-end properties selling for up to $30 million. "We manage everything on Mustique, from the airport to security, which creates a unique, safe environment without locks or keys," says Roger Pritchard, Managing Director of The Mustique Company. Property values on Mustique surged by 25% during the pandemic, with turnover mainly within the $5 million to $15 million range. However, since younger buyers who invested during the pandemic tend to hold on to their properties, inventory remains tight.

In summary, the Caribbean's real estate market has transformed, attracting new buyers with unique lifestyles and demands. Tax advantages, the allure of island life, and the luxury of tailored homes have all played significant roles in reshaping these tropical havens.

Caribbean Market Report Key Highlights:

- Tax Advantages: The Bahamas and Barbados offer appealing tax regimes, with no capital gains, inheritance, or wealth taxes, attracting high-net-worth individuals (HNWIs) from high-tax countries.

- Flexible Visa Programs: Both Barbados and the Bahamas introduced extended-stay visas during the pandemic, allowing remote workers to live and work from the Caribbean. Many of these temporary residents have since become permanent, especially in the Bahamas.

- Shift to Condominiums: In response to surging property values, particularly in the Bahamas, buyers are increasingly choosing condominiums for their convenience and low maintenance. Popular investments are in the $1 million to $5 million range.

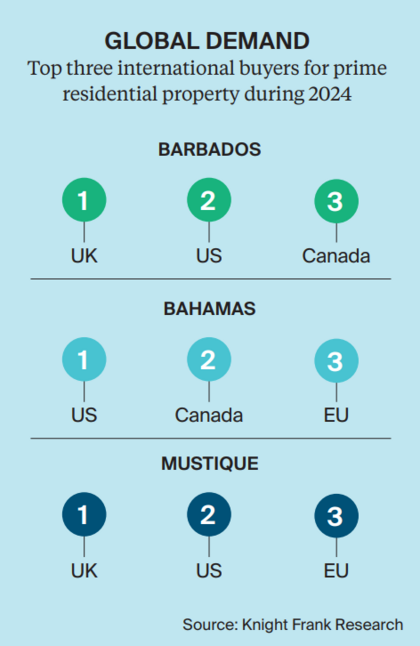

- Global Buyer Interest: The top buyers come from the U.S., UK, and Canada, drawn by lifestyle, remote work opportunities, and privacy. The Caribbean's appeal lies in its natural beauty, luxury living, and relaxed tax policies.

- Exclusive Market in Mustique: With only 100 properties and stringent security, Mustique offers seclusion and is favored by HNWIs prioritizing privacy and security, commanding the highest property values in the region.

High Demand on Limited Land: Barbados faces intense competition for limited land, especially on the West Coast, leading to rising prices as developers cater to luxury and ultra-luxury buyers seeking vacation or secondary homes.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024